The VN-Index ended the trading session on September 26, 2024, with a gain of 0.31%, closing at 1,291.49.

The total trading value on the three exchanges reached VND24,009.2 billion, a 4.7% decrease compared to the previous session. Specifically, the matched order trading value reached VND22,086.7 billion, down 2.0% from the previous session but up 34.2% and 54.2% compared to the 5-day and 20-day averages, respectively.

In terms of sectors, liquidity decreased notably in Real Estate, Securities, Steel, and Software, with the first two sectors posting gains. Conversely, the Banking, Oil & Gas Production and Exploration, and Textile sectors witnessed both price and liquidity increases compared to the previous day’s session.

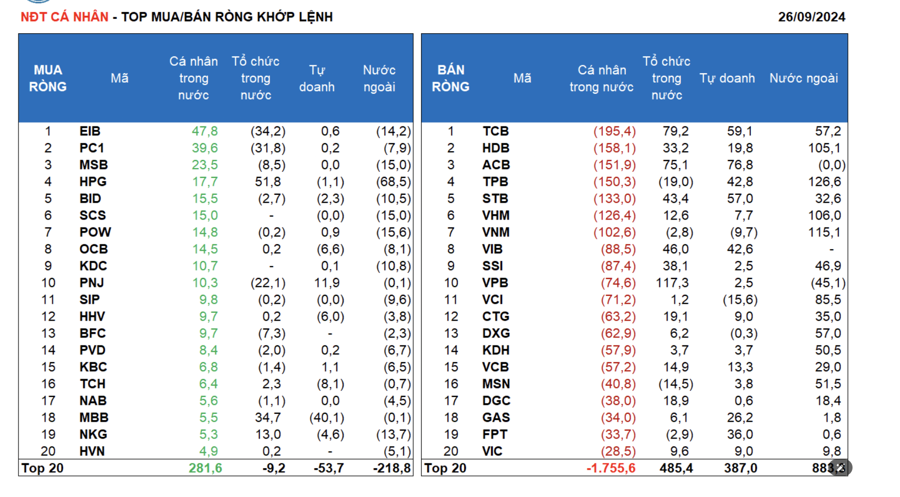

Foreign investors recorded a net buy value of VND974.4 billion, with a net buy value of VND941.7 billion in matched orders. Their main net buy sectors were Banking and Real Estate. The top stocks that foreign investors net bought were TPB, VNM, VHM, HDB, VCI, TCB, DXG, MSN, KDH, and SSI.

On the selling side, foreign investors’ net sold sectors were Basic Resources. The top stocks that foreign investors net sold were HPG, VPB, POW, SCS, MSB, NKG, FUESSVFL, KDC, BID.

Individual investors net sold VND1,727.6 billion, with a net sell value of VND1,869.8 billion in matched orders. In terms of matched orders, they net bought 6 out of 18 sectors, mainly in Construction and Materials. The top stocks that individual investors net bought were EIB, PC1, MSB, HPG, BID, SCS, POW, OCB, KDC, and PNJ.

On the net selling side, they net sold 12 out of 18 sectors, mainly in Banking and Real Estate. The top net sold stocks were TCB, HDB, ACB, TPB, STB, VHM, VIB, SSI, and VPB.

Proprietary trading recorded a net buy value of VND148.9 billion, with a net buy value of VND447.2 billion in matched orders.

In terms of matched orders, proprietary trading net bought 13 out of 18 sectors. The top net bought sectors were Banking and Financial Services. The top stocks that proprietary trading net bought were ACB, TCB, STB, TPB, VIB, FPT, GAS, HDB, HCM, and BMP. The top net sold sector was Basic Resources. The top net sold stocks were MBB, VCI, VNM, TCH, OCB, HHV, NKG, HSG, DBC, and PDR.

Domestic institutional investors recorded a net buy value of VND620.6 billion, with a net buy value of VND480.8 billion in matched orders.

In terms of matched orders, domestic institutions net sold 11 out of 18 sectors, with the highest net sell value in Construction and Materials. The top net sold stocks were EIB, FUEVFVND, PC1, MWG, PNJ, TPB, MSN, MSB, BMP, and HCM. The top net bought sector was Banking. The top net bought stocks were VPB, TCB, ACB, HPG, VIB, STB, SSI, MBB, CTG, and DGC.

Negotiated trading value reached VND1,922.4 billion, a 28.0% decrease compared to the previous session, contributing 8.0% of the total trading value.

Noteworthy transactions include domestic proprietary trading selling over 7.3 million BWE shares, worth VND319.7 billion, to individual investors.

Additionally, individual investors negotiated the sale of more than 9.6 million TCB shares (valued at VND215.4 billion) to domestic proprietary trading.

Money flow allocation increased in Banking, Retail, Oil & Gas, and Textiles, while it decreased in Real Estate, Securities, Steel, Food & Beverage, Chemicals, Software, and Power Production & Distribution.

In terms of matched orders, money flow allocation increased in the large-cap VN30 and small-cap VNSML groups, while it decreased in the mid-cap VNMID group.