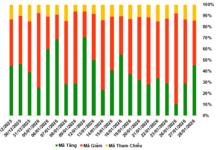

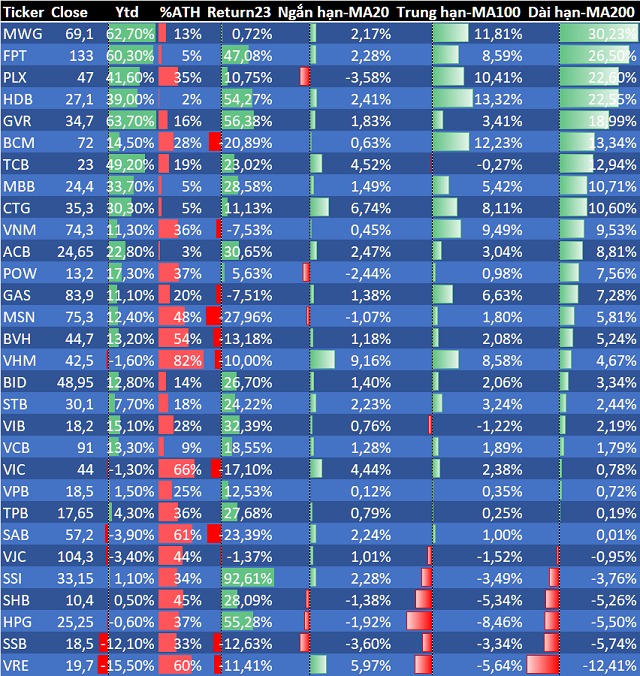

After a series of intraday shakes with extremely low liquidity, the market recovered strongly this afternoon. It was a signal that the supply test had positive results. The feeling of discouragement has been replaced by excitement and expectations that the market will resume its upward momentum and challenge old peaks.

If we include the ETF restructuring session with high liquidity last weekend, the market experienced about 2.5 shaky sessions. The adjustment range for stocks is wider than the index, but generally, the amplitude is not large, with very few codes decreasing by more than 2% during this time. Therefore, there are not many short-term trading profit opportunities. Due to the small amplitude, buy orders at deep prices have fallen, and liquidity is maintained at a very low level during the adjustment sessions. Yesterday, the liquidity of the two floors was also just over 11.2k billion (excluding agreements).

Small liquidity combined with a narrow price fluctuation range is a positive combination when looking at the adjustment after a series of rapid price increases last week. Investors who successfully catch the bottom face the choice of holding or taking profits to realize gains. Usually, if the market has bottomed out, the steep increase will only create minor divisions in expectations, and only new T+ players will sell out. Most will trade small amounts available to reduce capital prices. Therefore, the selling volume will not be large and will not accept a lower price (as this will limit profits).

On the other hand, for cash holders, the choice of waiting to buy at a certain price and buying a certain amount reflects confidence and projections about the possible adjustment range. The deeper the waiting price, the more pessimistic it is, and some even wait for a short-term bottom test. If the market does not follow their script, a decision must be made. If this group changes their perspective and aggressively disburses, prices will rise in resonance with the effect of less selling. That is why there is usually low liquidity, small price declines, higher liquidity during recovery, and wider price increases.

In general, there is no upward trend that is continuous, and there are always stages of stagnation and shaking before rising again. When short-term perspectives change continuously and are caught in a vortex of continuous buying and selling, the market often has unexpected reversals. No matter the reason or the information that governs it, it ultimately comes down to a change in market assessment perspectives.

The recent adjustment fluctuations were quite rapid and narrow, so there were not many trading opportunities, and not everyone could take advantage of them. In an uptrend, patience is less of a headache than continuous trading. Even if you close at the peak and buy back, it will only be slightly cheaper, or even buy at the selling price or “black” at a loss, which only takes time and invites fatigue. When looking at a broader picture, the market has already seen all the risks and replaced them with expectations, so the probability of an uptrend is higher than a downtrend. Stocks will have their own momentum in such a situation.

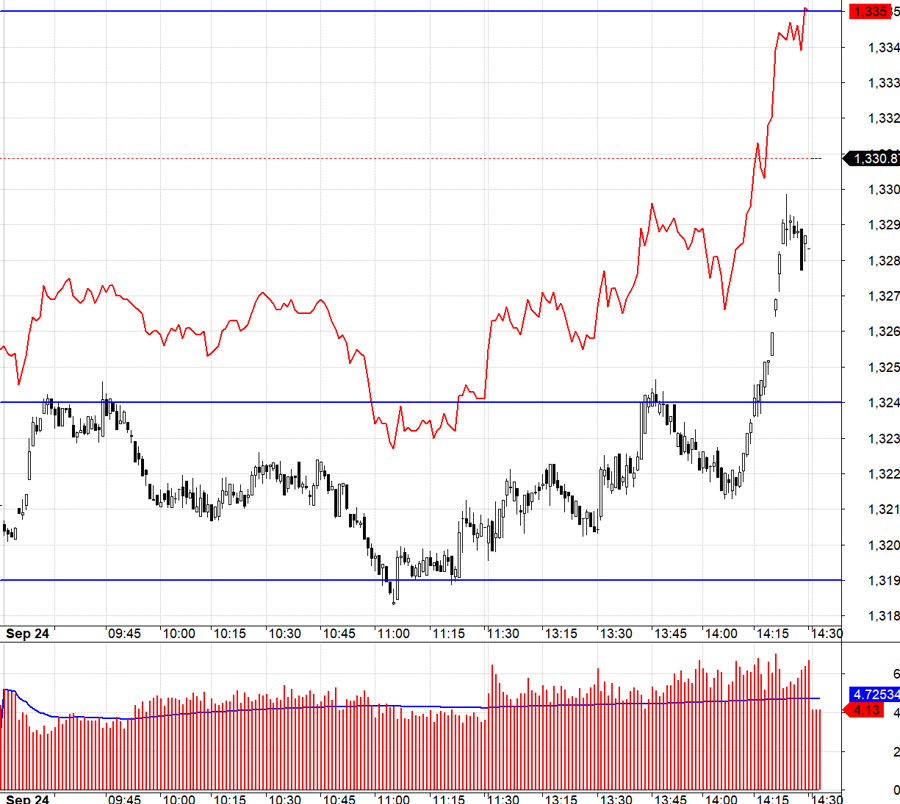

Today, the derivatives market maintained a significantly wider spread than yesterday. VN30 had a narrow range of fluctuations from 1324.xx to 1319.xx, but the average F1 basis was more than 4 points, so it was very difficult to Short. The test pace of 1324.xx at the beginning of the session pushed VN30 down to 1319.xx, but F1 decreased very little, although theoretically, the wide spread is favorable for Short. This reflects a strong psychology for the underlying market.

In the recovery this afternoon, although the basis was very unfavorable for Long, F1 had a stronger upward momentum, even widening the spread further. However, the market is not easy to play; when VN30 touched 1324.xx for the second time and turned around, the right thing to do was to close the Long position. This missed the final uptrend when VN30 surpassed 1324.xx because the speed of increase was very fast, and the remaining time was very little.

This afternoon’s recovery momentum had good liquidity, and after a period of shaking without liquidity, the opportunity to increase expanded. VN30 is much stronger than VNI and is about to surpass the peak. The strategy is to wait for Long, Short in the short term.

VN30 closed today at 1330.87. Tomorrow’s nearest resistance levels are 1335; 1341; 1348; 1352; 1361; 1370. Support levels are 1326; 1318; 1310; 1305.

“Stock Blog” is personal and does not represent the opinions of VnEconomy. The views and assessments are those of individual investors, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the investment assessments and perspectives published.

The Most Investor-Beloved Listed Company: HDBank

On September 24, 2024, HDBank (stock code: HDB) was voted as the “Listed Company in the Large-cap Finance Sector with the Most Favorite Investor Relations Activities” according to the results announced at the IR Awards 2024 by Vietstock, the Vietnam Association of Financial Executives (VAFE), and Fili Magazine.