A broker informed us that an investor has recently halted the sale of a land lot in Thu Duc City, Ho Chi Minh City (formerly District 9) as the asking price was deemed too low compared to the surrounding area. This lot measures over 50sqm, accessible by car, and had a selling price of 2.35 billion VND set by the investor.

According to the investor, the reason for discontinuing the sale was that the price was too low, and they didn’t urgently need the capital. “Upon further investigation, I realized that my asking price was significantly lower than that of neighboring lots, while my land was rectangular, well-located, and in an existing residential area,” the investor shared. “I decided to hold off on the sale and try again later.”

The broker who missed out on this deal shared that it’s not uncommon for investors to withdraw their properties from the market. Initially, brokers would get frustrated with such situations, but ultimately, the decision to sell rests with the client. In one instance, a broker arranged for a potential buyer to visit the seller’s home and make a deposit, only for the seller to change their mind. The land was then relisted at a different price.

However, according to this broker, offloading properties has become more challenging, mainly because the asking prices set by landowners are often higher than what the market can bear. “The sellers’ high expectations of the market’s performance after the new Law took effect have led them to withdraw their properties and increase their asking prices,” the broker explained. “However, the reality is that the market hasn’t rebounded as strongly as they anticipated.”

The market’s slow recovery has left sellers disappointed as they struggle to sell their properties at high prices. Photo: Tieu Bao

In a recent example, a land lot in Ho Chi Minh City’s Eastern area was initially listed at 2.5 billion VND but was then withdrawn and relisted at 2.7 billion VND. This price made it challenging to compete with other lots on the market, and despite the attractive features of the land, the owner struggled to sell it for several months.

According to a broker, there have been cases where landowners increased their asking prices after August 1, even though they had previously tried to sell multiple times without success. However, higher prices also mean fewer potential buyers, as most investors in this market are still on the lookout for bargain deals. They are not yet ready to pay prices comparable to those at the beginning of 2022.

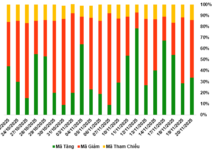

As observed, there is a tug-of-war between sellers and buyers in the Southern real estate market. In mid-2023, sellers were at a disadvantage due to the weak market, leading to many instances of cutting losses and selling below cost. Now, sellers are more confident and have increased their asking prices, making it challenging for buyers to find deeply discounted properties. However, the mismatch in price expectations between buyers and sellers has stalled transactions.

Specifically, sellers want to get their desired prices because they believe the market is recovering. On the other hand, buyers acknowledge the market’s improvement but refuse to pay the prices demanded by homeowners or landowners.

Compared to the real estate market in the North, the pace of the Southern market remains relatively slow as we enter Q3 of 2024. Apart from apartments, land plots, individual houses, and townhouses in urban areas have yet to regain their momentum after the decline. Recently, land records in Ho Chi Minh City that were “frozen” from August 1 have been unblocked, which is expected to boost transaction activity in the market towards the end of the year. However, according to brokers, demand is not evenly distributed across projects and areas. It will take more time for prices and transactions to recover fully.

The Allure of Square Real Estate

Owning a shophouse or townhouse in the central square of the city has always been the top choice for seasoned real estate investors with strong financial backing.

The Latest Land Price List: What You Need to Know

The Ministry of Construction has assessed that the application of the new land price framework will have a ripple effect, triggering a surge in the property and housing market. Experts predict a 15-20% increase in prices compared to pre-framework levels, a significant jump that will have far-reaching implications for the industry and consumers alike.