Although liquidity weakened slightly in the afternoon compared to the morning, trading remained vibrant, and stock prices continued to rise. The dominant blue-chip group pushed the VN30-Index to its intraday high at the close, successfully breaking through the June 2024 peak, which was also the highest in 28 months.

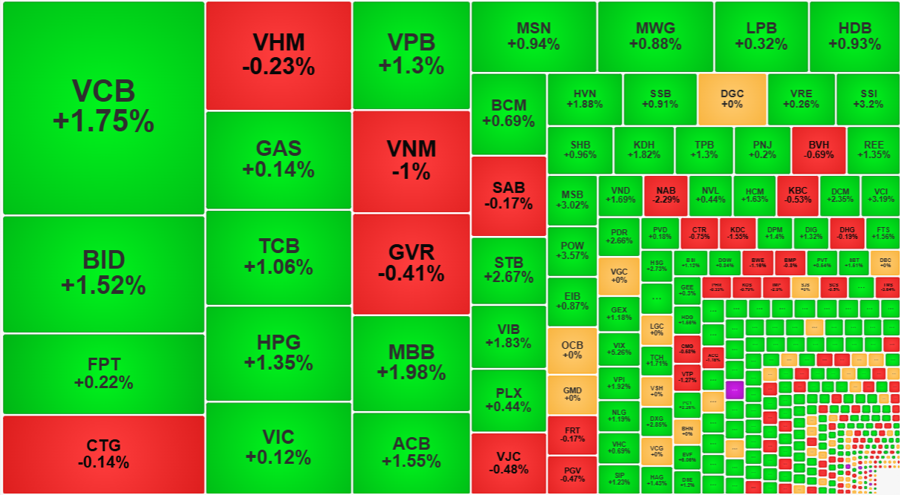

The VN30-Index closed up 0.99%, while the VN-Index gained 0.82%. One of the reasons for the VN30-Index’s outperformance was the strength of bank stocks. The top three stocks driving the index were ACB, up 1.55%; STB, up 2.67%; and MBB, up 1.98%. In contrast, their impact on the VN-Index was significantly less prominent. Additionally, the influence of HPG, up 1.35%; TCB, up 1.06%; and SSI, up 3.2%, was also more pronounced.

Foreign investors’ net buying was another notable feature, with many blue-chips strongly bought. In the morning session, the VN30 basket saw negligible net buying, but by the close, it recorded inflows of 205.3 billion VND. The HoSE floor, which had seen inflows of 41.9 billion VND in the morning, witnessed an additional 482.9 billion VND in the afternoon.

Impressive net buying was observed in several blue-chips: MWG (+84.3 billion VND), TCB (+79 billion VND), SSI (+65 billion VND), MSN (+46.1 billion VND), FPT (+44.6 billion VND), and VCB (+26.2 billion VND). Additionally, stocks outside the VN30 basket also saw significant net buying: VCI (+89.7 billion), VIX (+49.2 billion VND), DXG (+38.4 billion VND), DPM (+37 billion VND), HCM (+36.2 billion VND), DCM (+25.8 billion VND), HVN (+25.7 billion VND), NKG (+24.6 billion VND), and HSG (+21.5 billion VND). Overall, foreign investors’ net buying in the VN30 basket accounted for 13.5% of the basket’s total trading volume.

As a result, the streak of net buying by foreign investors appears to be extending. Yesterday, this investor group recorded net selling of over 2,400 billion VND on the HoSE due to a special deal with VIB (net selling of 2,664 billion VND). Excluding this transaction, foreign investors are still net buyers of other stocks. They net bought approximately 150 billion VND on the first day of the week and over 1,220 billion VND the week before.

In terms of indices, the VN-Index’s afternoon gains were limited primarily due to the weakness of some pillar stocks. CTG was the most notable, as it traded higher by 1.25% in the morning but fell continuously in the afternoon. It closed with a loss of 0.14%, equivalent to a price decline of 1.37% in the afternoon alone, despite being the fourth-largest capitalization stock on the VN-Index. GVR also experienced a significant price slide, falling by 0.96% from its morning price and closing with a loss of 0.41%. VNM also fell further, closing with a loss of 1%.

While the blue-chips failed to push the VN-Index higher, the VN30 reflected the resilience of the advancing stocks within the basket. The VN30-Index closed at its intraday high, with 13 stocks rising more than 1%. On the other hand, the VN-Index’s impact on the broader market was muted, and the performance of mid and small-cap stocks was even better than in the morning: Midcap closed up 1.12%, and Smallcap rose 0.67%, outperforming the morning session. Notably, the number of strong stocks increased: The VN-Index had 91 stocks rising more than 1% in the morning but closed with 113.

The matched order volume on the two trading floors decreased slightly by 12% in the afternoon compared to the morning, with HoSE down over 10%. Nevertheless, today’s trading volume was still significantly higher than the 10- and 20-session averages, reaching approximately 22,000 billion VND, excluding deals. This volume even surpassed that of the ETF restructuring session last weekend. It is evident that large amounts of money have entered the market, a distinct feature from the first wave of increases last week after the market hit a short-term bottom.

Currently, the ability of the VN-Index to break through its peak depends on the consensus of the largest stocks. For example, today, we have not seen the participation of VHM, VIC, GAS, FPT, and VNM, which are either in the red or have risen insignificantly. However, stocks are gaining strength as large amounts of money begin to flow in. Investors will choose stocks to invest in rather than focus on whether the VN-Index has peaked.