Gold ring prices updated on the afternoon of the 27th of September, with some brands increasing by 100,000 to 200,000 VND per tael.

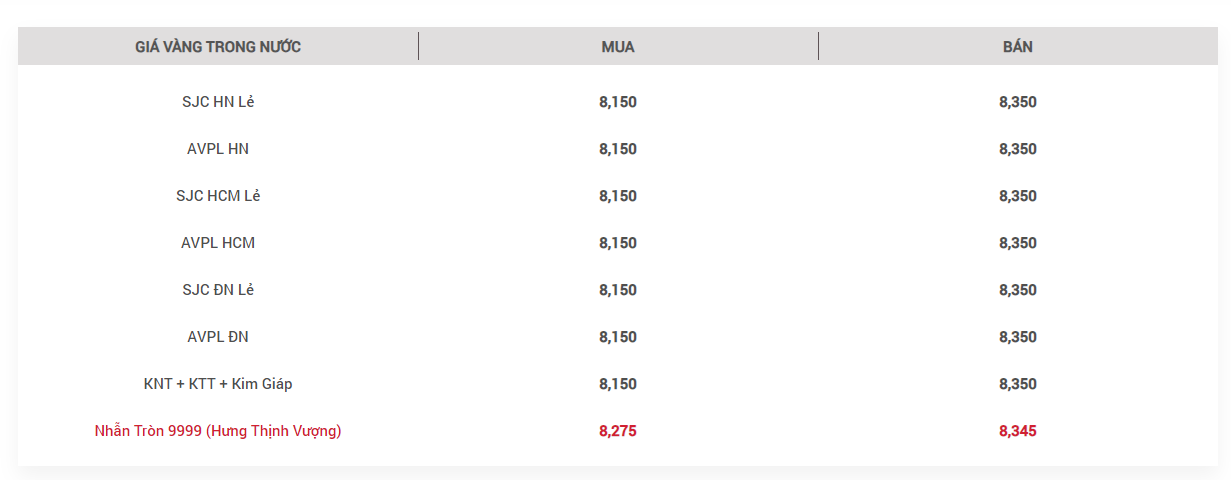

DOJI Group maintained their buying price while increasing their selling price by 100,000 VND per tael to 82.75-83.45 million VND per tael.

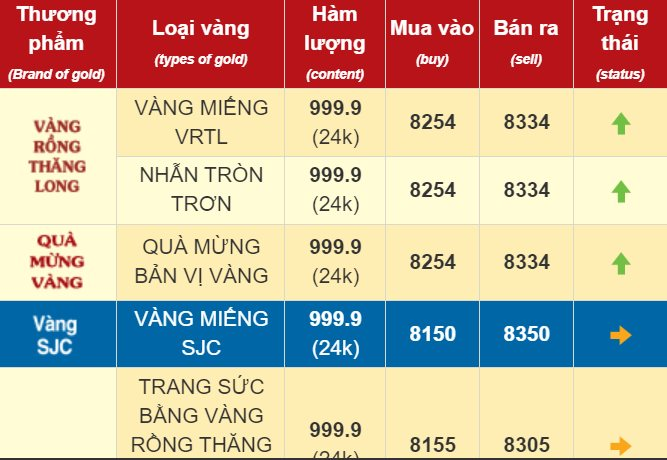

Similarly, Bao Tin Minh Chau and PNJ raised their prices by about 100,000 VND per tael, now listing at 82.54-83.44 million VND per tael and 82.5-83.3 million VND per tael, respectively.

———————————-

Specifically, at SJC, gold ring prices are listed at 81.5-83.1 million VND per tael, an increase of about 200,000 VND per tael compared to yesterday. SJC gold prices remain unchanged at 81.5-83.5 million VND per tael.

DOJI Group’s gold ring prices remained unchanged at the beginning of the day, listed at 82.75-83.35 million VND per tael. Prior to this, this type of gold had already increased by about 800,000 VND per tael on the 26th of September.

Bao Tin Minh Chau’s 9999 gold rings are priced at 82.54-83.34 million VND per tael, while Phu Nhuan Jewelry (PNJ) lists their gold rings at 82.1-83.2 million VND per tael.

Thus, SJC gold and gold ring prices have leveled out, with no significant difference between them. Those who own gold rings and sell them at this time (around 82.5 million VND per tael) are getting a better price than those selling SJC gold (81.5 million VND per tael).

Recently, the State Bank of Vietnam responded to citizens’ reflections on the difficulties in registering to buy SJC gold online from commercial banks. According to the Government Portal, Ms. Tran Thi Thuy Linh (Ho Chi Minh City) reflected that from the 12th of June, 2024, to the present, banks have decided to allow people to buy gold only if they have registered to buy SJC gold online to reduce the difficulties and long waiting times when buying gold.

However, according to Ms. Linh, this also causes difficulties for buyers. For more than a week, she has been monitoring the announcements and accessing the website at 9 am sharp to register to buy gold online at four large banks, including Vietcombank, Agribank, BIDV, and VietinBank, but has not been successful even once. Ms. Linh has also registered at many other branches of all four banks but still could not complete the registration.

Ms. Linh requested that the authorities consider and find a solution so that people can buy gold at stabilized prices.

Regarding this issue, the State Bank of Vietnam stated that following the Government’s and Prime Minister’s directions on continuing to implement solutions to manage the gold market, from the 3rd of June, the State Bank of Vietnam has organized the sale of SJC gold bars through four state-owned commercial banks and the Saigon Jewelry Company (SJC) to sell gold bars directly to the people.

After a period of implementation, to limit the gathering of large crowds and prevent the phenomenon of hiring people to queue and speculate on gold purchases at gold selling points, the four state-owned commercial banks and SJC implemented online gold sale registration.

SJC continues to sell gold bars directly at the announced selling points.

“Customers can choose to buy gold according to the instructions of the four state-owned commercial banks and SJC,” said the State Bank of Vietnam.

———————————————————–

In terms of international gold prices, on the evening of the 26th of September, the spot gold price continued to hit a new peak at $2,685 per ounce. Converted to VND/USD exchange rate, the world gold price is equivalent to about 81 million VND per tael, excluding taxes and fees. Meanwhile, the December gold futures price has surpassed the $2,700 per ounce mark.

Since the beginning of the week, a new peak has been set every one to two days, despite many investors starting to worry about the excessive price increase.

This continuous upward trend can be explained by several factors, including the recent interest rate decisions of central banks. The recent 50-basis-point cut by the US Federal Reserve (Fed) to the federal funds rate has been a significant catalyst. This move has been echoed by other central banks worldwide, fueling the rise of this precious metal.

Market sentiment indicates the possibility of further rate cuts in the future. According to the FedWatch tool of CME, there is a 51.1% chance of another 50-basis-point cut in the upcoming Federal Open Market Committee (FOMC) meeting on the 7th of November, while the remaining 48.9% leans towards a 25-basis-point reduction. This expectation of continued monetary policy easing has increased the appeal of gold as a hedge against currency devaluation.