In a recent report on real estate price trends sent to the Government Office, the Ministry of Construction stated that when applying land prices for 2024, the cost of land use for real estate projects is expected to increase significantly compared to previous years.

Cascading Effects

According to the Ministry of Construction, there are seven main cost components that influence housing and real estate prices, including: land use fees, site clearance compensation, project construction costs (housing and real estate), taxes, and related fees. Therefore, the new land price list, which is closer to market prices, will increase costs related to land, such as site clearance, land compensation, and taxes. While land use fees typically account for a significant proportion of the total project cost, ranging from 7% to 20% for high-rise apartment projects and 25% to 50% for villa and adjacent projects.

Land and housing prices in many areas of Hanoi have recently increased significantly, even before the application of the new land price list. Photo: LE THUY

The cost varies among projects, depending on location and the convenience of technical infrastructure. On the other hand, compensation for assets on the land usually accounts for an insignificant proportion, about 2%, of the investment cost. For instance, at the residential area of GP Invest (Hanoi), the land use fee calculated based on the selling price per square meter after applying the new land price list will increase to 22 million VND out of 36 million VND (approximately 60%). Currently, this ratio is only about 42%, equivalent to 15 million VND out of 36 million VND. Similarly, at the Dong Tang Long Urban Area (Thu Duc City, Ho Chi Minh City), the proportion of land use cost in the selling price per square meter of apartments is expected to increase from 27% (2.3 million VND out of 8.8 million VND) to 60-65%. At the Binh Duong Villa Project (Binh Duong Province), this ratio is projected to increase from 16.3% to approximately 50%… “A preliminary survey of several projects indicates that the application of the new land price list will have a cascading effect, triggering a 15-20% increase in real estate and housing prices compared to before,” the Ministry of Construction stated.

According to the Ministry, besides the factors mentioned above, the high housing and land prices in certain periods, projects, and areas can also be attributed to real estate investors taking advantage of limited supply to offer higher prices. Particularly, in cases where there is only one project available in an area, and the demand and number of registered buyers are high, the investor can increase the selling price (due to the absence of competition and reference prices) to maximize profits.

The Ministry of Construction also noted that, on average, project investors allocate about 3% of the selling price to real estate agencies and brokers. However, these agencies and brokers tend to add a premium based on market conditions when dealing with customers. For projects with limited supply but high demand, buyers often have to pay an additional amount, known as a “premium,” on top of the contract price agreed upon with the investor. This “premium” is not fixed and can range from 5% to 10% or even 20% of the selling price.

Moreover, there are cases where speculative groups, investors, and individual real estate brokers distort market information to “inflate prices” and create “illusory prices.” They take advantage of people’s lack of understanding to manipulate psychology and attract investment by following the herd mentality.

Land Valuation Based on Market Principles

According to Mr. Nguyen Quoc Hiep, Chairman of the Vietnam Contractors Association and Chairman of the Board of Directors of Global Property Investment Joint Stock Company (GP. Invest), the 2024 Land Law allows local authorities to apply the old land price list until December 31, 2025. Afterward, starting from January 1, 2026, the new land price list will come into effect, no longer constrained by the land price framework and required to be based on market prices. “Currently, local authorities are not obliged to develop a new land price list based on market price principles, but there is already a psychology of pushing land prices closer to market prices, leading to an increase in real estate prices,” said Mr. Hiep.

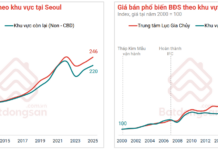

Mr. Hiep suggested that if land is considered a critical asset and product for the country’s stable development, it should be managed like essential commodities such as gasoline and electricity. If prices rise too high, the government should consider providing subsidies. Without specific policies affirming the state’s role in land price management and allowing “floating” prices based on market principles, it will be challenging to control, and Vietnam’s real estate and land prices could become among the highest in the world, possibly even surpassing Tokyo, Japan, or Hong Kong, China. This would be unreasonable.

Therefore, the Chairman of the Vietnam Contractors Association proposed that the state reconsider the principles for determining the new land price list to align with Vietnam’s conditions and global trends. This will promote economic development, including the real estate market, and prevent a “stalemate” that could paralyze the market.

Associate Professor and Doctor Nguyen Quang Tuyen, Vice President of the Council and Head of the Department of Economic Law at Hanoi Law University, emphasized that to implement land valuation based on market principles, as stipulated in the 2024 Land Law, the authorities must provide clear and synchronized guidance on determining specific land prices for local implementation. It is also necessary to have a professional team of valuers, which is currently lacking in quantity and quality, and comprehensive and transparent market information. As these elements are still missing in the market, land valuation is challenging to execute. “We need to recognize that the market is unpredictable, and real estate is unique and dependent on taste. One person may consider a land price acceptable, while another may find it expensive. Therefore, it is inappropriate to use that land price as a standard for an entire area,” he said.

Additionally, there have been cases of land price inflation in land auction sessions in Hanoi’s outlying districts. This has caused confusion in the market, leading residents in these areas to mistakenly believe that market land prices are exceptionally high. Consequently, land and housing prices have soared, with some apartments in Hanoi being advertised at over 100 million VND per square meter, and no longer any units available in the range of 30-40 million VND per square meter. This has made it challenging for workers to afford housing. This situation also contributes to the challenges faced by local authorities in determining land prices based on market principles, as stipulated in the 2024 Land Law.

Therefore, Associate Professor and Doctor Nguyen Quang Tuyen emphasized that land valuation, according to the 2024 Land Law, must adhere to the following principles: a land valuation method based on market principles; compliance with the process, procedures, and methods of land valuation; ensuring honesty, objectivity, publicity, and transparency; guaranteeing the independence of the organization advising on land price determination, the council for appraisal of the land price list, the council for appraisal of specific land prices, and the agency or person with competent authority to decide on land prices. Lastly, it is crucial to ensure a balance of interests between the state, land users, and investors.

Mr. TRAN KHAC QUANG, General Director of Viet An Hoa Real Estate Investment Company: A Roadmap is Necessary

The Ministry of Construction stated that applying the new land price list would trigger a 15-20% increase in real estate and housing prices. However, Mr. Quang believes that this estimate is conservative, and the increase could be as high as 30-50%. Real estate is inherently tied to land and land prices. Land is the foundation for generating assets, obtaining loans, and engaging in various economic activities. Therefore, when the land price list increases, everything else will follow suit. To curb rising housing prices, there is no other option but to implement a roadmap and prevent the new land price list from surging too high, which could disrupt the market.

Mr. TA TRUNG KIEN, Executive Director, Wowhome Real Estate Joint Stock Company: Adjustments for Suitability

Looking ahead, when the new land price list comes into effect, real estate transactions may not necessarily boom as buyers will consider their cash flow, and sellers will be unable to lower or maintain prices with the increase in land prices and taxes. To curb rising real estate prices, the state must also carefully consider adjusting the land price list to ensure suitability.

Mitigating Negative Impacts

The Ministry of Construction has requested that the Ministry of Natural Resources and Environment monitor the issuance of the new land price list by local authorities and implement measures to minimize negative impacts on housing prices and market supply and demand.

The Ministry has also urged real estate businesses to reduce product prices by reviewing and streamlining costs, adopting modern construction technologies, and investing in social housing projects and renovating old apartment buildings to align with the majority of the population’s needs.