According to a report by DKRA Consulting (a brand under the DKRA Group’s Research & Development Consulting Services division), the real estate market in Da Nang and its surrounding areas showed signs of recovery in Q3 2024, although it was not evenly distributed.

Specifically, the land segment witnessed positive shifts in primary supply, with around 11 new projects introduced to the market, equivalent to 1,039 plots, a 27% increase compared to the previous quarter. The primary land price reached VND 126.4 million/sq.m, with the lowest price recorded at VND 33.2 million/sq.m.

These positive recovery signs from the overall market have encouraged long-term individual investors to return to potential areas in Da Nang after a long period of observation. Notably, some believe that as the real estate market in Northern Vietnam is experiencing a surge, many investors will quietly take profits and redirect their money to Central Vietnam, including Da Nang. As a result, the Da Nang property market is expected to attract new investors, and prices are anticipated to rise again from the end of this year.

Over the past time, many investors holding land in Da Nang had to sell off their assets, resulting in a price decrease of hundreds of millions of VND per lot. Most of these investors used financial leverage for their investments. However, this situation has created opportunities for players with strong financial capabilities. Several investors with cash on hand are now actively looking to scoop up land at attractive prices. The areas of Hoa Vang, Ngu Hanh Son, and Cam Le have regained the attention of Northern investors. These locations previously experienced land fever, and many investors who bought at the peak are now forced to sell at a loss.

Previously, in 2022, numerous investors from Hanoi and Ho Chi Minh City exited the Da Nang market. Land prices remained high after the wave of speculation. When the market liquidity dried up, many investors sold their assets. Now, some investment groups show signs of returning and scooping up properties in potential areas following the news of new urban plans.

Nonetheless, the liquidity of land in Da Nang and its adjacent areas is not expected to see a significant short-term surge. The Da Nang property market is still recovering from its lows.

After a period of volatile pricing and the market crisis, many investors have yet to offload their properties, and the land speculators have left. Currently, the sentiment towards the Da Nang market has somewhat improved, but caution is still prevalent. While year-end liquidity is expected to be better, a surge in demand is unlikely.

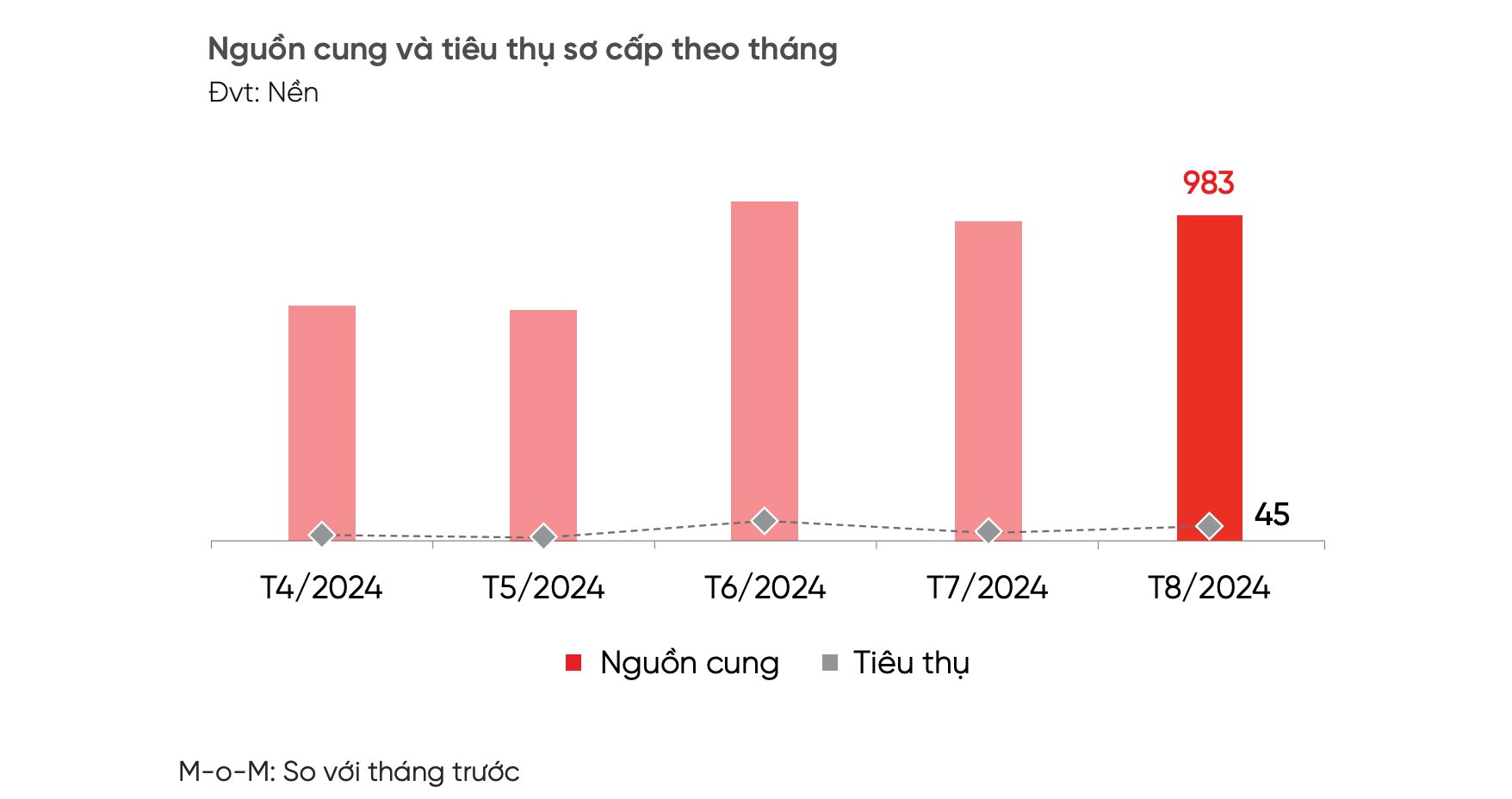

According to DKRA Consulting, in August 2024, the overall demand in Da Nang and its neighboring areas remained low, ranging between 2% and 15% of the total primary supply. Da Nang led the market in consumption, accounting for 71% of primary consumption. Transactions were mainly focused on products with completed infrastructure and legal status, with prices averaging below VND 50 million/sq.m.

The primary price level continued to record an average decrease of approximately 10% compared to the beginning of the year. Various policies, including discounts for cash payments and bank support, were implemented to improve liquidity.

Land demand remains relatively low.

According to the representative of DKRA Consulting, the market has not shown many clear recovery signals in terms of supply and liquidity. However, the passage of three real estate laws in early August 2024 is expected to bring positive impacts to the market in the coming time.

Some experts advise investors to exercise caution when investing in Da Nang real estate at this time and extend their investment horizon to 3-5 years. Investors should consider three factors: first, investing in products with complete legal procedures, located near the center or with convenient connections to the central area; second, choosing products they have experience investing in to facilitate negotiation and buying at a good price; and third, seeking out projects that offer significant discounts.

It is forecasted that the land segment in Da Nang will continue its recovery trend by the end of the year. Market demand is expected to increase slightly but remain low compared to the period before 2019. The primary price level is not anticipated to see significant changes compared to the previous launch.

The Power of VietinBank’s IR with 54,000 Shareholders

The Investor Relations (IR) activities of VietinBank are conducted with adherence to legal regulations, ensuring shareholder interests are paramount and that communications are integrated into financial operations. VietinBank does not discriminate between investors; every shareholder’s inquiry and request is supported and valued.

The Pen Is Mightier Than the Sword: Crafting Words to Conquer and Inspire.

On September 20, 2024, DBFS officially signed a contract to develop a luxury apartment project on nearly 1-hectare land in Tan Phu District, Ho Chi Minh City, with the investor, TC Tower Co., Ltd. This marks the beginning of an exciting journey towards creating a prestigious commercial residential project.

The Master Craft of Linguistic Sorcery: “The Debtor’s Tale – A Ca Mau Residential Project”

The investor of the Thanh Phu Residential Area project (in Ca Mau city), Thien Tan Limited Company, owes more than VND 16 billion in land use fees.

The Flow of Funds: Market Confirms Bottom, Shaking Hands to “Seal the Deal”

A week brimming with news and significant events propelled the market to surge beyond many investors’ expectations. The rapid ascent left some feeling like they missed the boat. However, experts believe that latecomers still have opportunities as the market is due for more volatility, shaking off short-term speculative positions while welcoming new investors.