The market saw another sharp dip in the morning session before selling pressure eased and bottom-fishing funds stepped in, lifting prices. Stocks recovered quite well, breaking out of their lows with large margins across the board. However, the results were not particularly impressive as liquidity was low and red dominated.

The afternoon rally saw even lower liquidity than the morning session. Nonetheless, the breadth improved, and stocks broke out of their lows quite well, indicating a reduction in selling pressure. If selling pressure remained intense, such small amounts of money wouldn’t have been able to push prices up.

The two exchanges traded around 12 trillion VND (excluding negotiated deals), a decrease of nearly 20% from the previous day. While this liquidity level is low, it doesn’t necessarily indicate a lack of money in the market; instead, it suggests that only a limited amount of capital is driving prices up, and there are still many buy orders. This reflects a clear buying perspective: attractive prices will be accumulated, but there’s no rush to push prices higher.

Of course, in a downward trend, any reduction in selling intensity is positive. To end a downward trend, long-term investors must first remain calm, while short-term traders naturally have the advantage and can afford to be patient. Today was the first session with reduced selling pressure after yesterday’s large-volume session that opened up the trading range. The market will likely experience more intraday dips to test whether today’s signal of reduced selling pressure is reliable or just a temporary supply-demand fluctuation.

From a cash holder’s perspective, a declining market is favorable as it presents opportunities to buy at reasonable prices without competition. The current market is undergoing a typical correction, with no significant changes in macro fundamentals or long-term trends. Therefore, deeper price dips will attract more buying interest, and technical support levels will be watched closely. The impact of flooding-related news will gradually fade, and new analyses will emerge regarding its effects on production, business operations, and economic growth.

There are still no clear signals indicating the end of this corrective phase when looking at the indices. A failed recovery session on low liquidity doesn’t reveal much. However, individual stocks have shown more evident signals, with strong stocks experiencing minimal corrections or merely typical fluctuations within their existing price ranges. Accumulating buying activities should focus more on the balance of supply and demand in specific stocks rather than solely on the index trend, as the latter is only undergoing a typical short-term correction.

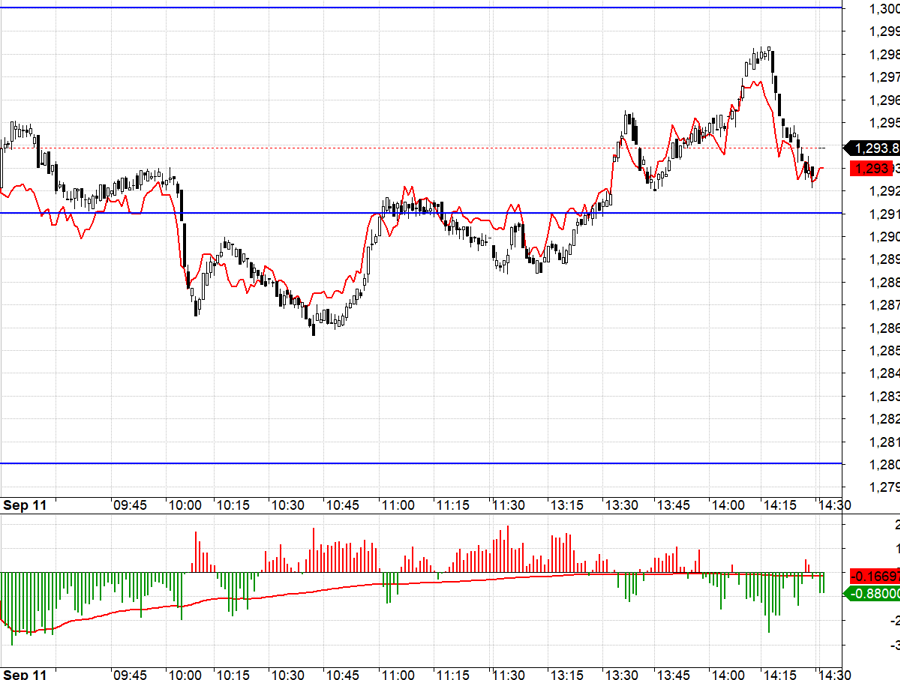

The futures market maintained a tight basis, favorable for both long and short positions. VN30 had two broad regions: one increasing from 1291.xx to 1300.xx and the other decreasing to 1280.xx. However, the absence of any dominant large-cap stocks pushing the index and the overall reduced selling pressure resulted in lackluster movements in both directions. The short position taken during the morning dip when VN30 broke below 1291.xx was profitable but limited in scope due to the shallow decline. The afternoon rally, which breached 1291.xx, was slightly better but couldn’t quite reach 1300.xx, and we saw a pullback in the final minutes. Overall, today’s futures market was indecisive and frustrating, but it bodes well for the underlying market as the large-cap stocks only witnessed minor declines, and the overall selling pressure was minimal.

VN30 closed today’s session at 1293.88. Tomorrow’s immediate resistance levels are 1300, 1306, 1317, and 1324. Support levels are 1290, 1280, 1276, 1270, and 1264.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The perspectives and assessments are solely those of the individual investor, and VnEconomy respects the author’s viewpoint and writing style. VnEconomy and the author are not responsible for any issues arising from the investment perspectives and opinions presented here.

“PNJ Receives the Coveted ‘Most Investor-Beloved IR Activities Listed Company 2024’ Accolade”

PNJ has been voted as the Best Investor Relations Company among large-cap enterprises in 2024. This recognition is a testament to our unwavering commitment to adhering to information disclosure regulations and safeguarding the rights and interests of our shareholders.