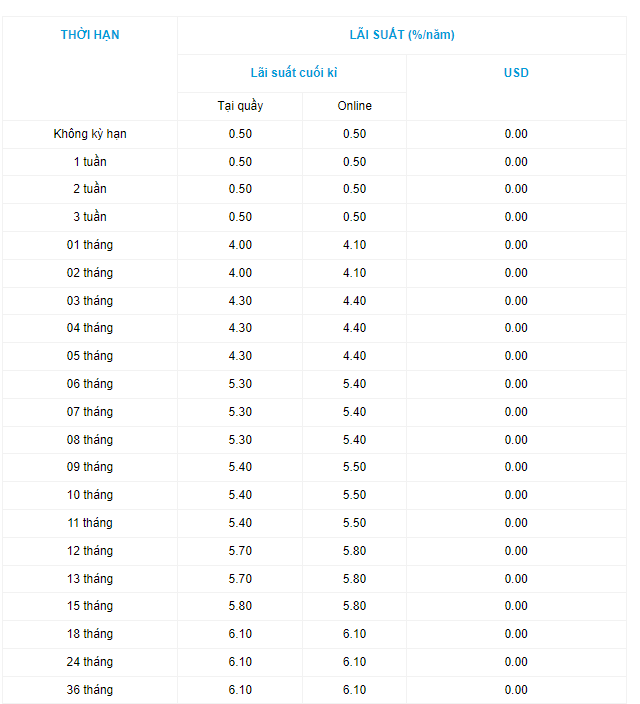

OceanBank has officially adjusted its savings interest rates as of September 24, 2024.

The bank has increased interest rates for fixed deposits with tenors ranging from 1 to 15 months, with an average increase of 0.2-0.4% per annum.

Specifically, interest rates for 1-2 month tenors have increased by 0.3% per annum to 4.1% per annum.

For 3-5 month tenors, the interest rate has been raised by 0.2% per annum to 4.4% per annum.

Savings rates for 6-8 month tenors have been increased by 0.4% per annum to 5.4% per annum.

The interest rate for 9-11 month tenors has also been bumped up by 0.4% per annum to 5.5% per annum.

OceanBank has further enhanced its offering for 12-15 month tenors, increasing the rate to 5.8% per annum with a 0.2% per annum increment.

Meanwhile, online deposit interest rates for 18-36 month tenors remain unchanged at 6.1% per annum, which is among the highest in the market today.

OceanBank’s Latest Savings Interest Rates.

Since the beginning of September, this is the second time OceanBank has raised its savings interest rates. Previously, on September 4, the bank increased rates by 0.1-0.4% per annum for tenors ranging from 1 to 15 months. Following this adjustment, OceanBank currently offers the highest interest rate in the market for 3-5 month tenors at 4.4% per annum.

OceanBank is also one of the banks offering competitive savings rates, with a maximum rate of 6.1% per annum for 18-24 month tenors applicable to regular deposits. Currently, SHB, Saigonbank (36 months), and HDBank (18 months) are also offering 6.1% per annum in the market. Meanwhile, NCB is providing a rate of 6.15% per annum for tenors ranging from 8 to 36 months.

Thus far, ten banks have increased their interest rates, including Nam A Bank, PGBank, ACB, BVBank, NCB, Agribank, GPBank, VietBank, OceanBank, and Dong A Bank, Bac A Bank, and OCB. On the other hand, ABBank has decreased its deposit rates this month, with reductions ranging from 0.1- 0.4% per annum for tenors between 1 and 12 months.

The Great Savings Interest Rate Surge

We are thrilled to announce that our bank is raising its savings interest rates starting today, September 17th. This decision reflects our commitment to delivering exceptional value to our esteemed customers. With this rate increase, we aim to empower our customers to grow their hard-earned savings and achieve their financial goals. Stay tuned for more updates, and thank you for choosing [Bank Name].

Online Savings Accounts: Uncovering September’s Highest Interest Rates at Agribank, Vietcombank, VietinBank, and BIDV

With its recent adjustment to online savings interest rates, Agribank has emerged as the leading bank in terms of interest rates for 1- to 12-month terms.