On October 21, 2024, the Ho Chi Minh City Stock Exchange (HSX) will announce changes to the constituent stocks and calculation coefficients for VNDiamond, effective November 4, 2024. This means that November 1, 2024, will be the last trading day for the structural adjustment of ETFs tracking the VN-Diamond Index.

Previously, HSX issued Decision No. 502/QD-SGDHCM on the promulgation of the rules for the construction and management of the Vietnam Diamond Index (“Vietnam Diamond Index”) version 3.0, replacing version 2.1. The decision took effect from the October 2024 evaluation period.

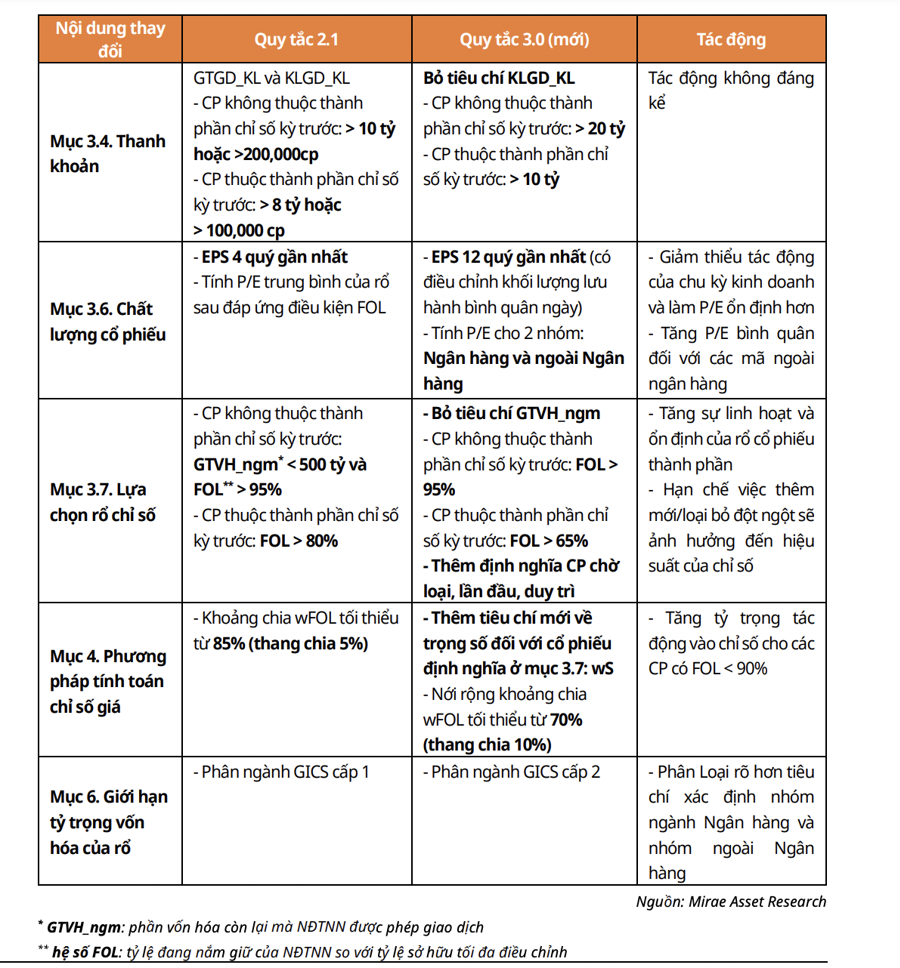

Some of the changes to the rules include removing the criteria for trading volume, with the volume of stocks not in the previous period’s index being larger than 20 billion, and the volume of stocks in the previous period’s index being larger than 10 billion. This rule has an insignificant impact on the basket of stocks in the index.

With the new rule on adjusted EPS for the latest 12 quarters, average daily trading volume, and P/E calculation for two groups of banks and non-banks, the impact of the business cycle will be minimized, and P/E will be more stable. The average P/E for non-bank codes will also increase.

In terms of index basket selection, the new rules state that stocks not in the previous period’s index with an FOL of >95%, and stocks in the previous period’s index with an FOL of >65%, will be included. Additionally, definitions for stocks awaiting removal, first-time inclusion, and retention have been added. These rules increase the flexibility and stability of the basket of constituent stocks and prevent sudden additions or removals that could affect the index’s performance.

For the index calculation method, there is a new criterion for the weight of stocks defined in Section 3.7. The minimum wFOL range has been widened from 70% (with a 10% division scale), increasing the proportion of the index’s impact on stocks with an FOL of <90%.

The GICS Level 2 industry classification rule helps to more clearly define the criteria for determining the banking group and the non-banking group.

With the new set of rules, Mirae Asset believes that in the October review, there will be no stocks added to or removed from the index. VRE will be placed on the watchlist for potential removal due to violating the minimum FOL criterion of 65%. This means that in the next period, in January 2025, if VRE’s FOL remains below the required 65%, it may be completely removed from the index.

The fact that VRE is on the watchlist means that its weight will be reduced to 50%. This significantly reduces VRE’s contribution to the index, directly affecting the structural portfolios of passive funds tracking the VNDiamond.

Based on closing price data as of September 20, 2024, Mirae Asset believes that the current stocks meet the criteria to remain in the index basket.

Currently, there are five ETFs using this index as a reference: VFMVN Diamond, MAFM VNDiamond, BVFVN Diamond, KIM Growth Diamond, and ABF VNDiamond, with a total value of VND12,700 billion. VFMVN Diamond accounts for the majority of the scale (~95%), so Mirae Asset provides a forecast for this group of funds. As no stocks are expected to be added to or removed from the index, these funds will only trade existing stocks to rebalance their portfolios.

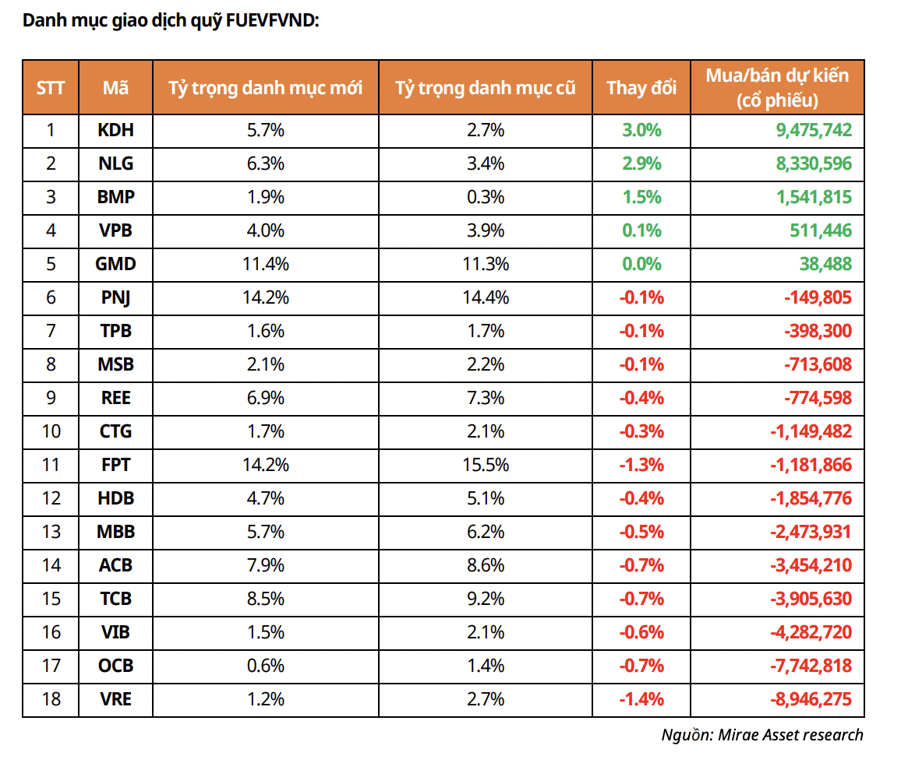

In terms of trading fluctuations, a small number of stocks have seen significant increases in their weights, namely KDH, NLG, and BMP. Meanwhile, most other stocks have been adjusted towards net selling, focusing mainly on VRE, OCB, and VIB.

KDH was the most bought stock with 9.47 million shares, followed by NLG with 8.3 million shares, BMP with 1.5 million shares, VPB with 511,000 shares, and GMD with 38,000 shares.

On the other hand, VRE was the most sold stock with 8.9 million shares, followed by OCB with 7.7 million shares, VIB with 4.2 million shares, TCB with 3.9 million shares, ACB with 3.45 million shares, and MBB with 2.4 million shares. The remaining stocks, such as HDB, FPT, CTG, REE, MSB, TPB, and PNJ, were also sold, ranging from a few hundred thousand to over one million shares.