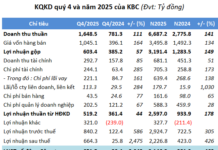

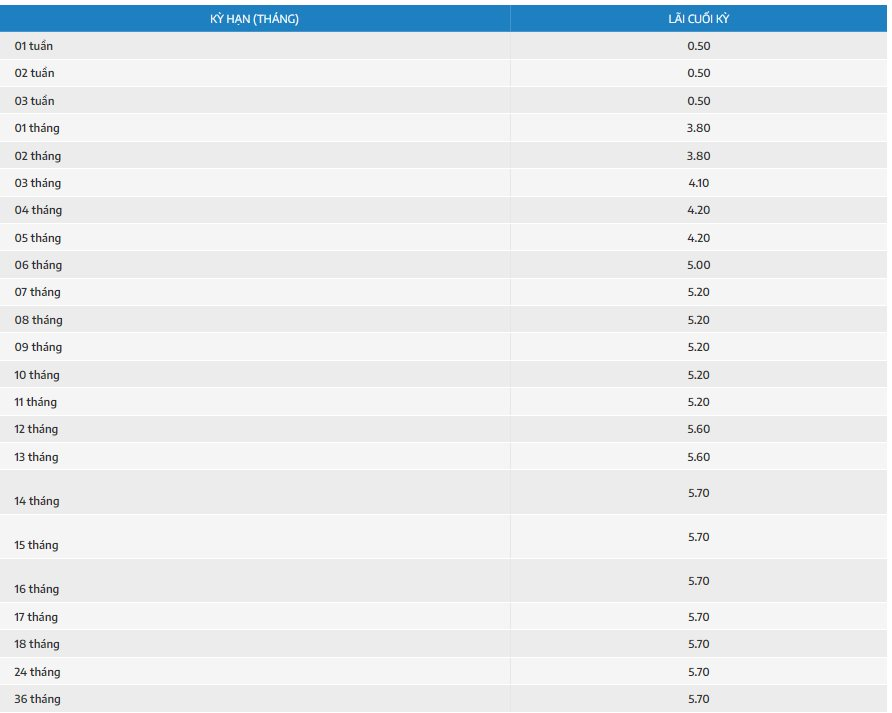

Nam A Bank has officially adjusted its interest rates as of yesterday, September 24th. The bank has only increased interest rates for the 1-month term, applicable to online deposits.

Specifically, the interest rate for the 1-month term increased by 0.3 percentage points to 3.8% per annum. The bank maintained interest rates for other terms. Accordingly, interest rates for 3-month, 6-month, 9-month, and 12-month terms remain at 4.1%, 5%, 5.2%, and 5.6% per annum, respectively. The 18-36 month term continues to offer an interest rate of 5.7% per annum.

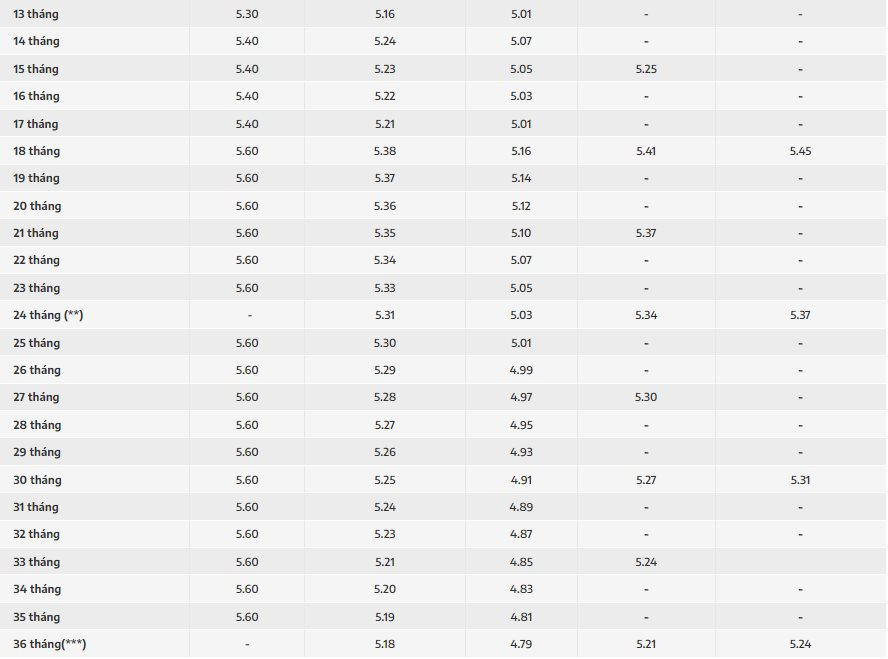

Nam A Bank’s latest online savings interest rates.

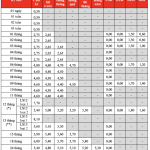

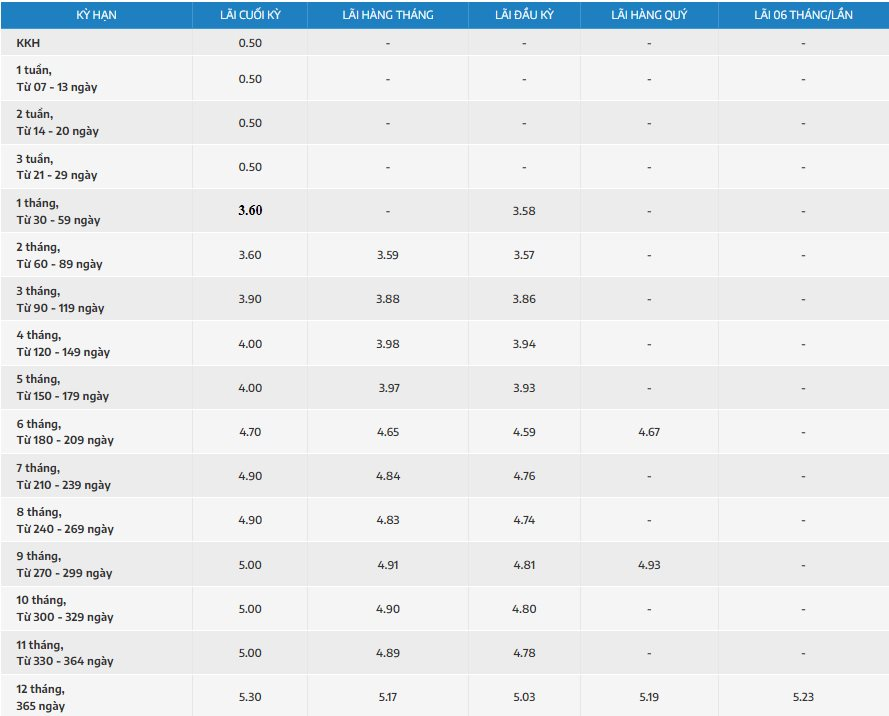

For customers choosing to deposit at the counter, the interest rates for 1-month, 3-month, 6-month, 9-month, and 12-month terms are 3.6%, 3.9%, 4.7%, 5%, and 5.3% per annum, respectively. The 18-36 month term offers an interest rate of 5.6% per annum.

Nam A Bank’s counter deposit interest rates.

For customers depositing for 24 months with an amount below VND 500 billion, the applicable interest rate is equivalent to the rate for a 23-month term, with interest paid at maturity. For the same term, deposits of VND 500 billion or more will earn an interest rate of 5.8% per annum with the approval of the General Director.

Additionally, for 36-month term deposits with an amount below VND 500 billion, the interest rate applicable is the same as the 35-month term with interest paid at maturity. For deposits of VND 500 billion or more, the interest rate offered is 6.2% per annum with the approval of the General Director.

In the current market, for large deposits of a few hundred billion VND, many banks offer interest rates exceeding 7% per annum. For instance, HDBank maintains an interest rate of 8.1% per annum for a 13-month term for deposits of VND 500 billion or more. PVcombank also offers a high-interest rate of 9.5% per annum for a 12-month term, with a minimum deposit requirement of VND 2,000 billion.

Moreover, MSB continues to offer an interest rate of 8% per annum for a 13-month term. This rate is applicable to new savings accounts or automatically renewed accounts opened from January 1, 2018, with a 13-month term and a deposit amount of VND 500 billion or more.

For interest rates of 7% per annum and above, HDBank offers 7.7% per annum for a 12-month term with a minimum deposit of VND 500 billion. Similarly, MSB maintains an interest rate of 7% for a 12-month term for new savings accounts or automatically renewed accounts opened from January 1, 2018, with a deposit amount of VND 500 billion or more.

NCB also offers the highest interest rate of 6.15% for customers depositing for 18-60 months, with no conditions on the deposit amount.

Latest HDBank Savings Interest Rates April 2024: Best Interest Rates for 18-Month Term

In April, HDBank’s highest saving interest rate for regular deposits is 5.9%/year, applied for online deposits with a term of 18 months.