The Boom of QR Code Payments in Southeast Asia

QR code payments via smartphones are rapidly gaining traction in Southeast Asia, with countries like Malaysia and Cambodia leading the pack in terms of transaction growth.

QR payments began to spread in the region a few years ago, driven by factors such as low bank account ownership, scarce ATM networks in rural areas, and the advent of affordable smartphones. This trend has been partly fueled by the emergence of travel and cross-border services.

In Cambodia, according to the central bank, QR payments surged by 29% in 2023 to around 601 million transactions, a tenfold increase in just three years.

Last month, the National Bank of Cambodia launched Bakong Tourists, a mobile payment system that enables tourists to make cashless transactions and encourages the use of the Cambodian riel.

Bakong Tourists builds upon the Bakong digital payment system introduced in 2020 and is widely known as the central bank’s digital currency. Bakong payments are made using the country’s unified QR code, called KHQR.

“For KHQR payments, we have up to 3.3 million payment locations nationwide. In Phnom Penh and Siem Reap, even street vendors and small retailers accept QR codes,” said Chea Serey, Director-General of the National Bank of Cambodia, at the launch of Bakong Tourists in Siem Reap.

Bakong Tourists is “a good idea to facilitate tourist payments,” said Sam Nang, a 37-year-old tour guide in Siem Reap, home to the world-famous Angkor Wat, to Nikkei Asia.

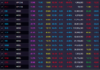

In Malaysia, DuitNow QR, introduced by Payments Network Malaysia (PayNet) in 2019, has quickly become the backbone of the digital payment ecosystem. According to the central bank, Bank Negara Malaysia, in the first six months of this year, there were 1.5 billion transactions totaling 1.37 billion ringgit ($320 million) – a respective increase of 64% and 37% from the same period last year.

DuitNow QR can be used interchangeably with systems in other ASEAN countries. For example, Malaysian users can scan QR codes from Indonesia’s QRIS, Singapore’s NETS, Thailand’s PromptPay, or China’s Alipay for overseas payments, and international visitors to Malaysia can also scan DuitNow QR codes there.

“We are working closely with regional partners to enhance our presence by continuing to build more cross-border channels to interoperate QR codes,” said Farhan Ahmad, PayNet’s chief executive, to Nikkei Asia. “We are also focusing on small merchants and tourists. PayNet aims to be the safest and best way to transact.”

Cross-Border QR Payments

In Southeast Asia, Singapore was an early adopter of digital payment forms. Launched in 2017, PayNow has become essential infrastructure, enabling real-time money transfers 24/7. The system processed 437 million transactions worth S$157 billion ($120 billion) in 2023, up 41% and 28%, respectively, from a year earlier, according to the Association of Banks in Singapore.

In April 2021, the association linked PayNow with Thailand’s PromptPay, allowing retail customers of banks from both countries to send money across borders securely. This was the first time in the world that similar instant payment systems were linked internationally.

Today, PayNow also serves as infrastructure for startups and emerging financial services, with a total of 27 traditional banks and fintech companies on board, including ride-hailing and food delivery company Grab.

The Bank of Thailand has also expanded PromptPay’s reach to other ASEAN countries. Links are being formed beyond ASEAN with countries that have strong economic ties with Thailand, particularly those that provide large numbers of migrant workers and tourists.

In 2023, PromptPay’s registered user count soared to a record high of 77.2 million, up 2.9 million from the previous year, and its average daily transaction value reached 129 billion baht ($3.8 billion).

Indonesia and Vietnam have also witnessed a surge in QR payments. According to Bank Indonesia, transactions involving its unified QR code, QRIS, grew by 226% year-on-year in Q4 2023, with user and merchant acceptance numbers standing at 50 million and 32 million, respectively.

Vietnam’s State Bank reported that QR transactions in the first half of 2024 increased by 104.23% in volume and 99.57% in value compared to the same period in 2023. Vietnam is unique in that it has a 24/7 interbank transfer system, along with multiple e-wallets, so QR payments are made diverse across multiple platforms.

In the Philippines, digital payment transactions reached 2.6 billion in 2023, up 28.1% from the previous year, according to the country’s central bank. QR transactions through the unified code, QR Ph, reached 73.8 million in 2023, a 17.2-fold increase from 2022.

The Odyssey Cup Dota 2 Southeast Asian and Oceanic Championship

Six representatives from Southeast Asia and two from Oceania will compete for a total prize pool of $20,000.