The Ministry of Finance has recently submitted a draft decree to the Government regarding a proposed reduction in land rental fees for 2024.

This regulation aims to boost production and business activities for organizations, units, enterprises, households, and individuals who lease land directly from the state through decisions, contracts, or certificates of land use rights and ownership of assets attached to the land, issued by competent state agencies. The payment is structured as an annual land rent.

REFUND AND PENALTIES FOR MISREPRESENTATION

The regulation also applies to cases where the lessee does not fall under the category of those eligible for exemption or reduction of land rent after the expiration of the exemption or reduction period. It also covers lessees who are already receiving reduced land rent according to the Law on Land and other relevant laws.

The Ministry of Finance has proposed two options for reducing land rent: (i) a 15% reduction or (ii) a 30% reduction in land rent payable for 2024 for lessees. The reduction will be calculated based on the land rent payable for 2024 as per legal regulations and will not be applied to any outstanding debt from previous years or late payment fees (if any).

Previously, the Ministry of Finance had suggested a 15% reduction based on a proposal in Official Dispatch No. 5461/BTC-QLCS dated May 29, 2024. This suggestion took into account the improved production and business conditions in 2024 compared to 2023, with a GDP growth estimate of 5.66% for the first quarter of 2024 year-on-year, outpacing the growth rate of the same quarter in the previous four years (2020-2023)

In cases where the lessee is already receiving a reduction in land rent as per regulations or is entitled to deductions for compensation and site clearance costs as per the Law on Land Rent, the reduction will be calculated based on the payable amount (if any) after such reductions or deductions have been applied as per the law.

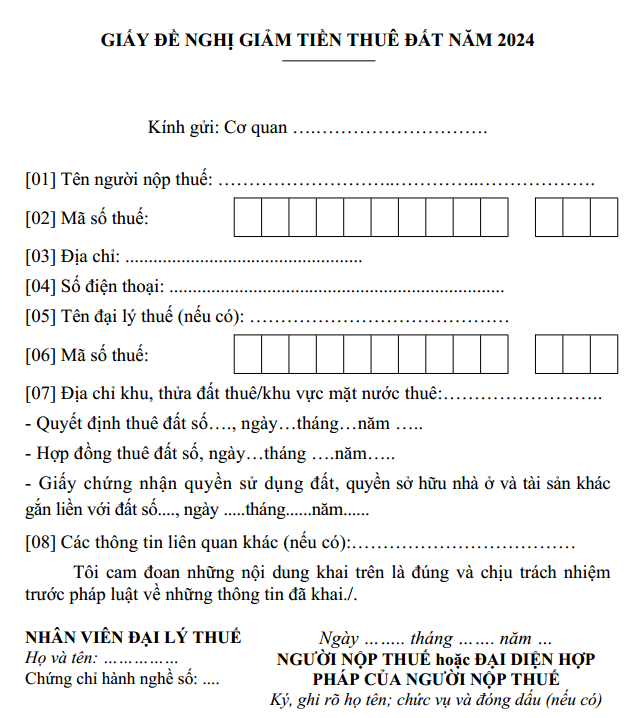

To be eligible for the land rent reduction, the Ministry of Finance requires lessees to submit a request using the form provided in the appendix to the decree. Lessees are responsible for the accuracy and truthfulness of the information and their request for a reduction, ensuring that they meet the criteria for eligibility.

Additionally, lessees must provide a copy of the land lease decision, contract, or certificate of land use rights and ownership of assets attached to the land, issued by the competent state agency.

Within 30 days of receiving a complete and valid application, the authorized agency will determine the amount of land rent reduction and issue a decision on the reduction in accordance with the Law on Collection of Land Rent and the Law on Tax Administration.

“In cases where the lessee has been granted a reduction in land rent by the competent agency as per this decree but is subsequently found by the state management agency, through inspection or examination, to not meet the conditions for the reduction as stipulated in this decree, the lessee shall refund the state budget for the amount of land rent reduced and late payment fees calculated on the reduced amount, in accordance with the Law on Tax Administration,” the Ministry of Finance stated.

REDUCING GOVERNMENT REVENUE FROM LAND RENT BY 4.5-9%

In the past, to overcome difficulties caused by the impact of the Covid-19 epidemic and contribute to the recovery and socio-economic development, the Ministry of Finance has submitted to the Prime Minister for issuance of decisions on reduction of land rent in 2020, 2022 for enterprises, organizations, households, and individuals who lease land annually from the State and are affected by the Covid-19 epidemic.

The average amount of land and water surface rent reduced in the years 2020-2023 according to the above decisions of the Prime Minister is VND 2,890 billion/year, of which the average for the years 2021-2023 is VND 3,734 billion/year. Thus, it has contributed to supporting enterprises, organizations, units, households, and individuals in removing difficulties due to the impact of the Covid-19 epidemic, so that they can soon restore production and business activities after the epidemic, and at the same time stimulate production and business activities.

Explaining the necessity of reducing land rent in 2024, the Ministry of Finance said that currently, the economy is still facing many risks and uncertainties, negatively affecting sustainable growth.

Along with that, on September 15, 2024, the Ministry of Planning and Investment reported to the Government on the damage caused by storm No. 3. Accordingly, the growth rate in the last 6 months of the year of the whole country and many localities is expected to slow down, the GDP growth rate of the whole country in the third quarter of 2034 may decrease by 0.35%, the fourth quarter of 2024 decreased by 0.22%; estimated for the whole year, GDP may decrease by 0.15% compared to the scenario without Storm No. 3.

One of the solutions to overcome the consequences of the storm and floods, and to restore production and business activities proposed by the Ministry of Planning and Investment is to reduce land and water surface rent for subjects affected by Storm No. 3 and the influence of storms, floods, and landslides.

The expected amount of land rent reduction according to the draft decree is about VND 2,000 billion with a reduction rate of 15% of the land rent in 2024, equivalent to 50% of the expected reduction in 2023; or VND 4,000 billion, equivalent to the expected reduction in 2023 with a reduction rate of 30% nationwide.

This amount accounts for about 0.13-0.26% of the total state budget revenue for one year and 4.5-9% of the state budget revenue from land rent for one year.

According to statistics from the State Treasury, up to the end of July 31, the revenue from land and water surface rent reached VND 24,681 billion, reaching 91.63% of the estimate.

“With the recovery and development of the economy in 2024 thanks to the fiscal and monetary policies of the Government and the efforts of the whole political system, the estimate of state budget revenue in 2024 approved by the National Assembly will be achieved and exceeded. Therefore, the reduction of land rent according to this policy will not significantly affect the state budget revenue,” the Ministry of Finance assessed.

When organizations, individuals, households, and enterprises recover and develop production and business, they will increase budget revenue from taxes, thereby offsetting the reduction in revenue due to the reduction of land rent.

A Helping Hand for Yên Bái and Lào Cai: Emergency Support Package of 180 Billion VND Proposed

The Ministry of Finance has proposed a generous support package for two provinces: a substantial 150 billion VND for Lao Cai and 30 billion VND for Yen Bai.

Rearing in Revenue: The Ministry’s Mandate?

The Vietnamese government has made significant strides in reforming state capital investment management. One notable change is the decision to no longer manage second-tier enterprises and reduce the number of enterprises requiring the Prime Minister’s approval for leadership appointments. These moves signify a shift towards greater autonomy for businesses and a streamlined decision-making process. However, a point of contention remains: how should state-owned enterprises distribute profits when the state does not hold a substantial amount of capital in these businesses? This question sparks an important debate, highlighting the need to balance state involvement and enterprise independence.