Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 874 million shares, equivalent to a value of more than 19.2 trillion VND; HNX-Index reached over 64.7 million shares, equivalent to a value of more than 1,231 billion VND.

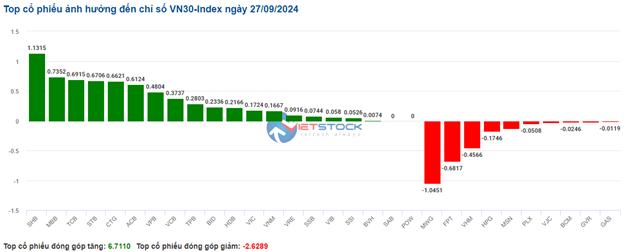

The tug-of-war between buyers and sellers continued for the VN-Index, with the latter gaining the upper hand, resulting in the index closing in the red. In terms of impact, VHM, GVR, GAS, and MWG were the most negative stocks, taking away nearly 2 points from the index. On the other hand, CTG, STB, EIB, and VPB were the most positive stocks, contributing almost 1.8 points to the index.

| Top 10 stocks with the highest impact on the VN-Index on September 27, 2024 |

Similarly, the HNX-Index also witnessed a lackluster performance, impacted negatively by IDC (-1.36%), PVS (-1.21%), NTP (-1.39%), and HUT (-0.6%).

|

Source: VietstockFinance

|

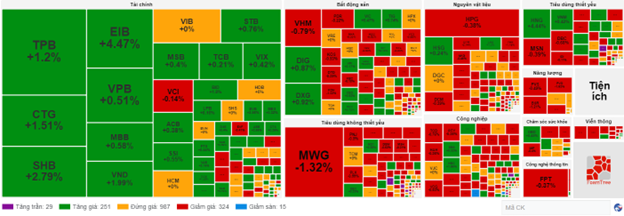

The telecommunications sector witnessed the sharpest decline in the market, falling by -1.84%, mainly due to VGI (-2.11%), YEG (-1.6%), CTR (-1.24%), and FOX (-1.11%). This was followed by the energy sector and the non-essential consumer sector, which decreased by 1.2% and 0.82%, respectively. On the contrary, the financial sector witnessed the strongest recovery in the market, with green signals from VPB (+0.77%), TPB (+1.5%), SHB (+2.33%), and EIB (+3.63%).

In terms of foreign investors’ activities, they continued to net buy over 138 billion VND on the HOSE exchange, focusing on TPB (95.38 billion), VNM (73.22 billion), FPT (62.91 billion), and SSI (59.23 billion). On the HNX exchange, foreign investors net sold over 19 billion VND, mainly offloading IDC (22.49 billion), TNG (6.5 billion), SHS (3.1 billion), and PVB (1 billion).

| Foreign Investors’ Buying and Selling Activities |

Morning Session: Fluctuations at Strong Resistance Level

Large-cap stocks attempted to lead the market, but the overall market lacked consensus, resulting in fluctuations around the strong resistance level of 1,290 – 1,300 points. At the midday break, the VN-Index gained 2.21 points, or 0.17%, to reach 1,293.7 points, while the HNX-Index rose 0.23% to 236.47 points. The market breadth returned to a more balanced state, with 329 gainers and 337 losers.

The morning session maintained decent liquidity, with the VN-Index matching volume reaching nearly 494 million shares, equivalent to a value of over 10 trillion VND. The HNX-Index recorded a matching volume of over 32 million shares, with a value of nearly 587 billion VND.

Among the top 10 stocks positively impacting the index, eight were from the banking sector (the remaining two were VNM and VRE), helping the VN-Index gain nearly 4 points. The leaders included BID, CTG, and VPB. Conversely, VHM, MWG, and GVR were the most negative stocks, taking away more than 1 point from the index.

The red color gradually gained the upper hand in most sectors, but the fluctuations were mild, with changes of less than 1%. On the positive side, the financial sector led the market with the strong performance of bank stocks. Bright green signals were observed in BID (+1.2%), CTG (+1.65%), VPB (+1.79%), SHB (+2.79%), EIB (+3.91%), and KLB (+3.79%). In the securities sector, only VND rose nearly 2%, while most other stocks witnessed mild fluctuations of less than 1%. Meanwhile, insurance stocks traded in a lackluster manner, with red signals dominating several large-cap stocks such as BVH, MIG, BMI, and PTI.

Following closely was the healthcare sector, which increased by 0.5%. Buying interest concentrated in IMP (1.39%), DBD (+1.13%), DTP (+4.42%), TTD (+2.95%), and VET (+3.29%). In contrast, sellers remained dominant in DVN, TRA, DCL, and DP3.

On the opposite end, the telecommunications sector ranked at the bottom with a decline of 1.65%, as red signals prevailed in VGI (-1.96%), CTR (-1.4%), FOX (-1.22%), and FOC (-1.81%). The essential consumer sector also faced selling pressure, with negative contributions from MWG (-1.32%), OIL (-4.41%), PLX (-0.99%), PNJ (-0.5%), and FRT (-0.78%).

Foreign investors turned to net selling in the morning session, offloading a small amount of nearly 36 billion VND on the HOSE exchange. The stocks facing the most significant net selling pressure were HPG (95 billion), MWG (81 billion), and VPB (67 billion). On the HNX exchange, foreign investors net sold nearly 8 billion VND, focusing their sales on IDC and TNG stocks.

10:30 am: Investors Display Hesitation at the 1,300-Point Level

Investors exhibited a cautious attitude, causing the main indices to fluctuate around the reference level, despite the VN-Index briefly surpassing the 1,300-point mark. As of 10:30 am, the VN-Index slightly increased by 1.96 points, hovering around 1,293 points. Meanwhile, the HNX-Index decreased by 0.15 points, trading around 236 points.

VN30-Index witnessed a robust recovery, led by most banking stocks. Notably, SHB rose by 1.13 points, MBB increased by 0.74 points, TCB gained 0.69 points, and STB added 0.67 points. Conversely, a few stocks continued to face selling pressure, including MWG, FPT, VHM, and HPG, which took away more than 2.2 points from the overall index.

Source: VietstockFinance

|

Stocks in the financial sector currently lead the market’s upward momentum and account for more than 35% of the total market capitalization. Specifically, green signals were observed in most stocks, such as TPB (+1.2%), SHB (+3.26%), EIB (+4.75%), VND (+2.33%), etc. Only a small number of stocks remained unchanged, including VIB and MSB, while a few others, such as VCI, HCM, and DSC, faced selling pressure, but the declines were not significant.

Following closely, the essential consumer sector maintained its positive performance despite the mixed market breadth. Notable gainers included HNG, which rose by 4.44% right after the market opened, along with VNM (+0.42%), ANV (+0.46%), and BAF (+0.24%). On the other hand, MSN declined by 0.53%, DBC fell by 0.68%, and HAG dropped by 0.47%, but the selling pressure was not overwhelming.

In contrast, the telecommunications sector continued its downward trend for the third consecutive session, with leading stocks facing selling pressure, including VGI (-2.11%), CTR (-1.4%), FOX (-1.11%), and YEG (-1.18%)…

Compared to the beginning of the session, sellers gained the upper hand, despite the market breadth still being dominated by stocks trading around reference prices (over 980 stocks). There were 324 declining stocks (including 15 at the lower circuit) and 251 advancing stocks (including 29 at the upper circuit).

Source: VietstockFinance

|

Opening: Green Signals from the Start

At the opening of the September 27 session, as of 9:30 am, the VN-Index rose by more than 4 points to reach 1,295.56 points. Meanwhile, the HNX-Index also witnessed a slight increase, trading above the reference level at 236.9 points.

Green signals temporarily dominated the VN30 basket, with 6 declining stocks, 22 advancing stocks, and 2 unchanged stocks. Notably, SHB, TPB, and BID were the top gainers. Conversely, BCM, MWG, and VHM experienced mild declines of 1.02%, 0.56%, and 0.34%, respectively.

As of 9:30 am, the financial sector witnessed impressive growth, with numerous stocks recording gains from the beginning of the session. These included EIB (+4.19%), TPB (+2.1%), SHB (+2.79%), VND (+1%), HCM (+0.16%), TCB (+1.04%), and others.