Nam Kim Steel Joint Stock Company (HNX: NKG) has just approved the registration dossier for offering additional shares to the public for existing shareholders.

Previously, Nam Kim Steel approved the plan to offer shares to existing shareholders at a ratio of 50%, meaning that for every 2 shares owned, shareholders will have the right to buy 1 new share at a price of VND 12,000/share. The offering is expected to be implemented from Q3 – Q4/2024, after approval from the State Securities Commission.

With more than 263.2 million shares currently in circulation, Nam Kim Steel is estimated to offer an additional 131.6 million shares to raise over VND 1,579.6 billion. The proceeds will be used to contribute capital to Nam Kim Phu My Steel Joint Stock Company to invest in the Nam Kim Phu My Steel Sheet and Roof Project, with the investment disbursed from Q4/2024 to Q1/2025.

Illustrative image

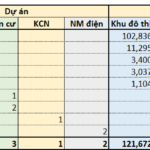

The Nam Kim Phu My Steel Sheet and Roof Project includes a galvanizing line with a capacity of 350,000 tons/year, 2 zinc-aluminum alloy coating lines with a capacity of 300,000 tons/year and 150,000 tons/year, and a color coating line with a capacity of 150,000 tons/year.

The project is located on Road No. 1, My Xuan B1 – Dai Duong Industrial Park, My Xuan Ward, Phu My Town, Ba Ria – Vung Tau Province, with a total investment capital of VND 4,500 billion.

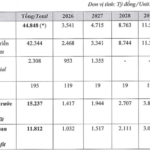

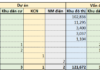

In terms of business results, according to the reviewed consolidated financial statements for the first 6 months of 2024, Nam Kim Steel recorded net revenue of over VND 10,951.6 billion, up 10.9% over the same period last year. After deducting expenses, Nam Kim Steel reported a profit of VND 369.7 billion, 4.86 times higher than the previous year.

As of Q2/2024, Nam Kim Steel’s total assets stood at VND 12,899 billion. Of this, short-term assets were VND 10,109 billion, up 8.44% from the beginning of the year, and long-term liabilities were VND 2,789 billion, down 4.24% from the beginning of the year.

The company’s total liabilities were VND 7,110 billion, mainly short-term liabilities of VND 7,082 billion, and long-term liabilities of VND 27.8 billion, down 1.52%. Owner’s equity was VND 5,788 billion, up 6.73% from the beginning of the year.

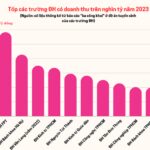

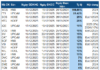

The Top 10 Universities with Revenue in the Thousands of Millions

As per the recent enrollment proposal and the ‘public transparency’ reports submitted by universities to the Ministry of Education and Training, 10 higher education institutions boasted impressive annual revenues exceeding 1,000 billion VND in 2023. Among these top-performing institutions, 6 were public universities, while 4 were private.