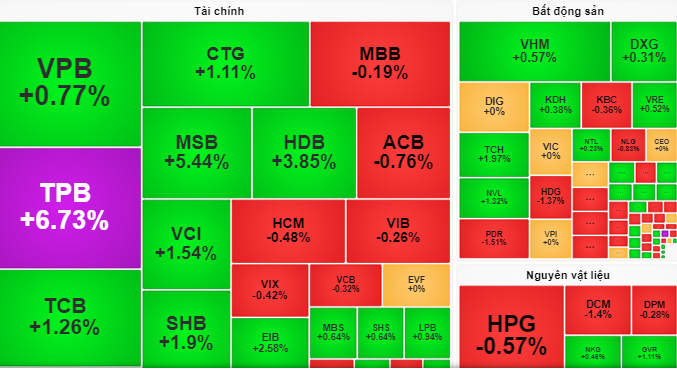

Banking and real estate stocks surged in the final hour of the session on September 26th.

The stock market maintained its enthusiasm from the previous session and opened on September 26th in the green. However, the morning session saw a curb in point gains as several large-cap stocks fell.

Entering the afternoon session, the VN-Index’s upward momentum unexpectedly expanded thanks to strong buying pressure towards banking and real estate stocks.

This was evident as TPG soared by 6.7%, HDB rose by 3.8%, MSB climbed 5.4%, and Vingroup’s stocks saw impressive gains (VIC up 1.5%, VHM up 0.57%, and VRE up 0.52%). This has sparked hopes among investors for further surprises from banking and real estate stocks.

Notably, foreign investors net bought stocks with a total net value of VND 969 billion, focusing on TPB, DXG, and HDB.

At the close, the VN-Index ended at 1,291 points, up 4 points, or 0.3%.

-

Pre-trading session briefing for September 26th: Trường Thành Wood receives another warning. READ NOW

ACBS Securities Company shared that the market maintained its upward trend for most of the trading session. High liquidity is a positive factor supporting the stock price increase.

“In the coming time, the market is likely to experience strong fluctuations around the 1,300-point mark. Afterward, the upward trend is expected to continue.” – ACBS predicted.

According to the Vietnam Joint Stock Commercial Bank for Industry and Trade Securities Company (VCBS), although selling pressure intensified towards the end of the September 26th session, it is not a cause for concern. This simply reflects investors’ caution as the market approaches the 1,300-point threshold.

Therefore, VCBS advises investors against chasing high-priced stocks, especially those at their peak and showing signs of strong selling. Instead, investors can hold onto stocks attracting capital flow in the banking and real estate sectors. They can also take advantage of intra-session fluctuations to invest in oil and gas stocks, venture capital stocks, and more.

The Southern Textile Manufacturer: A Public Listing, Strategic Investor Appeal, and a Real Estate Pivot with a $252 Million Project in Binh Duong.

“With an unwavering commitment to innovation, the company is poised to venture into the realm of nutraceutical manufacturing. This strategic expansion is geared towards tapping into the burgeoning export market, offering our high-quality products to a global audience.”

The Master Wordsmith’s Craft: Crafting a Captivating Headline

“Unveiling the Expert’s Land Auction Deposit Reduction Strategies: A Comprehensive Guide”

The proposed real estate tax reforms are designed to address the issues of land speculation and contract flipping. By increasing taxes on properties that are sold shortly after being acquired, or on land that remains undeveloped, the reforms aim to discourage speculative practices and reduce instances of price gouging and contract abandonment.