Recently, TCBS, a leading securities company, announced that they will be seeking shareholder approval through a written resolution from September 24 to October 4, 2024, with the shareholder list locked on September 23, 2024.

Notably, the agenda includes amendments to the plan for issuing bonus shares, which was previously approved at the 2024 Annual General Meeting of Shareholders.

In the revised plan, TCBS added a clause specifying that treasury shares, if any, will not be entitled to receive bonus shares. However, shares subject to transfer restrictions as per company regulations will still be eligible for the issuance.

Additionally, the company has adjusted the approach to fractional shares, deciding not to apply any treatment as the issuance ratio of 1:8 will not result in fractional shares.

The new plan also provides a more detailed breakdown of the current and projected foreign ownership limit, which is expected to remain unchanged at 1.0335% of the charter capital post-capital increase.

Prior to this, on April 26, the TCBS shareholder meeting approved the plan to issue bonus shares. Subsequently, on June 25, the Board of Directors passed a resolution to implement the share issuance plan.

The very next day, on June 26, TCBS submitted the offering registration dossier to the State Securities Commission of Vietnam (SSC).

However, the TCBS Board of Directors carefully considered the share issuance process and decided that some adjustments were necessary to align with the practical situation. As a result, they resolved to amend certain aspects of the plan and withdraw the previously submitted registration dossier.

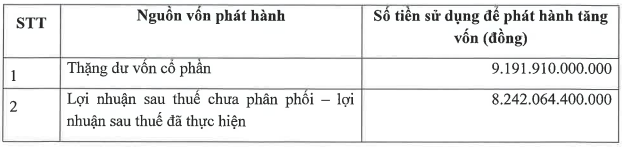

As per the original plan, the company intended to issue 1.74 billion new shares to increase its charter capital by 800%, utilizing retained earnings as of December 31, 2023, including VND 9,192 billion in share premium and VND 8,242 billion in undistributed post-tax profits.

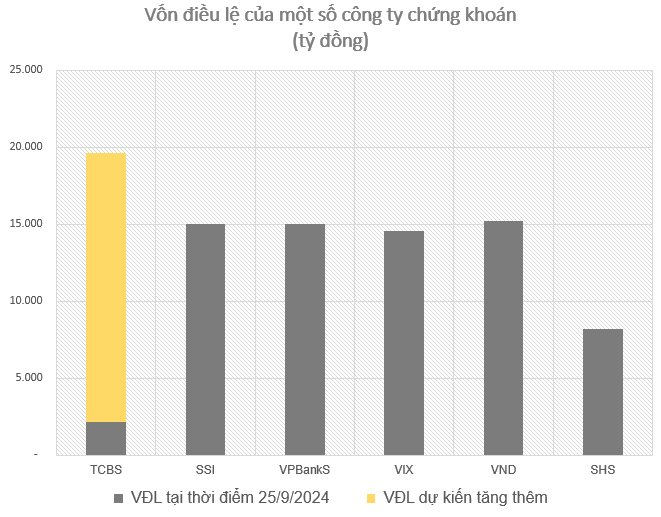

With a successful issuance, TCBS anticipated an increase in its total shares to over 1.96 billion, resulting in a charter capital of VND 19,613 billion, thereby positioning the company among the top securities firms in the market in terms of charter capital.

A Strategic Pause: Phát Đạt’s Tactical Move to Halt Dividends and Focus on Debt-Equity Swaps

“Phat Dat Corporation has decided to put on hold its plans to issue 131 million bonus shares as dividends to its shareholders. Instead, the company is prioritizing the issuance of over 34 million shares, priced at VND 20,000 per share, to offset a USD 30 million debt. This strategic shift is a pivotal move by the company, and further details are awaited by investors and industry observers alike.”