Mr. Pham Anh Duong, Chairman of the Board of Directors of An Phat Holdings Joint Stock Company (code: APH), has just announced the sale of 6.67 million APH shares out of the previously registered total of 11.87 million. The transaction was made through order matching from September 6 to September 24, 2024. The reason for not selling all the shares was due to unfavorable market conditions.

Following this transaction, Mr. Duong’s ownership decreased from 11.87 million shares (4.87%) to 5.2 million shares (2.13%). Immediately afterward, Mr. Duong registered to sell the remaining shares. The transaction is expected to be executed through order matching or negotiated deals from October 1 to October 30, 2024.

Mr. Pham Anh Duong started working at An Phat Holdings in 2002 as the Director of Anh Hai Duy Company Limited (now known as An Phat Xanh Plastic Joint Stock Company, a subsidiary of An Phat Holdings). In March 2017, Mr. Duong was officially appointed as the Chairman of the Board of Directors of An Phat Holdings and continued to hold this position for the 2022-2027 term.

Along with registering to sell all his APH shares, Mr. Pham Anh Duong also submitted his resignation from the position of Chairman of the Board of Directors and as a member of the Board of Directors of An Phat Holdings. Mr. Duong cited personal reasons for his inability to continue his duties in the upcoming term.

Regarding personnel changes, An Phat Holdings recently announced the resolution of the Board of Directors to relieve Mr. Nguyen Le Thang Long from his position as Vice President, effective September 25, 2024, respecting his personal wishes. Mr. Long was elected as Vice President and member of the Board of Directors of An Phat Holdings in 2021. Since June 2022, he has been serving as Chairman of the Board of Directors of An Phat Xanh Plastic Joint Stock Company.

In addition to Mr. Duong, several other leaders at An Phat Holdings have also sold large quantities of shares recently. Specifically, Mr. Pham Do Huy Cuong, Member of the Board of Directors and General Director, sold 750,000 shares; Ms. Tran Thi Thoan, Vice President in charge of production, sold all 500,000 shares she held; Ms. Nguyen Thi Tien, Vice Chairman of the Board of Directors and Permanent Vice President, sold 750,000 shares; and Ms. Hoa Thi Thu Ha, Vice President in charge of finance, also sold 500,000 shares.

Notably, these leadership changes occur as An Phat Holdings prepares for its upcoming 2024 Extraordinary General Meeting. The Group plans to present to shareholders a proposal to change the business lines, amend and supplement the Company’s charter, and discuss other matters. The Company will announce the details in the coming days.

In the market, APH shares have declined by more than 40% since the beginning of June, falling to near historical lows. Currently, the market price of APH is at VND 6,440 per share, corresponding to a market capitalization of less than VND 1,600 billion, while the charter capital is over VND 2,400 billion. It is estimated that Mr. Duong earned approximately VND 40 billion from this transaction and could earn an additional VND 30 billion if he sells the remaining registered shares.

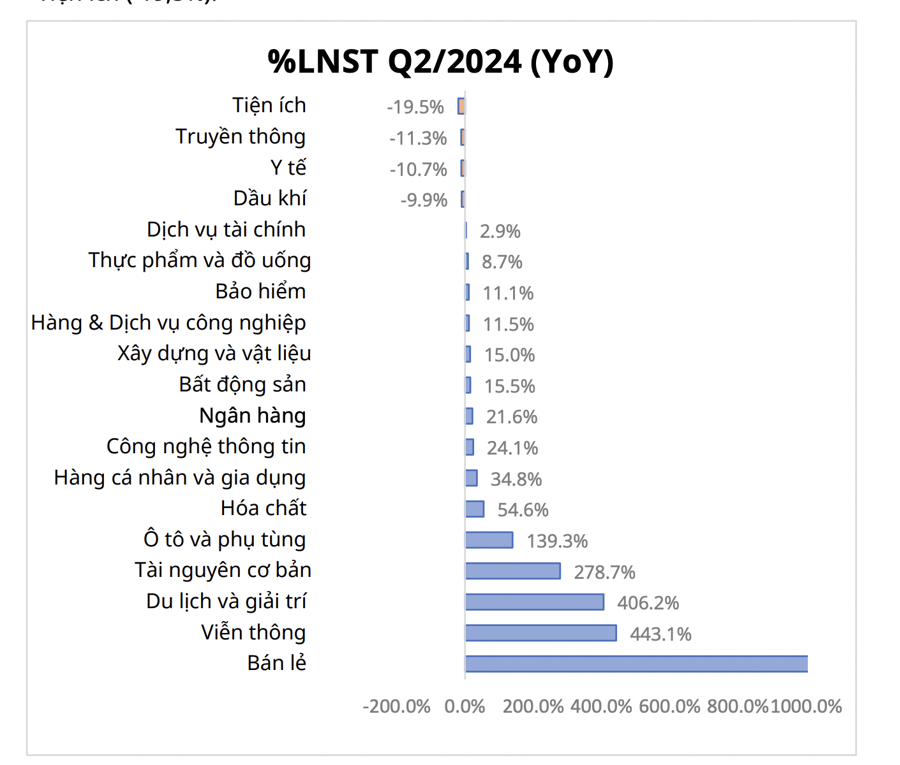

Regarding the financial results for the first half of the year, An Phat Holdings’ net revenue reached VND 6,640 billion, a 10% decrease compared to the same period last year. However, its after-tax profit increased by 438%, reaching VND 242 billion. This year, An Phat Holdings targets an after-tax profit of VND 314 billion, a 43% increase compared to the performance in 2023. Thus, the Company has accomplished 77% of its full-year profit plan.