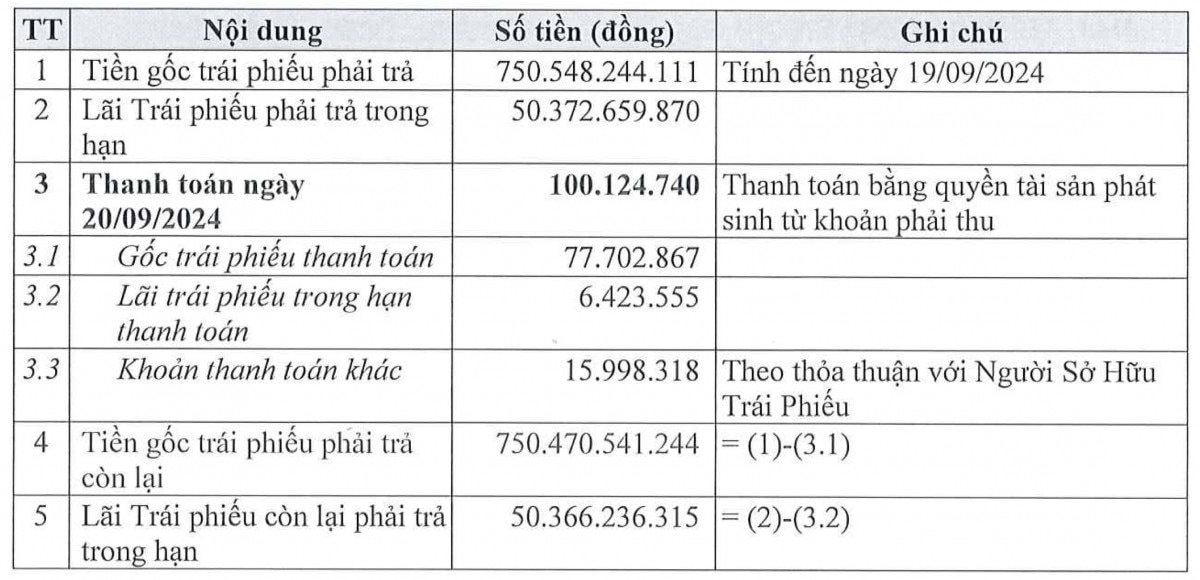

Recently, Novaland, a leading real estate investment group in Vietnam, disclosed unusual information regarding its repayment of principal and interest on bonds. As of September 19, the company had to repay a total of over VND 800 billion for the NVLH2123009 bond lot, including over VND 750 billion in principal and over VND 50 billion in interest.

Novaland stated that out of the VND 800 billion bond debt, they have only managed to repay a mere VND 100 million, with VND 77.7 million being paid towards the principal. This repayment was made using the rights to assets arising from receivables. Notably, Novaland did not provide a timeline for the remaining debt repayment in their disclosure.

Image caption

Prior to this, on September 16, Novaland also announced a delay in repaying VND 173.5 billion of the NVLH2123009 bonds. The company is in the process of reviewing its finances to negotiate with bondholders regarding a potential extension.

Additionally, at the beginning of September, Novaland had also missed interest payments on five bond lots, totaling VND 107 billion. Thus, during the month of September, the group has disclosed delays in repaying a total of VND 1,080 billion in bonds, including both principal and interest.

Despite the continuous divestment by the shareholder group related to Mr. Bui Thanh Nhon, the company’s Chairman, to aid in debt repayment, Novaland is still facing significant challenges. Mid-September, Nova Group sold 3 million NVL shares, reducing the shareholder group’s holdings to less than 39% of Novaland’s capital.

Image caption

With the ongoing sale of shares and the enforcement of collateral liquidation, the ownership percentage of the shareholder group related to the Chairman of Novaland is approaching the “red line” of 36% – the threshold for veto power.

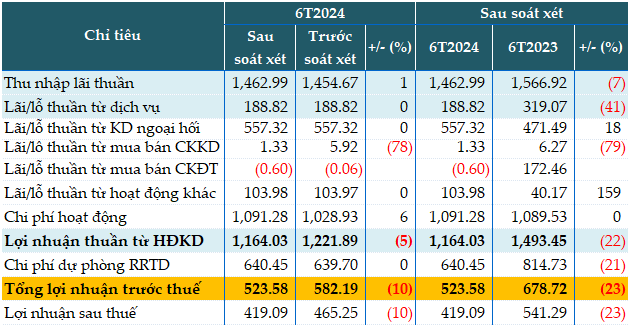

The Great ‘Savings’ Shake-Up: Unraveling the Property Sector’s Mid-Year Review for 2024

Vinhomes and Novaland remain the real estate giants with the largest reserves, while Ha Do Group and An Gia Real Estate have experienced a significant decline in their pre-sales.