The Hanoi real estate market has witnessed a notable recovery this year, with prices and transactions on the rise across most segments, especially in the apartment sector. According to data from the OneHousing Market Research and Customer Insight Center, as of Q2 2024, primary apartment prices in Hanoi reached nearly VND 65 million/sqm, up 25% from Q1/2024 and 30% from the same period last year.

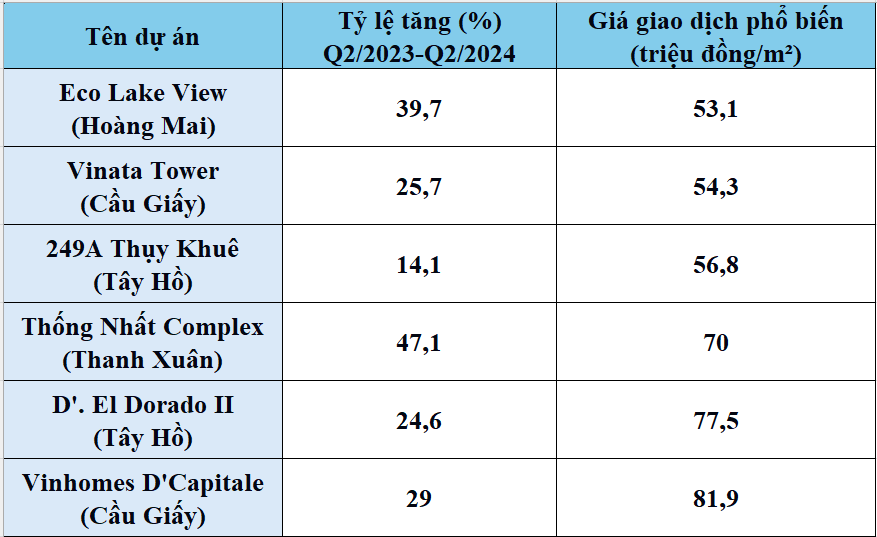

Looking back at 2021, the average primary apartment price in Hanoi was only around VND 36 million/sqm, a 13% increase from 2020, considered the highest annual growth rate in the previous five years (according to CBRE). Currently, Hanoi apartments have established a new price level, doubling the previous one, and many forecasts indicate that this upward trend will continue. In the secondary market, selling prices have also increased significantly compared to the previous year, ranging from 10-50% per year.

Prices of some used apartments (Information compiled from Batdongsan.com.vn data)

While not increasing as dramatically as apartments, the detached house segment has also recorded robust growth recently. Houses in alleys priced at VND 3-4 billion are also hard to come by, as the average market price is now around VND 100 million/sqm in the outskirts of the third ring road and VND 150 million/sqm in the inner districts.

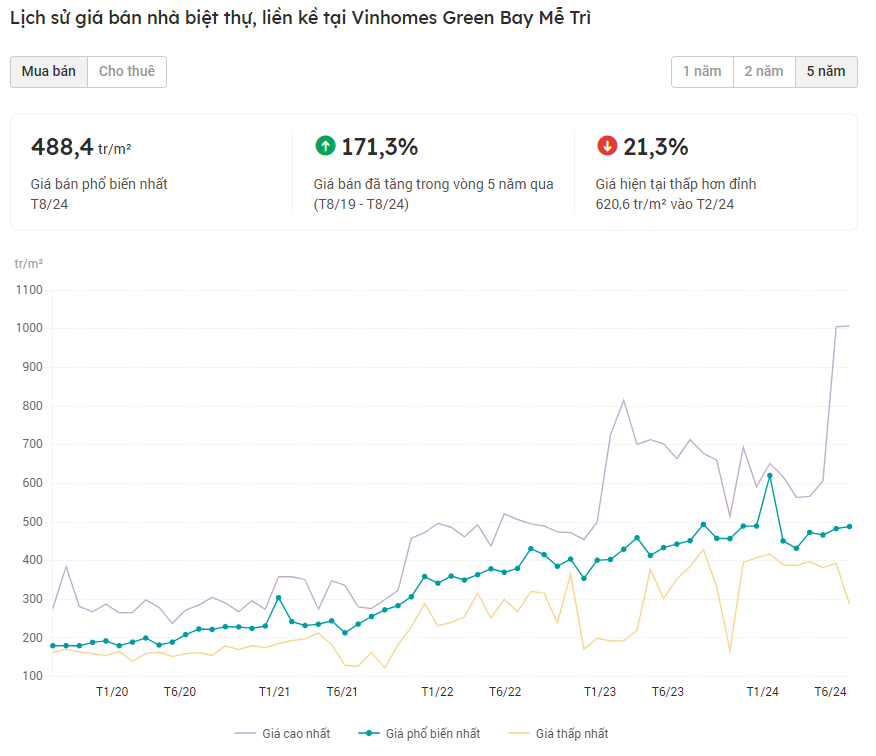

A relatively niche real estate segment, such as villas and terraced houses in Hanoi, has also seen significant price increases. Some areas, including Hoai Duc, Dan Phuong, and Nam Tu Liem, have recorded increases of 50-100% in just the past two years. The high primary selling prices have pushed up the resale price level.

For example, at Vinhomes Green Bay, the average selling price in August 2024 was VND 500 million/sqm, and those by the lake even reached over VND 1 billion/sqm. Statistics show that, in the past five years, the selling price of villas here has tripled on average.

History of selling prices of villas and terraced houses in Vinhomes Green Bay Me Tri in the past five years (Source: Batdongsan.com.vn)

Land is also part of the heated Hanoi real estate market, with outlying areas such as Dong Anh, Hoa Lac, Hoai Duc, Thach That, and Gia Lam experiencing localized “fevers,” with prices rising by an average of 20-30% compared to the end of 2023. Not only have land prices increased, but the number of investors flocking to these areas has also surged.

Additionally, auctioned land in some localities has unexpectedly regained interest. Although only a few land plots were put up for auction, they attracted hundreds or even thousands of registration dossiers and direct participants. The highest successful bid price was up to ten times the starting price in some outer districts like Hoai Duc and Thanh Oai.

In contrast to the vibrant Hanoi real estate market, the market in other provinces and even in Ho Chi Minh City has yet to show clear signs of recovery. Comparing the apartment segment, Hanoi is experiencing higher price increases than Ho Chi Minh City, gradually catching up in both the primary and secondary markets. Notably, in the past five years, Hanoi’s primary market prices have increased by about 5% per quarter and 25% per year, while Ho Chi Minh City’s figures are 3% per quarter and only 6% per year.

The contrast is even more striking when looking at the land segment. In the first half of 2024, Hanoi’s land and residential land were on a strong upward trajectory after hitting rock bottom in 2023, with a significant increase in search volume (118%) compared to the same period last year. In contrast, outlying provinces such as Ha Nam, Bac Ninh, Hung Yen, and Bac Giang remain “quiet” for an extended period. Just a few years ago, these localities were frequently mentioned during land “fevers.”

Recalling the year 2021, the real estate market fluctuated significantly nationwide. Major cities like Ho Chi Minh City and provinces like Quang Ninh, Bac Giang, Bac Ninh, Thanh Hoa, Lam Dong, Nghe An, Binh Phuoc, Dong Nai, and Long An continuously witnessed soaring land prices. However, this feverish trend quickly cooled down by the end of 2021.

Areas that had previously experienced rapid increases due to rumors soon plummeted as government agencies intervened, and the Covid-19 pandemic situation became complex nationwide. Consequently, liquidity suddenly dropped, leaving many land investors struggling to offload their properties. Investors were forced to sell at a loss to recoup their capital or due to loan interest payment pressures. However, reducing the price did not always guarantee a successful sale.

Up to now, many provincial land investors are still trying to sell but cannot find buyers. Even properties with favorable locations and potential for price appreciation face challenges in finding buyers. Especially in the southern region, transactions remain cautious. The investment money flow for real estate purchases has not recovered to the level of 2021-2022. Sales transactions are being discounted by 20% or more compared to 2021 prices.

Mr. Vo Hong Thang – Director of Consulting and Project Development Services, DKRA Group

Mr. Vo Hong Thang – Director of Consulting and Project Development Services, DKRA Group

While land in the provinces remains stagnant, another real estate segment that once attracted many investors, vacation real estate, is facing an even more challenging situation. Looking back at the period from 2015 to 2017, condotel apartments and vacation villas were priced above their actual value, accompanied by attractive profit commitments. At that time, the prices of vacation apartments in Da Nang and Nha Trang were comparable to those of high-end apartments in Hanoi, yet tens of thousands of investors were still willing to pour their money into these projects, expecting super profits.

However, when the legal issues surrounding condotel apartments surfaced, coupled with the collapse of the Cocobay project, and the operational losses of many projects that could not meet the initial profit commitments, this segment officially “froze,” losing liquidity. Purchasing power has also decreased significantly, with a lack of new supply and a high value of unsold inventory. Vacation real estate has almost entered a prolonged “hibernation” cycle.

The years 2022-2024 marked the strongest growth period for Hanoi’s real estate market, coinciding with investors’ return to the capital’s market after a period of searching for “tastier pies” across the country. This is especially true for Hanoi investors, who have long been considered the primary investment force in all real estate markets from north to south.

As the land fever in the provinces cooled down and prices dropped rapidly, investors became more cautious after learning expensive lessons. Notably, after the recent fluctuations, Hanoi investors have started to change their psychology, withdrawing capital and focusing on the capital’s market. As a result, a large amount of money suddenly flowed back into the Hanoi market, and the blocked supply pushed real estate prices to increase sharply.

Notably, the money flow came not only from Hanoi and northern provinces but also from the south. According to Batdongsan.com.vn’s research data, since mid-2023, there has been a clear trend of capital flowing from the south back to the north due to various factors.

“In addition, southern real estate prices had already increased significantly before 2020, while northern prices were slowly rising. Before 2020, few people considered investing in Hanoi apartments or houses because prices had been stagnant for a long time. However, since the Covid-19 pandemic, Hanoi real estate prices have surged as investment capital has returned to the market,” said Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.

Sharing the same view on the “hot” real estate situation in Hanoi, Mr. Nguyen Anh Que, Chairman of the Board of Directors of G6 Group and a member of the Vietnam Real Estate Association, provided six reasons for this phenomenon.

First, Mr. Que believes that a large amount of money has returned to Hanoi. According to statistics from the State Bank of Vietnam, deposits at the end of 2023 reached nearly VND 14 quadrillion, the highest level in history. Hanoi enterprises and residents’ deposits accounted for more than one-third of this amount. This is an enormous sum of money.

Second, in addition to the factor of money flow, there is also a considerable demand for real estate buying and investing among Hanoi residents.

Third, Mr. Que assesses that, at the beginning of each new real estate cycle, places with the richest people and the most significant population will experience a “fever” first, and Hanoi is such a market.

Fourth, Hanoi investors have a high “asset control” habit, so in the context of recent fluctuations, they have started to change their investment preferences. In other words, they have shifted from “fishing in distant waters” to choosing to invest in closer areas where they can easily observe and monitor their real estate assets.

“Previously, investors only needed to care about the planning vision and expected profits and returns. Now, we can see that they have switched to the habit of being able to control their real estate assets, which is also controlling their money flow,” Mr. Que affirmed.

Fifth, Hanoi residents are particularly “safe and sound,” paying more attention to legal issues, and real estate with cash flow. Hanoi real estate has solid legal grounds and assured cash flow as it can be sold, rented, or mortgaged at banks, not just for business purposes. In contrast, investing in distant areas makes it challenging for investors to access capital through property collateral.

Finally, another critical factor is that Hanoi is home to many large banks. Mr. Que observed that there are signs of an increasing number of bank leaders and employees participating in the real estate investment market. This group of investors has the advantage of accessing preferential capital, not to mention that the real estate products launched in Hanoi recently have been prioritized for bank loans.

These are the opinions and insights from experts. However, if we observe carefully, we can identify another reason for the vibrant Hanoi real estate market: the “Northern expansion” wave of southern investors in recent years. Numerous southern “giants” have actively participated in the Hanoi market, such as Capitaland Group, Masterise Homes, and Kusto Home. This trend has not only contributed to the abundant supply in the Hanoi market but also created many opportunities for investors.

The Riverfront Residences: A Luxury Haven by the Saigon River. Where Do Young Professionals Turn to Home Ownership?

Are you seeking a suburban location that’s closer to the heart of Ho Chi Minh City than even some inner-city areas? A place where you can enjoy a proud quality of life at half the price? Well, look no further! The savvy young professionals of today are taking the smart route to homeownership, finding places that tick all the boxes without breaking the bank.

The Ultimate Property Guide: Unveiling the Quest for Million-Dollar Homes in Alleyways

“Finding a home within a 1-2km radius of Chuong Duong Bridge or Long Bien Bridge that is located down an alley wide enough for cars to pass through, and is priced between VND 5-7 billion, is a challenging task. In fact, it’s almost impossible according to a local real estate broker in Long Bien district.”