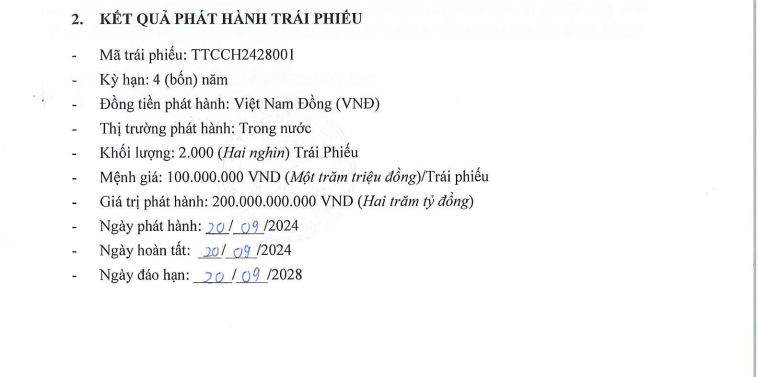

According to the financial report sent to the Hanoi Stock Exchange (HNX), TTC Investment Joint Stock Company (TTC Investment) successfully issued 2,000 bonds with the code TTCCH2428001 on September 20, 2024.

With a face value of VND 100 million per bond, the total issuance value was VND 200 billion. The bond lot has a term of 4 years and is expected to mature on September 20, 2028.

Source: HNX

Other information about the bondholders, issuance purposes, and collateral, etc., was not disclosed.

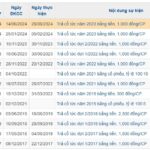

Bonds are a common fundraising channel for TTC Investment. Previously, in 2023, the company issued two bond lots with codes TTCCH2327001 and TTCCH2327002, with a total issuance value of VND 270 billion.

Going further back, in 2022, the company also issued two bond lots with codes TTCCH2226001 and TTCCH2229002, with a total issuance value of VND 675 billion.

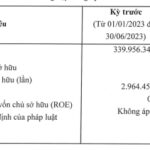

In terms of business performance, according to the periodic financial report for the first half of 2023, as of June 30, 2023, TTC Investment’s equity was VND 3,715 billion, up 3.4% compared to the previous year.

Net profit for the first half of 2023 was over VND 43.7 billion, 3.6 times higher than the same period last year.

The debt-to-equity ratio was 1.4, corresponding to liabilities as of June 30, 2023, of VND 5,200 billion.

TTC Investment is known as the “core” enterprise in the TTC Group ecosystem, founded by the entrepreneur Dang Van Thanh and his family.

As of December 2018, the company’s charter capital was VND 3,000 billion, and the shareholder structure was not disclosed.

Ms. Dang Huynh Uc My, daughter of Mr. Dang Van Thanh, previously held the position of Chairman of the Board and legal representative of the company. Since January 2019, Mrs. Huynh Bich Ngoc, Mr. Thanh’s wife, has been the General Director and representative of the company.

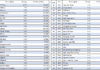

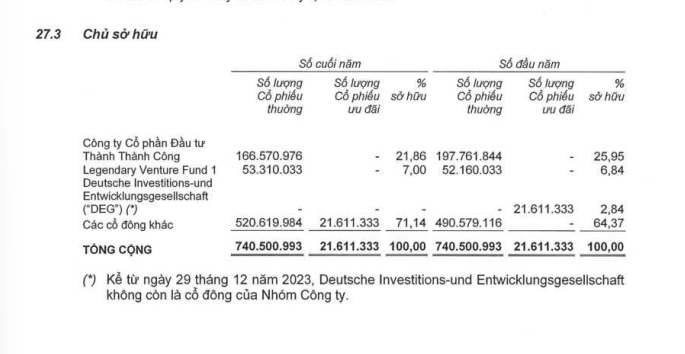

According to our research, as of June 30, 2024, TTC Investment is a major shareholder of Thanh Thanh Cong – Bien Hoa Joint Stock Company (TTC AgriS, Stock Code: SBT, HoSE) with a holding of 21.86%. Currently, Ms. Dang Huynh Uc My is the Chairman of the Board of TTC AgriS, replacing Mrs. Huynh Bich Ngoc.

Source: SBT’s Semi-annual Financial Statement 2024

In addition, TTC Investment is also a major shareholder in another company within the TTC Group ecosystem, GEG Joint Stock Company (Stock Code: GEG, HoSE). According to GEG’s reviewed consolidated financial statement for the first six months of 2024, TTC Investment holds 16.79% of the company’s capital.

GEG specializes in the field of renewable energy, including hydropower, solar power, and wind power.

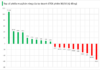

Recently, the Investigative Security Agency of the Ministry of Public Security requested EVN to provide information and documents related to 32 solar and wind power plants to serve the investigation and handling of the case of “Abusing position and power while performing official duties” occurring at the Ministry of Industry and Trade and provinces and cities.

Among the 32 wind and solar power plants mentioned, GEG owns four plants: Tan Phu Dong 1 Wind Power Plant, Tan Phu Dong 2 Wind Power Plant, Ia Bang 1 Wind Power Plant, and VPL Ben Tre Wind Power Plant.

The Ia Bang 1 Wind Power Plant (50 MW) and VPL Ben Tre Wind Power Plant (30 MW) are invested and owned by GEG. The Tan Phu Dong 1 Wind Power Plant (100 MW) and Tan Phu Dong 2 Wind Power Plant (50 MW) are invested by Tien Giang Wind Energy Joint Stock Company, a subsidiary of GEG.

The Ultimate Cash Flow: SBM Unleashes a Whopping $45 Billion Interim Dividend for 2024

“North Minh Development Investment Joint Stock Company (UPCoM: SBM) announces the record date for the first round of cash dividend payments for 2024. The ex-dividend date is set as October 9, 2024.