**CII Postpones Dividend Payment to Focus on Key Initiatives and Bond Maturity**

Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (Code: CII) has just announced a resolution by its Board of Directors to defer the dividend payment to shareholders, originally scheduled for the beginning of Q4 2024, to subsequent quarters. According to the company, the reason for this delay is the need to concentrate resources on critical tasks in Q4 of this year.

Specifically, one of its subsidiary units is expected to receive approval for a real estate project with an estimated total investment of nearly VND 5,000 billion, including 2,160 apartments, shophouses; 81 villas and some auxiliary works, utilities. Simultaneously, CII has a batch of CIIB2124002 bonds worth VND 500 billion maturing on October 21. Therefore, the company must strive to avoid late payment of principal and interest on bonds when they fall due.

To make up for this delay, CII intends to increase the dividend payout ratio in the following periods higher than the initially planned 4%.

CII drew attention at the end of 2023 with its rather unique dividend payment plan. The company decided to implement a consistent quarterly dividend payout of 4%, amounting to an annual dividend of 16% in cash. The announcement at that time stated: “CII will make every effort to pay cash dividends (at a rate of 4% per quarter, equivalent to 16% per year) regularly at the beginning of each quarter.”

Subsequently, in the first three quarters of 2024, CII carried out three dividend payments for the year 2022, totaling 12%, equivalent to over VND 340 billion. As per the approved plan, the remaining dividend payout ratio for the company is 4%.

For 2023 and 2024, the expected dividend payout ratio remains at 16% and will be paid in cash.

In terms of business results, according to the reviewed semi-annual financial statements for 2024, CII recorded VND 1,651 billion in net revenue, almost unchanged from the same period last year. After deducting expenses, CII achieved more than VND 470 billion in pre-tax profit, a surge of 195% compared to the previous year.

As of June 30, 2024, CII’s total assets stood at VND 35,673 billion, up 7% from the beginning of the year. Of this, the company’s financial debt exceeded VND 19,599 billion (including short-term and long-term debt), a 3.8% increase from the beginning of the year. CII’s debt portfolio mainly finances BOT traffic infrastructure projects.

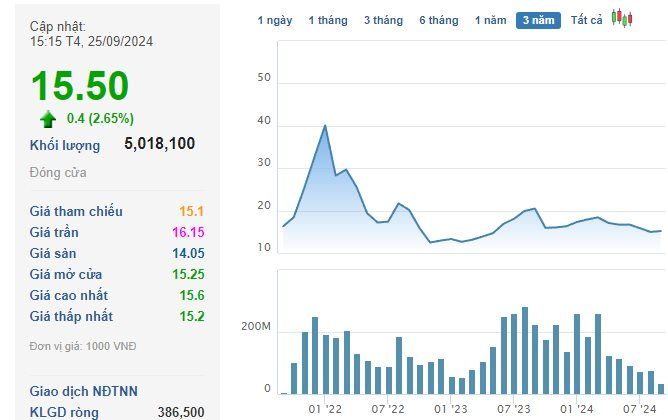

In the market, CII shares closed at VND 15,500 per share on September 25.