The stock market continued its upward trend on September 25, with positive developments and high liquidity. Strong buying power helped the VN-Index close 10.49 points higher at 1,287.48. Foreign exchange transactions were a bright spot, with a net buy of 557 billion VND in the market.

In contrast, securities companies’ proprietary trading sold a net of 463 billion VND in the market.

On the HoSE, securities companies’ proprietary trading sold a net of 459 billion VND, including a net sell of 504 billion VND on the matching order channel but a net buy of 45 billion VND on the negotiated trading channel.

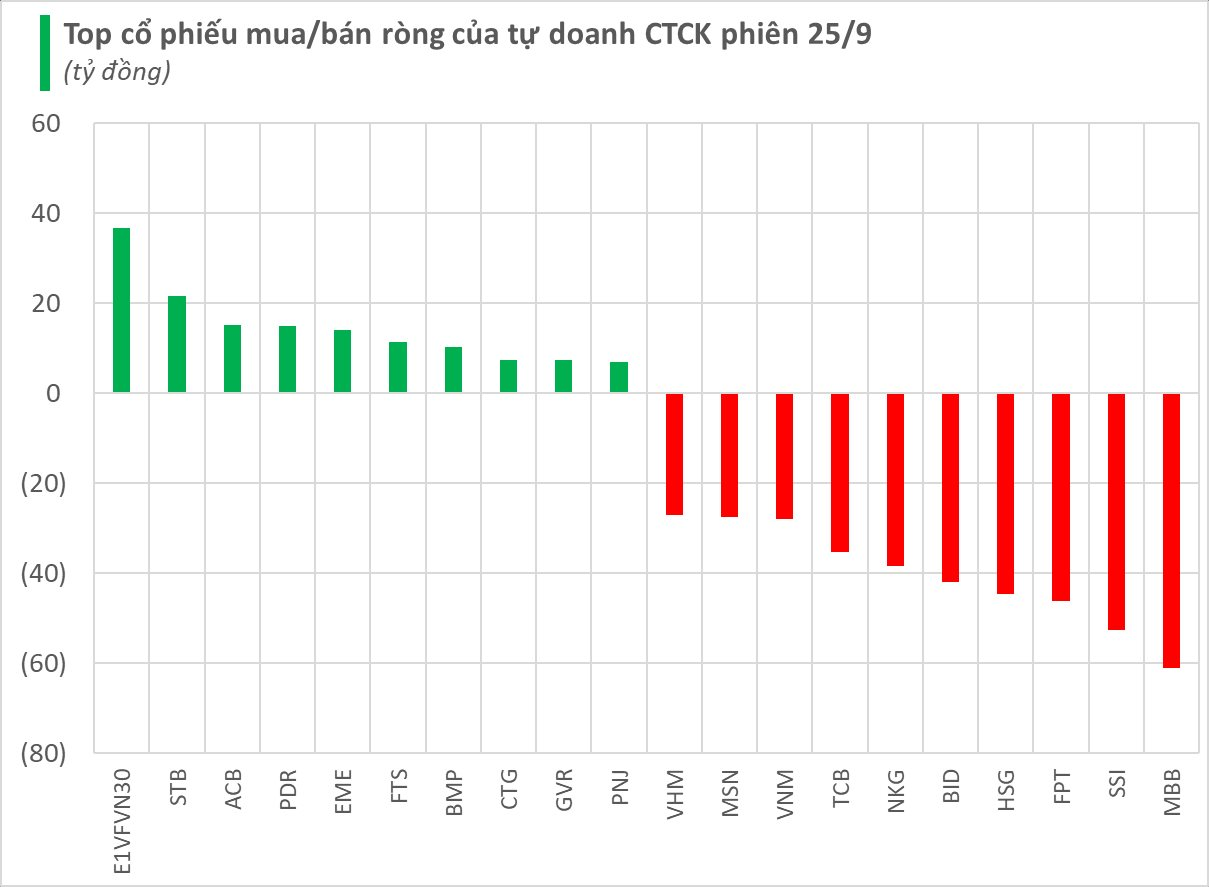

Specifically, the securities companies with the largest net sell were MBB and SSI, at 61 billion and 53 billion VND, respectively. FPT and HSG were also net sold, at 46 billion and 45 billion VND, respectively. Additionally, BID, NKG, TCB, and others were net sold on September 25.

On the other hand, the securities companies with the largest net buy were E1VFVN30, at 37 billion VND. STB, ACB, PDR, and FTS were also among the stocks net bought in today’s session.

On the HNX, securities companies’ proprietary trading sold a net of 9 billion VND, with PVS being the most net sold at 4 billion VND. SHS and TNG were also net sold at 3 billion VND each. Conversely, IDC was net bought at over 1 billion VND.

On the UPCoM, securities companies’ proprietary trading bought a net of 4 billion VND, with EME being the most net bought at 14 billion VND. Conversely, HIO and VNP were net sold at nearly 8 billion and 3 billion VND, respectively.

The Capital Stampede: A Rush to Invest

The market witnessed a strong comeback today (September 25th) with the VN-Index surging over 10 points at the closing bell. Domestic and foreign investors ramped up their buying activity, pushing the benchmark index towards the old peak of 1,300 points.

Stock Market Outlook for September 26: Top Picks for a Bullish Week Ahead

Liquidity in the September 25th session increased from the previous session, indicating a strong tug-of-war between supply and demand. The stock market is still striving to maintain its upward momentum and is likely to move towards the 1,290-point threshold.