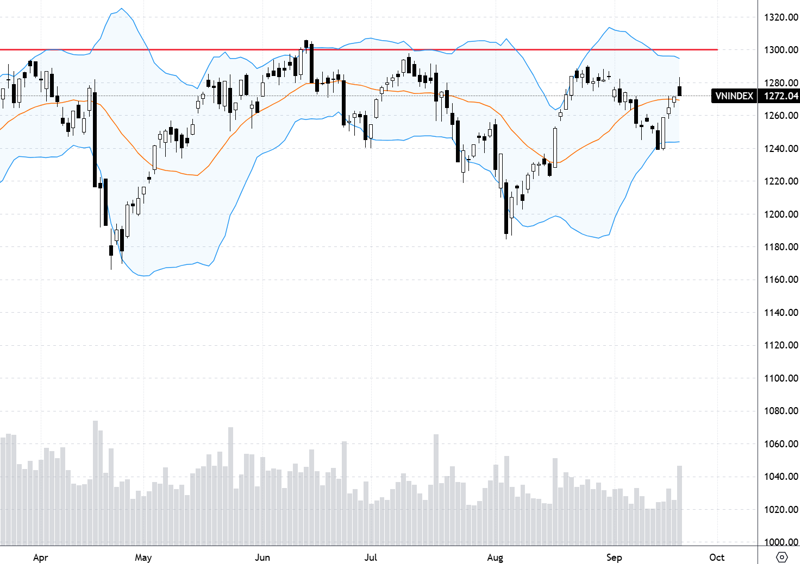

The strong two-week rally slowed down a bit as the VN-Index touched the 1300-point threshold last weekend. The highlight of the increased liquidity created excitement about the returning cash flow, while also causing investors to worry about another peak distribution.

For three consecutive sessions last week, the matching liquidity on HoSE and HXN exceeded the 20,000 billion VND threshold, a breakthrough compared to the average of only 13,000-15,000 billion VND/session that had lasted for many previous weeks. However, this liquidity level came along with the market’s failure to break through the peak twice. This has caused a significant divergence in market assessments.

The experts interviewed by VnEconomy also differed, although positive views still prevailed. More opinions suggested that the slowdown in the last two days of the week was not a bad sign of distribution but only a pause or a retreat to accumulate momentum. Since the market had tested the 1300-point threshold four times and failed, it was normal to be cautious the fifth time. A large number of stocks stuck in this area will have to be released, so the market needs time to absorb them. A more cautious view leaned towards the possibility that the market had ended its uptrend, although it would still have to wait a few more sessions for a clearer signal.

In line with this risk assessment, the experts carried out different transactions and held different stock proportions. However, no expert sold all their stocks, but instead considered the correction, if it appeared, as an opportunity to restructure the portfolio for the Q3 financial report and the last months of the year.

Nguyen Hoang – VnEconomy

Last week, the VN-Index tested the 1300-point peak for the fifth time. Some argued that this uptrend was just a Q3 NAV pull effect. The market struggled, and the index has not yet broken through, even plunging on the last day of the week, while liquidity has increased strongly. Are you disappointed? Is this a retreat to accumulate momentum or a distribution?

I believe this is just the usual fluctuation when the index quickly rises to a psychological threshold, meeting profit-taking pressure. The large cash flow into the banking group is a positive signal to expect that the current uptrend may continue and surpass 1300 points.

Nguyen Thi My Lien

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

The market followed the scenario I forecasted in previous weekly reports, with the VN-Index having a wave 5 push on the 1h frame, approaching the 1300-point mark. With the current developments, the 1h frame has now reached the end of the wave 5 uptrend and will enter a correction phase, while the daily candle is continuously creating “hair-pulling” candles with large liquidity. I assess that the market is likely in a distribution phase.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

This is the fifth time the VN-Index has tested the 130x-point peak. There are concerns about the index’s unsuccessful breakthrough of the resistance, and these are not groundless as many investors have previously failed to bet on a strong breakthrough. In the end, the slowdown in the uptrend this time could be due to psychological factors, and there are still a significant number of stocks stuck at the peak, so the increased selling pressure on the last day of the week is not a bad signal, and the market still needs to retreat to retest cash flow.

Le Duc Khanh – Analysis Director, VPS Securities

In terms of developments, the consecutive rising sessions of the Vietnamese stock market last week, in the context of many global stock indices rising strongly such as DJ, Nikkei 225, CSI300…, is the inevitable result of the positive prospects of the global economy. Stimulus programs, accommodative policies to support growth boost investor confidence, cash flow participation increases, and equity investment channels become more attractive. We were right to believe that the VN-Index would soon return to the 1300-point mark. Adjustments or testing the old peak are always likely scenarios, and the sixth session of last week was no exception. In my opinion, this is just a retreat of the market to accumulate momentum.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

From my perspective, the market last week was relatively positive. The index was not under much selling pressure around 1290 points and surpassed this level, although it is facing resistance around the 1300-point threshold. I believe this is just the usual fluctuation when the index quickly rises to a psychological threshold, meeting profit-taking pressure. The large cash flow into the banking group is a positive signal to expect that the current uptrend may continue and surpass 1300 points.

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

This is the fifth consecutive time the VN-Index has tested the 1300-point peak. Some argued that this uptrend was just a Q3 NAV pull effect, and that opinion could be correct, but I think that motivation is not really big enough for an individual or organization to spend resources to do this because it is too costly to trade off a smaller benefit while the NAV closing pressure usually falls at the end of the year.

With liquidity still maintaining an upward trend as in the previous sessions, it is quite normal for the market to encounter resistance at the 1300-point threshold, so I am not disappointed but consider this an opportunity for traders to take advantage of the entry and exit points to make a decent profit. The important thing is whether the VN-Index can stay above 1300 points or not, which is a big question in the current context. To know if the market is accumulating or distributing, we need to wait a few more sessions to confirm. Usually, at such thresholds, investors tend not to act but wait for further developments before making decisions. If the market maintains many sessions above 1300 points, this threshold will change from a strong resistance level to a strong support level for the market.

Nguyen Hoang – VnEconomy

After the Fed cut the interest rate by 50 percentage points, many analyses worried that it was a signal of a US economic recession, but US stock indices still took turns setting new peaks. Meanwhile, Vietnam has many positive factors but still cannot explode. Will the market have enough momentum to break through this time? If this scenario succeeds, the VN-Index will form a new uptrend. What is your projection for this momentum?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

I expect the market to have enough momentum to create a new peak this year. The Fed’s aggressive 50-basis point rate cut creates an opportunity for the State Bank to have more room to implement a loose monetary policy. The foreign capital flow may reverse to net buying, and the weakening of the USD Index will reduce pressure on the exchange rate.

In addition, as I mentioned earlier, the NPS regulation (pre-transaction margin) takes effect from the beginning of November, which will also mark a new milestone for the Vietnamese stock market. All of these will positively affect market liquidity, thereby pushing the index to a new high. If the market follows this scenario, I expect the index to continue the uptrend to the supply zone at 1330-1370 points.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

Although the Fed cut 50 percentage points of interest rates at the September 18 meeting – the last time such a cut was made was in 2008, the implication behind the Fed Chairman’s speech is still a neutral policy direction, neither too loose nor too tight, to ensure that inflation does not rise quickly while avoiding a recession in the world’s number one economy. Therefore, it could be the reason why US stock indices continue to hit new peaks, as the probability of a “soft landing” is becoming clearer.

For the Vietnamese stock market, the Fed’s signal to continue lowering interest rates will positively affect not only the economy but also the stock market. Therefore, the scenario of the VN-Index setting new highs around 1350 points, or even 1400 points, is entirely possible. The slowdown in the uptrend is simply a normal supply/demand reaction when approaching strong resistance.

Adjustments or testing the old peak are always likely scenarios, and the sixth session of last week was no exception. In my opinion, this is just a retreat of the market to accumulate momentum.

Le Duc Khanh

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

There is a saying, “If it rains, the road will be wet, but if you see a wet road, it doesn’t necessarily rain.” When the economy shows signs of recession, central banks tend to cut interest rates to support the economy, but it can also be a necessary move after a series of interest rate hikes to curb inflation in the US before. Looking at the Vietnamese economy, although there are many positive factors, to have a rising stock market, it is important to have positive cash flow participation in the market, but recently, the market liquidity has been quite low, so for the VN-Index to rise well and especially to break through 1300 points, more cash flow needs to enter the market, and we need to look at many trading sessions next week to confirm this.

If the market forms a new uptrend, based on the Fibonacci expansion, the VN-Index is likely to return to the old peak around 1450-1500 points at the Fibonacci 161.8%.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

The current sessions have good cash flow momentum, but the index has not increased much, although banking stocks are leading the market (mainly small and medium-sized stocks are rising strongly) but cannot create consensus in other industries. Therefore, I assess that the market is still quite challenging to break through the 1300-point threshold. If the scenario surpasses 1300 points (without creating a trap and SFP), the threshold I expect the market to head towards is the area around 1370 points.

Le Duc Khanh – Analysis Director, VPS Securities

In my opinion, the end of September and the beginning of October have gathered enough supportive signals and factors of “heavenly time – geographical advantages – human harmony” – Economic prospects, investor confidence – increasing liquidity – positive developments of large-cap stocks. The new uptrend has begun and temporarily given way to a short accumulation phase. I assess that the phase in October could cause the index to fluctuate at least around the 1300-1350-point threshold.

With the current developments, the 1h frame has now reached the end of the wave 5 uptrend and will enter a correction phase, while the daily candle is continuously creating “hair-pulling” candles with large liquidity. I assess that the market is likely in a distribution phase.

Nguyen Viet Quang

Nguyen Hoang – VnEconomy

The market is about to end September and enter the Q3 financial report season. There are analyses that do not expect much profit growth for enterprises this quarter. What is your view and forecast? If you build an investment portfolio for Q3 financial results, which stocks and sectors are you interested in?

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

There is not much expectation for a breakthrough profit growth of the whole industry in Q3/2024. However, I think that some sectors may have positive business results, such as banks, seafood, textiles, rubber, and pig farming, thanks to positive macro factors and seasonality in some fields in the last months of the year.

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

Although there are analyses that do not expect much profit growth for enterprises this quarter, I have a more positive view of Q3. In the September Strategy Report of Rong Viet Securities, we have a very positive outlook for the macro context, with the focus on the Fed cutting interest rates by 50 percentage points in mid-September, which will somehow support businesses and the Vietnamese stock market. At the end of August, the State Bank announced that it would adjust the credit growth limit for banks that have completed 80% of the 2024 credit growth target. The adjustment of the credit growth limit for the second time is showing a reversal of the Fed’s monetary policy and the cooling of the DXY Index, which has strengthened the confidence of the State Bank in maintaining an “amicable” policy environment to support the economy.

Therefore, we maintain a positive view of stocks in the banking, industrial park, food and beverage, consumer, and industrial goods and services sectors. In particular, we expect banks to be the industry leading profit growth in Q3/2024 of the VN-Index when Q3/2023 was considered the most challenging period for the industry with many negative factors simultaneously occurring, such as weak credit growth, NIM bottoming out, high credit costs, and bad debts.

Specifically, for Q3 2024, we expect: i) Interest income growth, with (1) Positive credit compared to the same period and (2) Stable NIM, will drive the recovery of total operating income; ii) Bad debt at the industry level is expected to have peaked in Q2/2024, as signs such as the formation of new group 2 debt, group 3 and 4 debt, and the ratio of net bad debt formation have decreased compared to the previous quarter; iii) Income from bad debt recovery (mainly from the disposal of real estate collateral) is also showing positive developments. These developments are early indicators with many positive implications for the trend of bad debt formation and the consequent reduction in credit costs in the following quarters.

For bank stocks, I am interested in: VCB, CTG, BID, ACB, MBB, and VIB.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

Economic data from July and August show that there are many bases to expect positivity in the Q3 financial report. Except for the impact of Typhoon Yagi on the insurance industry and some manufacturing fields