Illustration

Oil Rises

Oil prices rose on the last trading day of the week, but posted a weekly loss as investors weighed predictions of increasing global supply against new stimulus from China, the world’s top crude importer.

Brent crude futures settled at $71.89 a barrel, up 38 cents, or 0.53%, on Sept. 27. U.S. West Texas Intermediate (WTI) crude futures rose 51 cents, or 0.75%, to $68.18. For the week, Brent lost about 3% and WTI fell roughly 5%.

China’s central bank cut interest rates and injected more cash into the banking system, aiming to prop up economic growth back to around 5% this year.

More financial measures are expected to be announced before China’s National Day holiday starting Oct. 1, after a meeting of senior Communist Party leaders signaled a heightened sense of urgency about the country’s growing economic woes.

Two OPEC+ sources said the Organization of the Petroleum Exporting Countries and allies, known as OPEC+, will stick to their existing deal to raise output by 400,000 barrels per day (bpd) each month, starting in December.

Saudi Arabia has repeatedly denied that it is targeting a specific oil price and sources from the group said the plan to increase output from December does not represent any major shift from current policy.

Additional supply could also come after rival factions in Libya declared a cease-fire and agreed to hold nationwide elections in December. The dispute had cut the country’s oil exports to around 400,000 bpd this month, down from more than 1 million bpd in the previous month.

In the U.S., some producers began restoring output in the Gulf of Mexico after Hurricane Lane made landfall in Florida. Meanwhile, the storm’s devastation, considered the seventh-strongest to hit the state, could impact fuel demand in the third-largest U.S. state for gasoline consumption.

U.S. consumer spending increased in August, a sign that the economy maintained momentum in the third quarter as inflationary pressures stabilized.

Gold Heads for Best Quarter in Over 8 Years

Gold prices are headed for their best quarter in more than eight years, repeatedly breaking records in recent sessions as U.S. monetary easing boosted the metal’s appeal.

Spot gold fell 1% to $2,643.88 per ounce after hitting an all-time high for a fourth straight session. The market had peaked at $2,685.42 on Sept. 26.

December gold futures on the New York Mercantile Exchange’s COMEX division settled down 0.9% at $2,668.10 per ounce. The metal has surged about 14% so far this quarter, its biggest increase since the first quarter of 2016, and is up around 28% so far this year, its best performance in 14 years.

With bets on further interest rate cuts in the future after the Federal Reserve’s half-point rate cut last week, speculative demand for the metal has pushed gold into technically “overbought” territory. Nevertheless, some banks expect prices to climb to $3,000.

Aluminum Hits 16-Week Peak

London aluminum prices touched a 16-week high as buying from funds was triggered by the latest economic stimulus in top metals consumer China.

Three-month aluminum on the London Metal Exchange (LME) rose 0.4% to $2,623 a ton during official trading hours after hitting $2,659, its highest since June 6. Prices of the metal have climbed 5% so far this week.

Analysts at Bank of America said the global aluminum market will be in deficit next year, with prices expected to trade at $3,000 per ton by 2025.

LME copper fell 0.9% to $9,990 a ton after touching $10,095, its highest since June 7.

Iron Ore Logs Over 10% Weekly Gain

Iron ore prices rose for a fourth straight session and posted a weekly gain of over 10%, underpinned by China’s latest interest rate cut and expectations of more fiscal and property stimulus.

The January 2025 iron ore contract on China’s Dalian Commodity Exchange ended daytime trading up 4.38% at 750 yuan ($106.94) per ton, the strongest since Sept. 2. The contract has jumped 12.2% this week.

In Singapore, the January 2025 contract climbed 3.38% to $101.85 a ton, gaining 13.8% this week. Earlier in the session, prices peaked at $103.10, the highest since Aug. 7.

On Sept. 27, China’s central bank announced a cut in the amount of cash that banks must hold as reserves, the second such reduction this year, to boost the slowing economy.

Additionally, China’s pledge to deploy “necessary fiscal spending” to meet its economic growth target for 2024 has raised market expectations of new fiscal stimulus measures. China also plans to issue 2 trillion yuan ($285.2 billion) in special government bonds as part of its new fiscal stimulus package.

These measures have boosted sentiment for commodities, including iron ore.

In Shanghai, steel rebar rose 2.58%, hot-rolled coil gained 2.94%, stainless steel climbed 0.63%, and wire rod edged down 0.17%.

Japanese Rubber Extends Gains for Fourth Straight Day

Japanese rubber futures closed higher, buoyed by a weaker yen and positive sentiment following China’s economic stimulus.

The March 2025 rubber contract on the Osaka Exchange closed 1 yen, or 0.26%, higher at 392 yen per kg. For the week, the contract gained 6.9%.

In Shanghai, the January 2025 rubber contract settled 75 yuan, or 0.41%, higher at 18,555 yuan per ton.

Thailand’s meteorological department, in the world’s largest rubber-producing country, warned of heavy to very heavy rainfall that could trigger flash floods from Sept. 27 to Oct. 3.

Sugar Declines

Raw sugar futures for October delivery closed down 0.52 cent, or 2.2%, at 22.79 cents per lb, up about 0.6% for the week, stabilizing after surging 19% in the previous week.

Producers are taking advantage of recent high prices to sell, and there are indications that India could produce enough sugar to export about 2 million tons in the next marketing year.

Overall, sugar prices remain on an upward trend. According to BMI, a unit of Fitch Solution, Brazil will produce 2 million tons less sugar in the 2024/25 crop year, or a total of 39 million tons, due to severe drought and associated forest fires.

Brokerage firm StoneX said Brazil would produce an additional 2.5% of sugar, or a total of 40.6 million tons, in the next crop year, but attributed the increase to more cane being allocated to sugar production rather than ethanol. They expect cane deliveries to fall 3.2% due to unfavorable weather.

Russia will produce 10% less sugar in the next marketing year due to adverse weather but will supply at least 600,000 tons to the international markets after lifting its export ban this month.

December white sugar fell 3% to $576.20 per ton.

Coffee Falls

December arabica coffee futures closed down 4.75 cents, or 1.7%, at $2.6915 per lb, but rose over 7.3% for the week.

Forecasts indicate that dry weather in Brazil will persist for the next 6 to 10 days, which is unfavorable for the crop and hinders flowering.

November robusta coffee fell 0.8% to $5,482 per ton, gaining 2% for the week.

Soybeans, Corn Hit Two-Month High

Chicago soybean prices hit a two-month high as soymeal futures soared amid concerns about damage to crops and infrastructure in the Gulf region following Hurricane Lane.

November soybean futures on the Chicago Board of Trade (CBOT) settled up 24-3/4 cents, or 2.4%, at $10.65-3/4 per bushel. For the week, the contract gained 53-3/4 cents, or 5.3%.

December corn on the CBOT ended up 4-3/4 cents at $4.18 per bushel after touching $4.19-3/4, its highest since July 26, and rose 16-1/4 cents, or 4%, for the week.

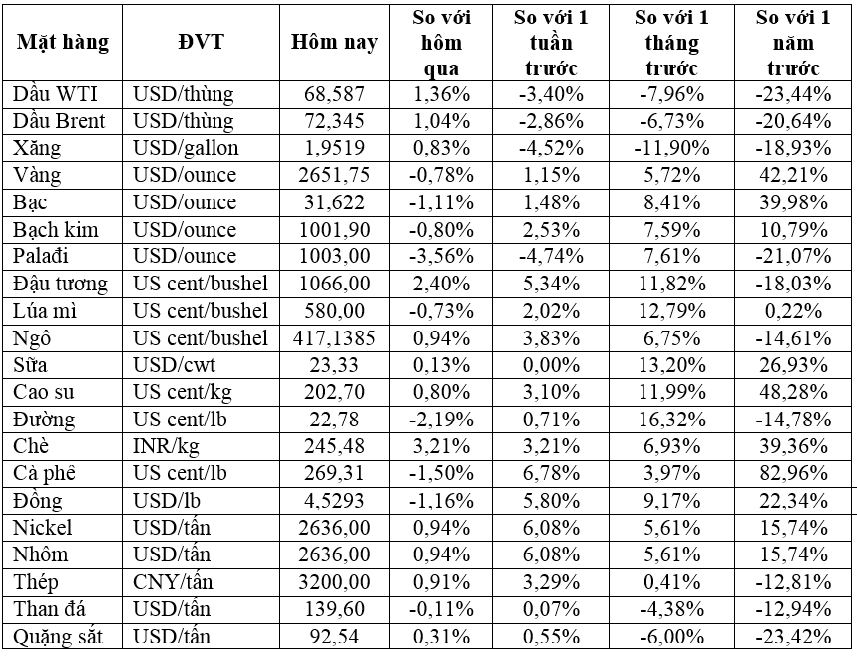

Prices of Key Commodities on Sept. 28

The Golden Touch: Crafting Cultural Legacy with Every Piece of Jewelry

In the vibrant and competitive world of jewelry, each prominent brand must forge its own path to assert its dominance.

“Securing Fuel Supply: The Prime Minister’s Directive for Uninterrupted Access”

The Prime Minister directs the Ministry of Industry and Trade to instruct gasoline and oil traders to secure their supply chains and ensure an uninterrupted flow of fuel to their distribution networks. The directive emphasizes the importance of proactive planning, urging traders to prepare for the upcoming year and beyond by developing comprehensive fuel plans for 2025 and subsequent years.