Oil Falls Nearly 3% as Saudi Arabia Reportedly Prepares to Hike Output

Oil prices fell by nearly 3% after a Financial Times report stated that Saudi Arabia, the world’s top oil exporter, would abandon its $100 price target in preparation for a production increase with OPEC members and allies in December.

On September 26, Brent crude oil fell by $1.86, or 2.53%, to $71.60 per barrel, while WTI crude oil dropped by $2.02, or 2.90%, to $67.67 per barrel.

According to the Financial Times, Saudi Arabia is preparing to abandon its unofficial oil price target of $100 per barrel as the country is ready to ramp up production.

Meanwhile, two OPEC+ sources indicated that the organization will continue to boost oil output in December, as the impact would be minimal if some members plan larger cuts to make up for overproduction in September and subsequent months.

OPEC, along with members including Russia, has been curbing oil production to support prices. However, prices have dropped by nearly 6% since the beginning of the year due to increasing supply from other producers, particularly the United States, as well as weak demand growth in China.

Transportation data revealed that Libya’s crude oil exports averaged around 400,000 barrels per day in September, down from over 1 million barrels per day in August.

However, news of China’s new economic stimulus package limited further declines.

Top government officials in China, the world’s largest crude oil importer, pledged to implement “necessary fiscal spending” to meet this year’s economic growth target of about 5%, acknowledging new challenges and raising market expectations for new stimulus measures beyond those announced this week.

Silver Hits 12-Year High

Silver prices surged to their highest level in nearly 12 years, riding on the coattails of gold’s record-breaking rally as central bank rate cuts fueled investment interest in precious metals.

Spot silver rose 0.6% to $32.03 per ounce, reaching its highest since December 2012 at $32.71.

Silver, serving both as a safe-haven investment and an important industrial material, has climbed more than 35% this year.

One of the primary catalysts for silver’s price surge is gold. The majority of silver demand stems from industrial usage, particularly in photovoltaic applications such as solar panels, which has nearly doubled compared to the previous year.

Spot gold increased by 0.5% to $2,670.52 per ounce, having reached a record of $2,685.42 during the session. December gold futures on the COMEX exchange settled 0.4% higher at $2,694.90 per ounce.

Copper Surpasses Key $10,000 Level

Copper prices climbed to their highest level in nearly 16 weeks, buoyed by hopes of robust metal demand following China’s announcement of additional fiscal stimulus measures and monetary policy easing to boost its sluggish economy.

Three-month copper on the London Metal Exchange breached the psychologically important $10,000 per ton mark, touching its highest since June 7 at $10,089.50 per ton. Prices rose 2.8% to $10,084 per ton as of 1600 GMT.

COMEX copper in the US surged 3.3% to $4.58 per lb.

According to sources speaking to Reuters, the new plan includes issuing special government bonds worth around 2 trillion yuan ($284.43 billion) this year.

Earlier in the session, before China’s latest announcement, copper prices dipped as investors cashed in on recent gains.

Prior to the US interest rate cut last week, the Chinese government had been concerned that stimulus measures would weaken their currency.

This positive sentiment could propel copper prices back to the record highs above $11,000 reached in May. However, at that time, investors may consider how the stimulus measures have impacted immediate demand.

Iron Ore Continues to Climb Toward $100/ton

Iron ore prices extended their gains for the third consecutive session after China pledged additional economic stimulus, boosting confidence just as the impact of the recent monetary easing measures started to wane.

In Singapore, iron ore for October delivery rose 2.49% to $98.80 per ton, reaching an intra-day high of $99.25 per ton and approaching the psychologically important $100 per ton mark for the second time this week.

The January 2025 iron ore futures contract on the Dalian Commodity Exchange erased earlier losses to close up 1.75% at CNY 728 ($103.73) per ton.

On September 26, Chinese leaders vowed to implement necessary fiscal spending to meet this year’s economic growth target of about 5%, surprising the market.

These measures bolstered sentiment across a wide range of commodity markets, including iron ore. Prices have completely erased the declines witnessed in September. Port inventories had been high, and demand softened as steel producers curbed output amid losses. This caused iron ore prices to drop by nearly 10% as of September 23.

In Shanghai, steel rebar rose 1.05%, hot-rolled coil gained 0.66%, wire rod fell 4.79%, and stainless steel dropped 0.07%.

Japanese Rubber Prices Rise

Japanese rubber prices climbed over 1% on hopes of new fiscal stimulus measures from China, although falling oil prices and synthetic rubber kept gains in check.

The March 2025 rubber contract on the Osaka Exchange closed up 4 JPY, or 1.03%, at 391 JPY ($2.70) per kg.

In Shanghai, January 2025 rubber fell 75 CNY, or 0.41%, to CNY 18,440 ($2,627.15) per ton.

Coffee and Sugar Prices Surge Due to Drought in Brazil

Coffee and sugar prices surged to new highs as investors remained focused on drought-stricken Brazil, with weather forecasts continuing to indicate dry conditions.

Brazil is experiencing one of the worst droughts on record.

Coffee brokers and industry experts stated that coffee trees in Brazil could still recover if consistent rainfall returns, but the overall outlook for the crop remains uncertain.

ICE arabica coffee reached its highest level in 13 years at $2.7505 per lb, later closing up 1.8% at $2.739 per lb.

Robusta coffee rose 1.5% to $5,527 per ton.

Raw sugar hit a seven-month high of 23.71 US cents per lb, eventually closing down 0.5% at 23.31 US cents per lb.

White sugar fell 0.5% to $593.90 per ton.

Coffee markets in major robusta-producing countries in Asia remained weak, with local prices declining this week ahead of the new harvest in Vietnam, while buyers stocked up in Indonesia.

Farmers in the Central Highlands sold coffee at VND 120,000–120,800 ($4.87–4.91) per kg, down from VND 123,000–123,400 the previous week.

Traders noted that the current weather is favorable for the crops, but trading remains subdued. A trader in the region commented, “Some traders have started to look for coffee, but in a very cautious way because some are still facing financial problems since last year when prices started to surge, while others are unsure about the weather in the coming days.”

The Vietnam Commodity Exchange (MXV) stated that some coffee-growing regions have started harvesting early-maturing cherries and are offering them at VND 120,000 per kg.

Traders offered robusta coffee with 5% black and broken beans at a discount of $200–250 per ton to the January 2025 futures contract on the London ICE exchange.

In Indonesia, Sumatran robusta coffee was offered at a discount of $450–500 per ton to the October contract and at a discount of $250 to the November contract. Last week, the discounts were $300–400 to the November contract.

Thai Rice Prices Hit Over 1-Year Low

Thai rice export prices dropped to their lowest level in over a year this week, pressured by subdued demand and competition from cheaper alternatives, while Indian rice prices rose due to a stronger rupee despite weak demand from Asian and African buyers.

In Thailand, 5% broken rice was offered at $550–560 per ton, the lowest since July 20, 2023, down from $562–565 last week.

A Bangkok-based trader stated that demand was coming from Indonesia, but competitors were undercutting Thai exporters with lower prices, adding that the weak baht would push prices down further.

Commerce Minister Pichai Naripthaphan said the impact of the strong baht on exports would ease in the next three months, especially for agricultural products.

Another trader mentioned that the market was awaiting potential changes in India’s rice policies in the coming months, with supply currently in the harvest season.

Indian 5% broken parboiled rice was quoted at $530–536 per ton this week, up from $528–534 a week earlier, the lowest since mid-January.

In Vietnam, 5% broken rice was offered at $565 per ton, according to the Vietnam Food Association, compared to $575–580 per ton last week.

A Vietnamese exporter won a deal to export 59,000 tons of rice, part of a Bulog international tender to purchase around 450,000 tons of rice, after accepting a lower price.

Vietnam’s rice exports from the beginning of the year to mid-September rose 6.25% over the same period last year, reaching 6.5 million tons.

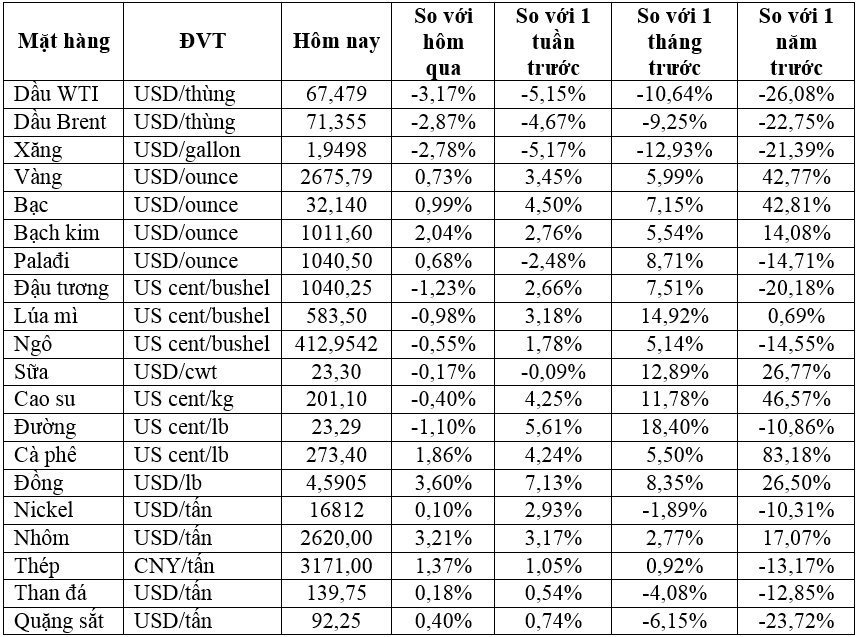

Prices of Key Commodities on September 27 Morning

The Golden Opportunity: Gold Prices Soar to 8-Year Highs, Iron Ore Surges Over 10% in a Week

Oil prices ended the week higher, capping off a week of losses, while gold shone with its strongest quarterly gain in eight years. Aluminum prices also soared to a 16-week high, and rubber continued its winning streak with four consecutive sessions of gains.

“Securing Fuel Supply: The Prime Minister’s Directive for Uninterrupted Access”

The Prime Minister directs the Ministry of Industry and Trade to instruct gasoline and oil traders to secure their supply chains and ensure an uninterrupted flow of fuel to their distribution networks. The directive emphasizes the importance of proactive planning, urging traders to prepare for the upcoming year and beyond by developing comprehensive fuel plans for 2025 and subsequent years.