The market maintained its excitement from yesterday’s session, opening with a positive bias. However, profit-taking pressures mounted towards the end of the day, causing a wobble and a slight retracement, trimming the gains. The VN-Index closed higher by 4.01 points or 0.31% at 1291.49. Trading volume on the HOSE declined, with 889.8 million shares traded.

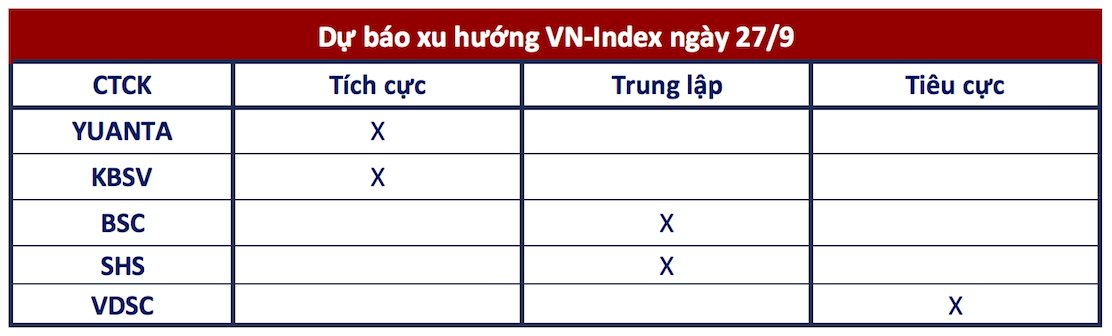

Analysts offered mixed views on the final trading session of the week:

Yuanta Securities Vietnam: The market is likely to extend its gains in the next session, with the VN-Index potentially retesting the 1,300 level. Largecaps and Midcaps remain in focus, attracting the lion’s share of liquidity. Given the positive momentum, we expect any correction to be short-lived and end within the session. Short-term sentiment indicators continue to climb, suggesting improving buying opportunities.

KBSV Securities: The rally fizzled out as the index approached a significant resistance level, where large trading volumes and previous peaks indicate growing profit-taking sentiment. While a long upper wick on the candle leaves the risk of a bull trap, support from large-cap stocks is expected to persist, leading the VN-Index towards higher resistance zones.

BSC Securities: The VN-Index failed to breach the 1,300 resistance today. In the upcoming sessions, we anticipate the index to consolidate around this previous peak.

SHS Securities: In the short term, we believe this is not an ideal price range for fresh investments, and a definitive breakout cannot be assured. As the quarter concludes, the VN-Index is expected to trade within a narrow range of 1,280-1,300 in the final two sessions of Q3 2024.

VDSC: The market continued its upward trajectory but faced resistance at the psychological level of 1,300. Although liquidity decreased from the previous session, it remained elevated, indicating a tug-of-war between buyers and sellers during the rally. With a cautious shooting star pattern, the market’s upward momentum may pause, and a corrective session could follow to test support at the 1,285 level.

Investors are advised to exercise caution, monitor supply and demand dynamics, and consider this recovery as an opportunity to restructure their portfolios with a risk-mitigating approach.