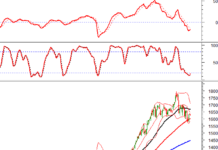

Bank stocks continued their upward momentum this morning, but it wasn’t enough to push the VN-Index into a breakthrough. The lack of consensus among large-cap stocks was the main reason why the opportunity to surpass the 1300-point mark slipped away. Profit-taking pressure emerged quite strongly, driving liquidity up by over 21% on the HoSE compared to yesterday morning’s session.

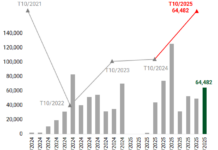

The VN-Index peaked at 9:47 am, reaching a high of 1300.31 points (+8.82 points). This was the first time since June 2024 that the index touched the 1300-point level. However, this momentum was short-lived as the index started to slide shortly after. By the end of the morning session, the VN-Index stood at 1293.7 points, a modest gain of 2.21 points (+0.17%) compared to the reference point.

The reason for the index’s inability to sustain its upward trajectory this morning was the divergence among some large-cap stocks. VHM witnessed the most notable reversal, suddenly turning red with a 1.68% decline during the session. It ended the morning session down 1.24% compared to the reference price. VHM is currently the fifth-largest stock by market capitalization on the VN-Index. While MWG is not yet a top large-cap stock, its decline this morning was also significant. It reversed by -1.75% from its peak and closed the session down by 1.32% compared to the reference price. Additionally, FPT and GAS, two other large-cap stocks, disappointed investors by turning red as well.

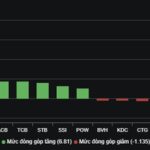

Regarding the banking sector, their strength also couldn’t be maintained at its maximum potential, causing the index’s support to weaken. BID was the strongest pillar, gaining 1.2%, followed by CTG with a 1.65% increase. However, BID had climbed as high as 3.4% and CTG by 3.16% during the session. The largest pillar, VCB, also lost about 0.96% from its peak and is now barely in the green with a 0.22% gain. MBB, ACB, STB, TCB, TPB, and VPB remain in positive territory but have lost considerable momentum compared to their strongest levels.

Looking at the broader HoSE, when the VN-Index reached its peak, the market breadth showed 197 gainers and 130 losers. By the end of the session, there were 182 gainers and 190 losers. While the number of stocks that reversed direction wasn’t significant, they included most of the blue-chips, which was the primary reason for the index’s loss of momentum. The rest of the stocks mostly slid within the green territory.

Liquidity on the two exchanges increased by 22% compared to yesterday morning’s session, reaching VND 10,872 billion in matched orders. The HoSE saw a rise of over 21% with VND 10,286 billion. This high trading volume indicates active participation in the market. The dominant trend was a gradual decline in prices, reflecting strong selling pressure. However, the presence of buyers was also significant, preventing a complete reversal and instead leading to a narrowing of the gain range.

Foreign investors also reduced their trading intensity, with net buying of VND 885.9 billion on the HoSE, a decrease of 19% compared to yesterday morning’s session. The net value stood at -VND 39.1 billion. Notable net selling was observed in HPG (-VND 94.9 billion), MWG (-VND 80.5 billion), and VPB (-VND 68.1 billion). On the net buying side, TPB (+VND 95.8 billion), CTG (+VND 42.8 billion), EIB (+VND 33 billion), SSI (+VND 25.3 billion), and VNM (+VND 22.3 billion) stood out.

The Capital Stampede: A Rush to Invest

The market witnessed a strong comeback today (September 25th) with the VN-Index surging over 10 points at the closing bell. Domestic and foreign investors ramped up their buying activity, pushing the benchmark index towards the old peak of 1,300 points.