Speaking at the conference, Bidiphar’s General Director, Pham Thi Thanh Huong, shared that over the past five years, DBD has shifted its strategy by focusing on company-produced goods. Previously, DBD engaged in both the production and business of external medicine, but later oriented towards opening room for foreign shareholders up to 100%, so the company narrowed its focus to manufacturing.

“In terms of figures, revenue may not be significant yet, but the growth rate of manufactured items is impressive. In five years, DBD grew by 178%, corresponding to an increase in profits,” said Huong.

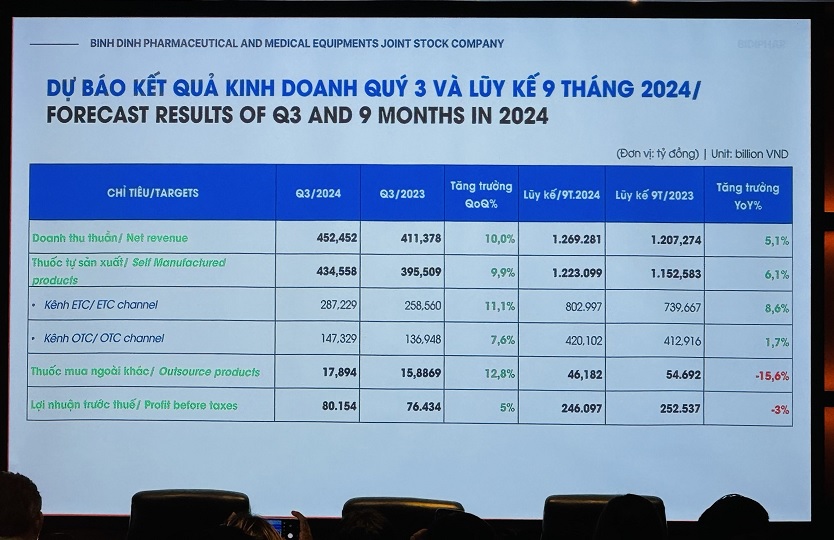

For the third quarter, DBD estimated revenue of over VND 452 billion, a 10% increase from the same period last year. Both the ETC (prescription drugs) and OTC (over-the-counter drugs) channels showed robust growth in self-produced medicine revenue. Pre-tax profit was estimated at over VND 80 billion, a 5% increase.

|

Bidiphar’s estimated results for the third quarter and the first nine months of 2024

Photo: Chau An

|

In the first nine months of 2024, the company estimated nearly VND 1,270 billion in net revenue, a 5.1% increase from the same period last year. Among this, company-produced goods accounted for more than VND 1,150 billion, a 6.1% increase year-on-year. The ETC and OTC channels witnessed growth of 8.6% and 1.7%, respectively. Meanwhile, externally purchased medicine continued to decrease by 15.6%, which was “in line with the orientation,” according to Huong.

Aiming for VND 4,000 billion in revenue by 2030 and entering the top 3 reputable pharmaceutical companies

Regarding some key products, Bidiphar’s leadership revealed that they had completed a cancer treatment drug factory adhering to GMP-EU standards and were in the process of obtaining certification. Currently, Bidiphar possesses 16 active ingredients and 2 dosage forms—injectable and lyophilized injectable drugs—which are sold to major hospitals, including central hospitals and the K Hospital.

For the antibiotic line, there are 37 active ingredients, 82 products, and 4 dosage forms used in leading hospitals such as the Central Hospital of Hue, the Central Tropical Hospitals, and provincial general hospitals…

The third line is peritoneal dialysis and blood dialysis solutions, in which DBD ranks second in market share and is favored by many large hospitals.

These product lines contribute to cancer drug revenue, accounting for 20% of the total and ranking first in the domestic market share (second only to five foreign companies). Antibiotics make up about 28% of total revenue, holding 2.05% of the national antibiotic market share, while kidney dialysis drugs account for approximately 10%.

General Director Pham Thi Thanh Huong (right) and Board Member Truong Thanh Liem answer shareholders’ questions. Photo: Chau An

|

Looking ahead to 2030, DBD‘s leadership shared their vision to elevate the company’s position from the top 5 to the top 3 most reputable pharmaceutical companies. Additionally, they aim to obtain GMP-EU certification for three production lines, including cancer drugs, sterile small-volume drugs, and Non-Betalactam injectables. Concurrently, they target achieving revenue of over VND 4,000 billion by 2030.

In reality, Bidiphar had set a revenue goal of VND 5,000 billion by 2030 in 2023, implying that the new target is a reduction. Explaining this change, Huong mentioned that the plan is subject to adjustments based on actual circumstances, and Bidiphar’s business model underwent significant fluctuations between 2023 and 2024.

“The orientation towards external business is gradually decreasing. Meanwhile, foreign investors desire distributed goods, so we couldn’t predict the situation at that time. As for our orientation, we focus on self-produced items.”

Another reason, according to Huong, is the slightly delayed progress in obtaining GMP-EU certification for the factories. “As the requirements of GMP-WHO and GMP-EU differ, the documentation had to be adjusted and refined from scratch. The standards for reporting are quite high, so we had to proceed very cautiously and meticulously to meet the requirements. We are working on it, and although we are slightly behind schedule, we will soon achieve the set goal,” she assured.

Additionally, market fluctuations could also lead to changes in the set goals.

To accomplish these objectives, DBD has outlined a detailed plan: From 2024 to 2026, the focus will be on efficiently operating the newly inaugurated cancer drug factory. In the following years, from 2026 to 2027, the company aims to complete the investment in a small-volume sterile drug factory adhering to GMP-EU standards while also finishing the investment in a new R&D, QA&QC (quality control) center. These are pivotal aspects that will leverage DBD‘s application of science and technology, enabling the company to lead and create differentiation.

Between 2025 and 2028, DBD plans to finalize the Non-betalactam tablet factory and invest in several feasible items to foster the company’s development. They will also continue expanding the cultivation areas for medicinal materials and medicinal products.

Alongside these investments, DBD will prioritize new product development as the most critical factor. The company’s orientation is to venture into new product lines (first generic—meaning no domestic production yet) and products with advanced formulation techniques—specialty drugs that are currently imported. This aligns with the Ministry of Health’s directives, which Bidiphar is actively implementing.

Additionally, they will focus on key product lines like tablets, developing two lines of drugs that act on specific targets while also transferring biotechnology to treat cancer.

Regarding kidney dialysis solutions, DBD aims to develop new products with original formulas and collaborate with Swiss partners to obtain patents for developing improved drugs that benefit dialysis patients. This partnership has already been signed, and the process of transferring research documents to proceed with the subsequent steps is underway.

For the antibiotic line, the company will introduce new products that align with the disease model in Vietnam and meet the demands of the hospital channel.

Other medicinal products will be developed with investments in medicinal material sources adhering to organic GACP standards. In 2024, DBD‘s subsidiary in medicinal materials has shown positive signs in introducing new products and supporting localities to develop sources. The company will also promote technology transfer with research patent-holding units, a crucial direction to accelerate new product development in line with Bidiphar’s orientation.

Update on the private offering of more than 23 million shares

Bidiphar’s 2024 General Meeting of Shareholders approved the plan to issue 23.3 million shares in a private placement to a maximum of five professional securities investors (equivalent to 31.12% of the circulating shares). These shares will be restricted from transfer for one year from the completion of the offering.

The specific offering price will be determined by the Board of Directors through direct agreement with investors but will not be lower than VND 50,000/share. The mobilized capital will be used to supplement investment capital for two projects in the following order of priority: (i) Small-volume sterile drug factory (total investment of VND 840 billion) and (ii) OSD Non-Betalactam factory.

Providing an update on this plan, Mr. Truong Thanh Liem, a Member of the Board of Directors of Bidiphar, shared that the company is still in discussions with strategic investors.

“DBD is in the process of meeting investors, signing confidentiality agreements, making offers, conducting due diligence, negotiating final terms, and finalizing deals. We are engaging with both foreign and domestic investors. Our priority is pharmaceutical companies that can support, accompany, and commit to Bidiphar in the long term and have industry experience to contribute to the company’s development. Due to confidentiality measures, I cannot disclose further details”, Mr. Liem explained.

Addressing the question about the offering price of VND 50,000/share, which is 13% higher than the market price on September 26 (VND 44,100/share), Mr. Liem attributed it to historical data from the top 5 privatized pharmaceutical companies.

“The 2024 General Meeting of Shareholders approved this price. Additionally, we considered financial indicators and input from partners, taking into account market conditions. In previous transactions, the PE ratio was around 26-27 times, the EV/EBITDA ratio was 19.6 times, and the P/B ratio was approximately 3.5 times. These serve as the basis for the offering price”, Mr. Liem elaborated.

Viettel Construction: Leading Listed Company in IR Excellence 2024

Viettel Construction’s unwavering commitment to transparency and openness in its corporate governance has been a pivotal factor in winning over investors, both domestic and international. The company is proud to have been bestowed with the prestigious “Mid Cap with the Most Favorite IR Activities by Investors in 2024” and “Mid Cap with the Most Appreciated IR Activities by Financial Institutions in 2024” awards at the IR Awards 2024 ceremony.