TKV Repays $170 Million in Bonds

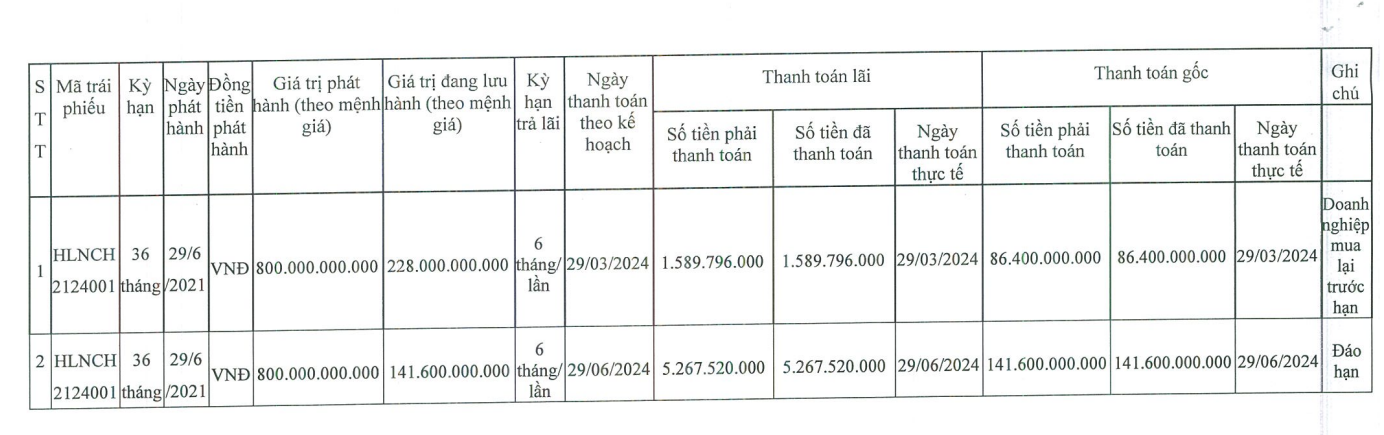

The Hanoi Stock Exchange (HNX) recently published a document from the Vietnam National Coal-Mineral Industries Group (TKV) disclosing periodic information on principal and interest payments for bonds from January 1, 2024, to June 30, 2024.

On June 6, 2024, TKV paid $3.1 million in interest for the TKV5Y.2019 bond lot.

On June 21, 2024, the company continued to pay $2.9 million in interest for the TKV_BOND2020 bond lot.

Source: HNX

Thus, in the first half of 2024, TKV paid a total of $6.1 million in bond interest.

It is known that both bond lots were issued on December 6, 2019, and December 25, 2020, respectively, with a term of 5 years and the same issue value of $80 million.

The total face value outstanding as of June 30, 2024, was $160 million.

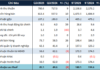

In terms of business performance, according to the financial statement for 2023 (based on TKV’s audited consolidated financial statements for 2023), as of the end of 2023, the Group’s equity reached $1.9 billion, up $89 million or 5% compared to the previous year.

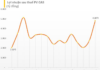

In 2023, the company recorded a profit after tax of $250 million, down 26% compared to 2022.

The debt-to-equity ratio improved from 1.61 to 1.34 times, corresponding to total liabilities of about $2.6 billion as of the end of 2023.

Government Approves TKV’s Restructuring Plan Until 2025

In another development, the government has approved the restructuring plan of the Vietnam National Coal-Mineral Industries Group until 2025.

According to the approved plan, the Vietnam National Coal-Mineral Industries Group will maintain the parent-subsidiary model. The parent company, TKV (wholly owned by the State), simultaneously performs two main functions: production and business; and investment in subsidiaries. The subsidiaries operate in industries and projects that the parent company does not directly involve.

The Group’s four main business sectors include coal, mineral and metallurgical industries; electricity; and industrial explosives.

Additionally, there are a number of sectors related to the main business groups, such as mechanical engineering; chemicals and building materials; port, transport and warehouse management; and construction.

Depending on the timing and business situation, TKV can add other sectors with the Prime Minister’s approval.

Moreover, the plan sets requirements for divestment from enterprises in which TKV holds a stake. TKV will hold 100% of the charter capital in 1 company, maintain a stake of over 65% in 10 companies, and hold 50-65% in 9 companies.

For the remaining 15 companies, the Group will hold less than 50% or divest completely.

“Vietcombank Tower Saigon’s Major Shareholder Defaults on Bond Interest Payments”

In the first half of 2024, Truong My Lan’s Setra Corp posted an after-tax loss of VND 114.5 billion, an improvement from the previous year’s loss of VND 273 billion.

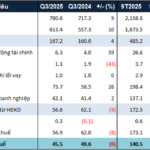

Vietnam Airlines Releases Reviewed Consolidated Financial Report for H1 2024

Vietnam Airlines (Vietnam Airlines, code: HVN) has released its reviewed consolidated financial statements for the first six months of 2024, reporting impressive figures. The airline’s revenue reached VND 52,562 billion, a nearly 20% increase compared to the same period last year. After deducting the cost of goods sold, gross profit stood at VND 6,704 billion, more than double the figure from the previous year.