The People’s Bank of China (PBoC) has recently unveiled a range of policies to support the economy in what is the largest stimulus package since the COVID-19 pandemic. This comes as the country faces headwinds from a sluggish housing market and subdued domestic consumption.

According to an update report by Agriseco Research, the measures include monetary policy easing, addressing difficulties, and supporting the real estate and stock markets.

In terms of monetary policy easing, the PBoC decided to cut the reserve requirement ratio by 0.5%, the lowest since 2020. The bank will also reduce the 7-day reverse repo rate by 0.2% to 1.5%, the medium-term lending facility rate by 0.3%, and the baseline lending rate by 0.2-0.25%.

To address difficulties and support the housing market, existing home loan rates will be cut by 0.5%. The minimum down payment ratio for second home loans will be reduced from 25% to 15%. The maximum support for loans funded by the PBoC will increase from 60% to 100%. Additionally, the measures include extending support for loans to real estate developers until the end of 2026.

In terms of supporting the stock market, China is allowing securities firms, insurance companies, and investment funds to access PBoC funds to purchase stocks, bonds, and ETFs, with a quota of over $70 billion. The PBoC also offers loans at a rate of 1.75% to banks, with a quota of about $42 billion, to support listed companies in buying back their shares.

Agriseco believes that immediately after the announcement of China’s supportive policies, stock markets in Asia and globally reacted positively. The two mainland indices surged in the session, with the Shanghai index up 3.88% and the Shenzhen index up 4.04%.

This could be considered the most positive trading session for mainland Chinese stocks since the beginning of the year. After the trading session on September 24, Chinese stock indices continued their upward momentum.

Expectation of Foreign Capital Inflow

With China’s massive stimulus package, analysts expect other countries in the region, including Vietnam, to continue and strengthen monetary easing policies to boost economic growth.

Additionally, the boost from the stimulus package will increase the attractiveness of the stock market, and Agriseco expects this to be a factor in reversing the foreign capital flow from a net selling to a net buying position in Asian markets in the last months of the year.

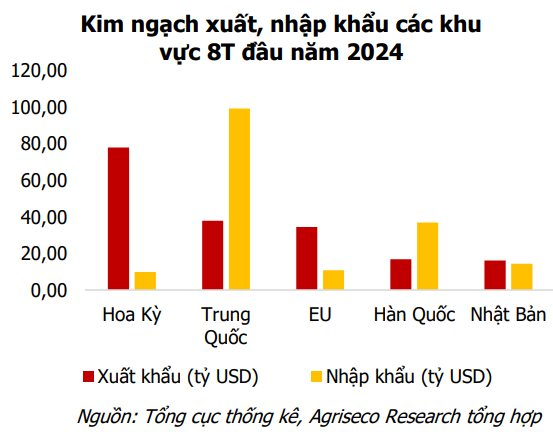

Furthermore, China’s policies are expected to stimulate domestic consumption, which will positively impact Vietnam’s export turnover. China is currently Vietnam’s largest trading partner and the second-largest export market, with export turnover reaching $37.86 billion in the first eight months of 2024.

In terms of imports, China remains Vietnam’s largest import market, with a turnover of $99.29 billion in the first eight months. With the expectation that Chinese companies’ production capacity will recover, import costs for raw materials will be reduced, supporting input costs for Vietnamese manufacturing businesses.

Benefiting Industries

Assessing the specific industries that will benefit from China’s new policies, the Agriseco analysis team identified four groups of stocks:

In the steel industry, China’s focus on monetary policy easing and supporting the housing market is expected to positively impact the real estate, construction, and materials sectors. The demand for construction materials, such as steel, may increase from the bottom and affect global steel prices.

For the oil and gas industry, with the expectation that supportive policies will help China’s economic recovery, oil consumption could increase rapidly and push up oil prices. According to the International Energy Agency (IEA), China will account for more than a quarter of global oil demand growth.

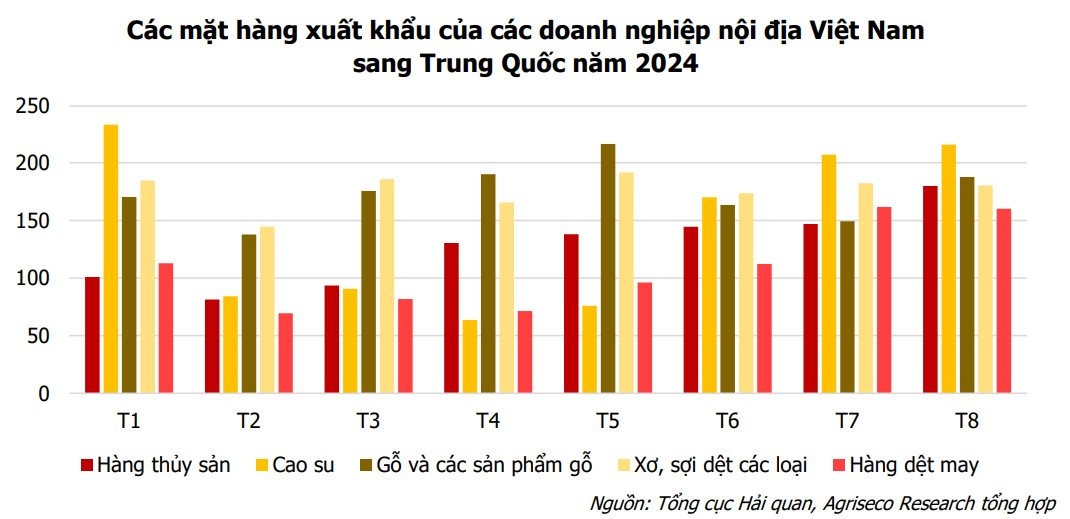

In the rubber industry, Agriseco expects manufacturing industries, especially the automotive industry, to recover, leading to increased demand for rubber. Vietnamese rubber companies are forecast to benefit from the current high rubber prices.

Another industry expected to grow is the seafood industry. China is an important export market for Vietnamese seafood, according to Agriseco specialists. In the first eight months of 2024, seafood exports to China reached $1.02 billion, accounting for about 16% of total seafood exports. With policies to support the economy and stimulate consumption, export items to China, such as pangasius and shrimp, are expected to benefit and continue to improve.

China Increases Gold Reserves for the 16th Consecutive Month

In February, the People’s Bank of China (Central Bank) increased its gold reserves by approximately 12 tons compared to the previous month. This marks the 16th consecutive month that the bank has increased its gold reserves.