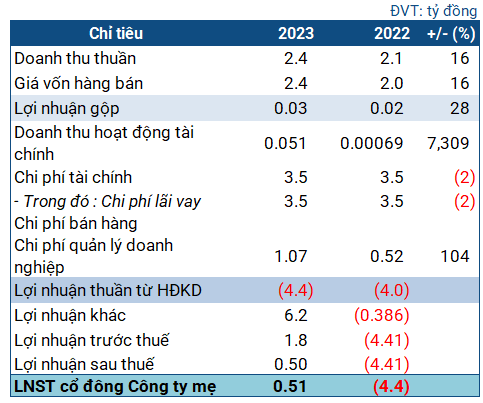

According to the 2023 audited financial statements, LTC recorded revenue of 2.4 billion VND, a 16% increase from the previous year. After deducting cost of goods sold, gross profit stood at 32 million VND, a 28% increase.

Net losses amounted to 4.4 billion VND after accounting for additional expenses (compared to approximately 4 billion VND in losses during the same period last year). However, other income totaling 6.2 billion VND turned the company’s fortunes around. Ultimately, LTC reported a net profit of over 500 million VND (compared to a loss of 4.4 billion VND in the previous year). This turnaround was attributed to auction proceeds from the sale of secured assets, namely real estate at BIDV, used to repay debts, as per the company’s explanation.

|

LTC’s 2023 business indicators

Source: VietstockFinance

|

Notably, LTC’s 2023 financial statements were met with a disclaimer of opinion from the auditing firm, AAC, due to a multitude of reasons.

Firstly, the existence and accuracy of various account items prevented AAC from providing an opinion, including:

– As of December 31, 2023, LTC had cash balances of approximately 2.7 billion VND, inventories of nearly 21.5 billion VND, fixed assets of 5.78 billion VND, and fully depreciated investment properties worth 564 billion VND. However, these figures were not subject to physical inventory counting. The inventories have been stagnant for years and have not been evaluated to determine the need for allowance for impairment, which the auditors were unable to address due to limitations in the scope of their audit.

– Accounts receivable, bank balances, and accounts payable were not subject to reconciliation or confirmation. The entire accounts receivable balance (nearly 185 billion VND) has been outstanding for years and is considered uncollectible, while the company has only provided for a portion of this amount, totaling approximately 15 billion VND.

– There was a total of 1.3 billion VND in payables with unknown creditors, which remained unchanged from the previous year. The auditors could not provide an opinion on this matter due to a lack of access to relevant documentation. Additionally, short-term borrowings from individuals and organizations (nearly 30 billion VND) with interest of over 1.4 billion VND were not reconciled or confirmed.

Secondly, the investment in an associate, CTCP Cáp và Thiết bị Viễn Thông, which has been consolidated using the equity method since the 2021 interim financial statements, amounted to over 19.2 billion VND. However, due to the non-provision of the associate’s financial statements for 2021, 2022, and 2023, the auditors were unable to determine the value of this investment using the aforementioned method.

Thirdly, the total bank deposits (over 1 billion VND) presented in the 2023 consolidated financial statements belonged to two individuals, Nguyen Ngoc Thu and Pham Duc Thuong, and were jointly owned. This recognition in the consolidated financial statements is inconsistent with the conditions set forth in Vietnamese Accounting Standards.

Fourthly, the total short-term accrued expenses at the end of 2023 amounted to nearly 62 billion VND, including approximately 40 billion VND in prepaid expenses that had been recognized in the cost of construction in previous years. The auditing firm was unable to fully assess this situation due to insufficient appropriate evidence.

Finally, the tax payable at the end of 2023 amounted to over 19.4 billion VND, representing the liability of the parent company. However, decisions from the tax authority and Hanoi Tax Department revealed that the parent company’s tax debt and overdue payments subject to enforcement as of July 31, 2024, totaled more than 45 billion VND, indicating a discrepancy of nearly 26 billion VND. Due to limitations in scope, AAC could not provide an opinion on this matter.

The tax enforcement situation also led AAC to emphasize the existence of a material uncertainty, casting significant doubt on LTC’s ability to continue as a going concern.

In response to these opinions, LTC provided a relatively concise explanation. The company stated that it is still in the process of reconciling and collecting documents to review and confirm the long-outstanding accounts receivable and payable. Additionally, they are working on conducting physical inventory counts and scrutinizing the account items, acknowledging that these matters date back several years and pledging to address them as soon as possible.

In reality, LTC has received a disclaimer of opinion from auditors since 2022. The delayed submission of the 2023 audited financial statements, coupled with the disclaimer of opinion on the 2022 financial statements, has resulted in HNX maintaining restrictions on the trading of LTC’s shares. According to the company’s explanation, LTC is facing challenges and a shortage of personnel. Additionally, the annual general meeting of shareholders for 2024 has not yet been organized and is expected to take place after the publication of the 2023 audited financial statements.

LTC was originally known as the Light Telecommunications Technology Center, under the Postal Construction Company – Vietnam Post and Telecommunications Corporation. Established in 1989, it was privatized in 2000 and became the Light Telecommunications Joint Stock Company, commencing operations in May 2001.

The company primarily operates in the manufacturing of cables and smart devices, electrical accessories, automation; providing technology solutions, document digitization and storage services; and constructing light telecommunications works.

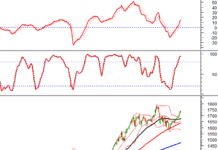

In the stock market, LTC’s share price has been on a downward spiral. From a peak of 7,700 VND/share in late July 2024, the market price has dropped to 4,400 VND/share (as of the closing price on September 27). Due to trading restrictions, LTC shares are only traded on Fridays, resulting in four consecutive floor price drops. One could argue that these restrictions are a blessing in disguise for LTC, as the share price could potentially plummet further amidst a gloomy outlook with no signs of improvement.

| LTC share price movement since the beginning of 2024 |

Chau An