The market witnessed a similar trend during today’s trading session, with investors taking profit on short-term positions as the VN-Index surpassed the 1,300-point mark.

The resistance at the previous peak continued to pose challenges for the VN-Index. Particularly after the lunch break, the sell-off extended, pushing the index below the reference level. The leading sectors, such as banking and real estate, also lost momentum. Real estate stocks like VIC, HDG, TCH, and LDG witnessed corrections.

The banking group was the main driving force behind the VN-Index’s approach to the 1,300-point milestone.

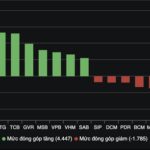

The upward momentum that pushed the VN-Index to new highs was largely driven by the banking sector. VPB and TPB witnessed strong inflows, with liquidity surpassing the 1,000-billion VND threshold. However, as the banking stocks retreated from their highs, the market faced pressure. The heavyweights with the most significant impact on the index, such as VCB, CTG, and BID, failed to maintain their leading roles. While VPB and TPB maintained high liquidity, their gains were limited to around 1%.

Despite the VN-Index closing slightly below the reference level, the market was dominated by red, with 228 decliners compared to only 148 advancers on HoSE. A similar scenario played out among the VN30 constituents.

As the market trimmed its gains, AGM continued to attract attention with consecutive sessions of strong gains followed by steep losses. The stock of An Giang Import-Export Company – Agimex (AGM) marked its second consecutive ceiling-priced session after a series of four consecutive floor-priced sessions (September 20-25). Earlier in September, AGM had also recorded a streak of eight consecutive ceiling-priced sessions from September 9 to 19.

In a clarification statement sent to HoSE, Angimex attributed the surge in AGM’s share price since September 10 to market supply and demand dynamics and fluctuations in the rice export industry. Specifically, the increase in rice import demand from Vietnam’s traditional customers contributed to the positive outlook for rice exports. However, Angimex also cautioned that India’s potential relaxation of rice export regulations could significantly impact the industry towards the year-end.

Super Typhoon YAGI inflicted severe damage on crops in northern provinces of Vietnam, particularly rice and corn, heightening concerns about domestic food shortages. This also fueled positive investor sentiment regarding rice prices, contributing to the sharp rise in AGM’s share price. Nonetheless, Angimex asserted that the company does not intervene in the stock price, and the recent fluctuations are solely driven by investor decisions and market forces.

At the close, the VN-Index lost 0.57 points (0.04%) to finish at 1,290.92. The HNX-Index declined by 0.21 points (0.09%) to 235.71, while the UPCoM-Index rose by 0.4 points (0.43%) to 93.9. Liquidity slightly eased from the previous session, with the matching value on HoSE reaching nearly 19,300 billion VND. Foreign investors net bought 228 billion VND, focusing on FPT, TPB, VNM, SSI, and CTG.