Vietnam’s stock market witnessed a volatile trading session on September 27, with the VN-Index briefly surpassing the crucial 1,300 mark. However, strong selling pressure forced the index to turn lower, closing down 0.57 points at 1,290.92. Foreign investors net bought nearly VND 230 billion in the market.

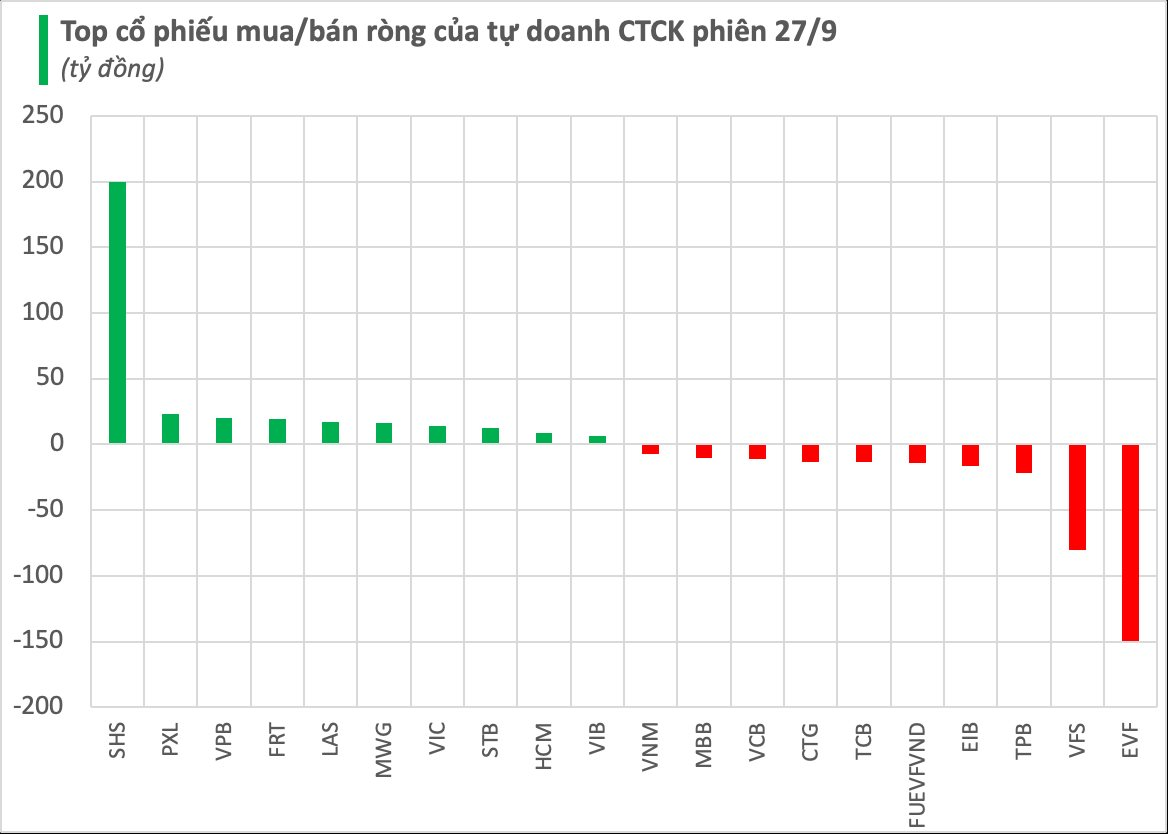

Brokerage firms’ proprietary trading activities recorded a slight net buying of VND 16 billion on the market.

On the HoSE, brokerage firms net sold VND 138 billion, including VND 5 billion on the matching order channel and VND 132 billion on the negotiated trading channel.

Specifically, brokerage firms’ transactions net sold VND 150 billion in EVF shares. In addition, stocks like TPB, EIB, and TCB were also net bought in the September 27 session.

Conversely, brokerage firms’ strongest net buying was in VPB and FRT, with respective values of VND 20 billion and VND 19 billion. MWG, VIC, STB, and other stocks were also net bought in today’s session.

On the HNX, brokerage proprietary trading activities net bought VND 12.9 billion, with SHS witnessing a sudden net buying of VND 199 billion, and LAS being net bought for VND 16 billion. In contrast, VFS was net sold for VND 80 billion.

On the UPCoM, brokerage proprietary trading activities net bought VND 24 billion, of which PXL accounted for VND 23 billion.