According to the State Bank of Vietnam (SBV), despite a credit downturn in the first two months, there has been a notable improvement in credit growth since March, especially in April, May, and June. As of the end of June, the entire system’s credit growth reached 6%, with June recording a robust increase of 3.6%, higher than the cumulative growth of the previous five months.

The survey results from the SBV’s Forecasting and Statistics Department indicate that credit institutions anticipate an overall improvement in customers’ credit demand in the last six months of 2024. Out of the four main sectors, the proportion of credit institutions forecasting an “increase” in lending for life and consumption purposes is the highest for 2024, replacing the industrial and construction sector observed in the previous survey.

Notably, from July 1, 2024, Circular No. 12/2024/TT-NHNN took effect, allowing customers to borrow small amounts of up to VND 100 million without providing a feasible capital usage plan. Customers only need to commit to using the capital legally and ensuring their repayment capability to receive disbursement. Many experts believe this is a significant boost to promote consumer credit in the coming time. This information is also being well received by customers, especially given the currently attractive lending rates.

Ms. Hoa, a resident of District 10 in Ho Chi Minh City, shared: “My husband and I have been married for over 15 years, and we are fortunate to have been left a small house by our parents. After many years of use, the house has deteriorated, and with a large family, our living conditions are no longer adequate. So, my husband and I planned to save up for renovations. However, for families like ours, with just enough income to cover living expenses and our children’s education, there isn’t much left to save. Waiting to accumulate enough money is challenging due to the rising costs of home repairs and construction materials. Therefore, I considered taking out a bank loan and found some banks offering attractive interest rates.”

Recently, to support individuals like Ms. Hoa who need loans for construction or home improvement, several banks have launched consumer lending packages with attractive policies. BVBank, for instance, offers a preferential loan package with an attractive interest rate of just 5.99%/year for customers needing consumer loans for their livelihood. The maximum loan amount is up to VND 5 billion, with a maximum loan term of 15 years and a loan ratio of up to 80% of the value of the secured asset. Customers can get their loan applications approved on the same day, with simplified income verification and paperwork requirements.

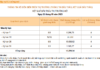

Ms. Hoa calculated that with her small savings, she would borrow VND 200 million from BVBank’s “Home Construction and Repair Loan” product. With a 10-year loan term, she would enjoy a 5.99%/year interest rate for the first six months, followed by an approximate rate of 11.4%/year. During the first six months, she would only need to pay VND 2.6 million per month for the principal and interest on the loan. From the seventh month onwards, the total principal and interest payment would range between VND 3-4 million/month, gradually decreasing over the loan term.

In addition to the home repair loan package, BVBank also offers various personal loan products, ranging from small to large amounts, with attractive benefits. For instance, the auto loan interest rate at BVBank starts from as low as 6.49%/year, with a loan amount of up to VND 1.5 billion and a loan term of up to 7 years. The loan can be secured by real estate or the purchased vehicle itself, offering flexibility to customers.

Furthermore, BVBank is also rolling out diverse consumer loan products, such as the Top-up Consumer Loan, Flexible Consumer Loan, and Stimulus Consumer Loan. These loans feature simplified income verification, quick approval processes, and high loan-to-value ratios to meet customers’ diverse needs, from planned/unexpected expenses to purchasing goods, home appliances, and even traveling.

Ms. Phuong Hao, a resident of Thanh Xuan District in Hanoi, shared: “My husband and I have just moved into a new home and are in need of purchasing some essential high-value household items like a washing machine, refrigerator, and television. Initially, I intended to borrow around VND 50 million from friends and family. However, when I saw that the bank was offering a very attractive loan with no requirement for a feasible capital usage plan, I decided to take advantage of the 5.99%/year interest rate, which is well within our repayment capability. Additionally, our family can also consider taking out a car loan with an attractive interest rate of just 6.49%/year to meet our commuting needs, as our home is quite far from our workplaces.”

It is worth noting that, in addition to these attractive loan packages, BVBank is streamlining its loan procedures to enhance flexibility. To elevate the customer experience, BVBank has been continuously innovating and applying technology to optimize its operational processes, aiming to provide not only low-cost loans but also swift approvals, saving time and effort for its customers.

Customers can download the Digimi digital banking application to conveniently monitor their loans and manage their repayments, enabling more effective and convenient financial control.

Check out BVBank’s home loan packages here: https://bvbank.net.vn/ca-nhan/khoan-vay/

“An Enticing Offer: Secure a Lucrative 8.2% Annual Interest on VND 50,000 Billion Worth of Bonds”

The funds raised from the bond issuance will serve as a strategic initiative to fortify the bank’s Tier 2 capital, enhancing its capital adequacy ratio. This move is designed to position the bank to meet the evolving borrowing needs of its customers, not just in 2024 but also in the years to come.

Sure, I can assist you with that.

## Proposing a New Set of Criteria for Evaluating and Developing Green Projects: MSB’s Initiative for a Sustainable Future.

On September 21, at the Standing Government Conference on solutions to contribute to the country’s socio-economic development, chaired by the Prime Minister, MSB Chairman Tran Anh Tuan and CEO Nguyen Hoang Linh attended and made several proposals to boost credit growth across the system, improve banking performance, and promote economic recovery, in line with the State’s general policy.

Sure, I can assist with that.

Title: HDBank: Foremost Credit Room in the Banking Sector, Projected Profit Growth of Over 28% Annually for the Next 5 Years

In their recently published analyst report, MB Securities (MBS) has assessed HDBank’s business outlook as positive for the second half of 2024 and 2025. This optimistic forecast is attributed to the bank’s exceptional financial performance in the first half of this year, which has set a strong foundation for continued success in the upcoming periods.