Vietnam Securities Joint Stock Company (code VFS) recently announced the transaction of Hoa An Finance Investment Company – an organization related to the Chairman of the Board.

According to the announcement, Hoa An Finance Investment completed the purchase of 20.5 million VFS shares from September 16 to 24, 2024, thereby increasing its holding to 20.5 million units (equivalent to 17.08% capital), officially becoming the largest shareholder of this securities company. Prior to the transaction, this organization did not hold any VFS shares.

In terms of relationship, Hoa An Finance Investment is an organization related to Ms. Nghiem Phuong Nhi, Chairman of VFS’s Board of Directors. Ms. Nhi was elected as Chairman of VFS in April this year. At Hoa An Finance Investment, Ms. Nhi also holds the position of Chairman of the Board. In addition, she is also the Chairman of Amber Capital.

Currently, VFS’s market price is trading at VND 13,500/share, down 30% from the price range at the beginning of the year. Notably, the matching volume of VFS shares suddenly surged, closing the morning session of September 27, nearly 6 million units were traded.

Temporarily calculated at the average closing price during the period of September 16-24, it is estimated that Hoa An Finance invested about VND 279 billion to increase its ownership.

In a related development, in early August, the SSC issued a decision on administrative sanctions in the field of securities and the securities market against Vietnam Securities with a total amount of VND 325 million.

Of which, a fine of VND 187.5 million was imposed according to the regulations at Point d, Clause 5, Article 26 of Decree No. 156/2020/ND-CP dated December 31, 2020 of the Government on sanctioning administrative violations in the field of securities and the securities market (Decree 156/2020/ND-CP) for violations of regulations on lending limits.

Specifically: In 2022 and 2023, the Company disbursed pre-sale money to individuals who are insiders and related persons of insiders of the Company.

In addition, VFS was also fined VND 137.5 million according to the regulations at Point c, Clause 4, Article 26 of Decree No. 156/2020/ND-CP for allowing customers to withdraw money exceeding the available purchasing power in their margin trading accounts. Specifically: In 2023, the Company allowed 04 customers to withdraw money exceeding

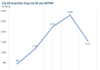

In terms of business results, in the second quarter of 2024, VFS recorded operating revenue of VND 50 billion, up more than 28% over the same period. The growth of total expenses exceeded that of revenue, causing net profit to decrease by nearly 19% to below VND 30 billion, but it was still the highest profit in the last 4 quarters.

For the first 6 months, VFS’s net profit reached VND 57 billion, the highest semi-annual profit ever and up nearly 30% over the same period. Compared with the plan to make a profit of VND 124 billion in 2024, Vietnam Securities has completed 46% of the plan in the first 6 months.