Has the “turning point” arrived after a long streak of net selling?

According to trading statistics from September 23-27, foreign investors withdrew nearly VND 550 billion net from the Vietnamese stock market, with HOSE seeing nearly VND 530 billion in net selling. However, the actual foreign investors’ trading balance was influenced by a sudden block deal to sell VIB shares during the September 24 session, related to the divestment of Commonwealth Bank of Australia (CBA).

Excluding the exceptional case of VIB (-VND 2,665 billion), in fact, foreign capital inflowed the market with more than VND 2,000 billion through order matching.

Meanwhile, observing the activities of foreign capital in the past two weeks, there have been 8 out of 10 sessions with the presence of foreign money. In total, in two weeks, foreign investors net bought more than VND 3,000 billion through order matching.

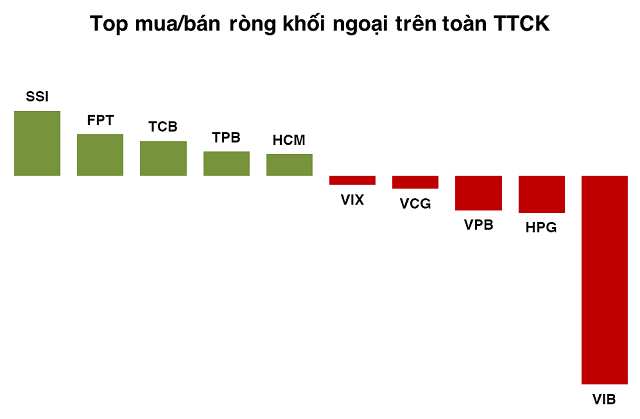

Going deeper into the trading structure, the 5 stocks that were most bought by foreign investors in the past two weeks were SSI (+VND 831 billion), FPT (+VND 532 billion), TCB (+ 448 billion), TPB (+VND 309.7 billion), and HCM (+VND 281 billion), all benefiting to some extent. TPB rose up to 12% in two weeks, while SSI and TCB both increased by more than 9%.

Top net buying and selling of foreign investors in the 2-week period from 16-27/9.

|

Meanwhile, the 5 stocks that were net sold the most were VIB (-VND 2,665 billion), HPG (-VND 474 billion), VPB (- VND 437.7 billion), VCG (-VND 164 billion), and VIX (- VND 115.4 billion). No stock in this group experienced unfavorable developments. In fact, VIB and VPB both increased by more than 7% in just two weeks of trading.

This shows that domestic investment funds no longer hesitate to invest in stocks that are still under pressure from foreign funds. Meanwhile, the stocks in the positive group are simultaneously benefiting from both domestic and foreign capital inflows.

With 8 out of the last 10 sessions seeing net buying, the market may be experiencing a “turning point” after the Fed officially reversed the cycle of tightening monetary policy.

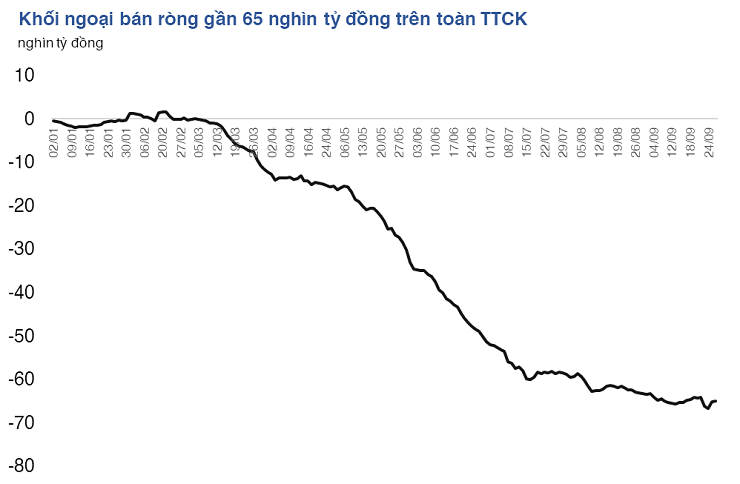

Foreign investors actually net bought in September 2024 if the block deal of VIB is excluded.

|

The picture of foreign investors’ activities will likely become clearer from October 2024, as September 2024 was the eighth consecutive month of net selling in the Vietnamese stock market. However, the intensity of net selling from the beginning of September 2024 has narrowed down to a low level in the selling streak, at around VND 1,600 billion.

The story of market upgrade is regaining its relevance.

For capital flows from ETF funds as well as active funds, the Fed’s rate cut is considered a positive factor supporting the reversal of the capital withdrawal trend.

In fact, even before the Fed reversed its monetary policy, selling pressure from foreign investors had weakened significantly as the supply from speculative funds decreased.

Mr. Nguyen The Minh, Director of Individual Customer Analysis at Yuanta Vietnam Securities Company, said that the Fed’s rate cut of 0.5% has created many positive effects, such as easing exchange rate pressure, which helps create more attractive valuations for the Vietnamese stock market.

Especially, the issuance of Circular 68 by the Ministry of Finance will improve the trading frequency of foreign investors and will be the key to helping FTSE Russell upgrade the Vietnamese market to the Secondary Emerging Market group.

The effectiveness of the implementation for ETFs to officially add Vietnamese stocks to their portfolios can be seen in 2025. However, Mr. Minh believes that whether FTSE considers the upgrade in October 2024 or March 2025, it will create a positive impact on the market.

Investors expect the upgrade to the emerging market to attract about $1.5 billion in capital inflows from ETFs, excluding capital from active funds.

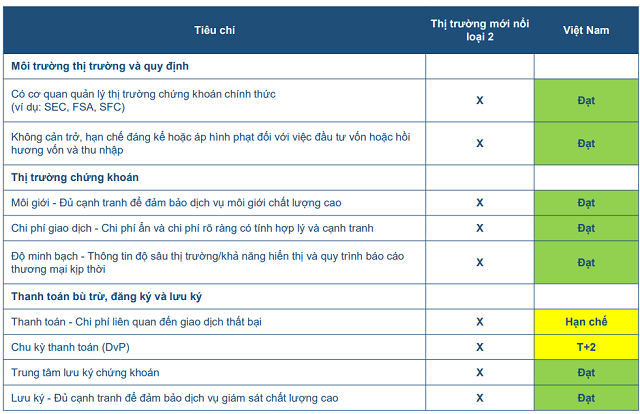

According to BVSC, the Vietnamese stock market will be considered for an upgrade at the earliest in March 2025 – after the final assessments on the “Transaction Failure Costs” criterion.

Source: BVSC.

|

Currently, 7 out of 9 groups of criteria for upgrading from a frontier market to an emerging secondary market of FTSE have been met. The two criteria that Vietnam has not yet met are:

✓ The “DvP Settlement Cycle” criterion is rated as “restrictive” because, currently, market practice requires checking to ensure sufficient funds before executing a transaction.

✓ The criterion “Payment – Costs related to failed transactions” is not rated because, by default, the market does not experience failed transactions.

After the Ministry of Finance issued Circular 68, Vietnam has come closer to meeting these two criteria of FTSE. In the upcoming assessment on October 8, 2024, BVSC believes that FTSE will recognize more positive developments in Vietnam’s upgrade process.