This information was shared by Le Tien Truong, Chairman of the Board of Directors of the Vietnam Textile and Apparel Group (Vinatex, UPCoM: VGT), at the Party Executive Committee Conference held last weekend.

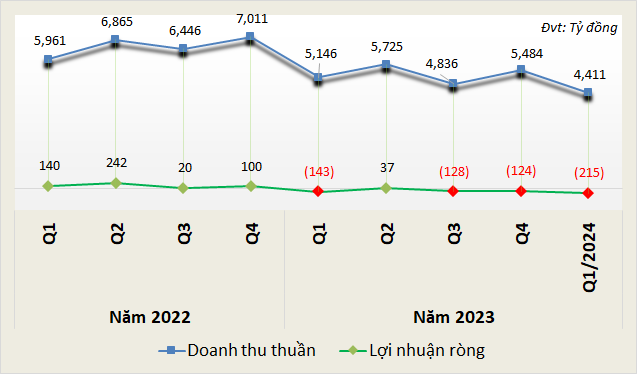

According to a preliminary report on the business results for the first nine months of 2024, Vinatex estimated consolidated revenue of VND 13,036 billion, a nearly 1% increase compared to the same period last year, and pre-tax profit of VND 490 billion, an over 70% surge. With these results, the Group has achieved nearly 73% of its revenue target and more than 89% of its profit goal for the year.

“The market context remains challenging and unstable in 2024,” noted Chairman Le Tien Truong. The only difference between 2024 and 2023 is that the market has become more favorable quarter by quarter.

In the first six months of 2024, the entire textile and garment industry only achieved approximately $20 billion in exports. However, subsequent instability in competing countries like Bangladesh and Myanmar created short-term advantages for Vietnam’s textile industry.

Illustrative image

|

“Businesses need to continue taking decisive actions, enhancing production capacity, and practicing savings to ensure stable production and business operations, especially for those producing raw materials who have been facing difficulties for the past 30 months,” emphasized Mr. Truong.

Vinatex targets niche markets with flame-retardant fabric

To achieve the industry’s export target of $44 billion in 2024, a 10% increase compared to 2023, Mr. Le Tien Truong remarked in a recent article on the Vinatex website, “Much depends on the market signals in the fourth quarter of 2024.”

Based on his experience, Mr. Truong observed that long-term forecasts of six months to a year have been highly inaccurate since 2022. Therefore, the most significant challenge for Vietnam’s textile industry is the unpredictability of future market conditions.

“We may experience excellent months, but immediately afterward, there could be one or two terrible ones”, said the leader of Vinatex. The market’s fluctuations since 2022 have taught the industry’s managers an important lesson: always make shorter-term forecasts, update them frequently, and be prepared to make quick and flexible management decisions to ride the waves of short-term growth spurts in the global market.

Chairman of Vinatex’s Board of Directors, Le Tien Truong, shares his insights at an event in May 2024

|

To meet their annual targets, Vinatex and its member companies have implemented various solutions and strategies. One such approach is to venture into niche markets by focusing on flame-retardant fabric and protective clothing production to increase product value.

Vinatex has entered into a joint venture with the Coats Group to invest in flame-retardant fabric production. They are currently expediting manufacturing and plan to export the first orders to Indonesia, India, the Middle East, and the US in the third quarter and the beginning of the fourth quarter.

“For this collaboration, Vinatex aims for a revenue target of $2-2.5 million in 2024 and expects to double this figure annually over the next five years. The primary goal is to meet the demands of the US market, and from there, we will expand our reach to the EU, Japan, South Korea, and other global markets”, shared Mr. Truong.