The latest financial report showcases promising financial signs for Vua Nem, Vietnam’s leading mattress retailer. Specifically, for the first seven months of 2024, Vua Nem’s net profit showed a remarkable reduction in losses, decreasing by 16 billion VND compared to the initial plan. Since June 2024, the company has been consistently profitable, continuing this positive trend into July. These are positive indicators that the company is well on its way to achieving a positive net profit for the entire year.

This impressive turnaround, with a significant reduction in losses and improved financial health, is the result of a comprehensive restructuring and optimization process implemented over the past year. Additionally, the contribution of a flexible pricing strategy and product diversification, timely adapted to the market during the economic downturn, cannot be understated.

LOW-PRICED STRATEGY IN A VOLATILE ECONOMIC ENVIRONMENT

As one of Vua Nem’s sustainable development goals, the company proactively expanded its product portfolio to include items under 5 million VND to cater to a diverse range of consumer needs, from affordable to premium options. This move not only demonstrates the company’s agility in responding to market fluctuations but also underscores its commitment to offering the best quality products at all price points.

Vua Nem’s “worthy sleep” campaign has proven effective, with an impressive 22% growth in the first eight months of 2024 (compared to the same period in 2023) in the sub-5-million-VND segment. This success illustrates that even in the low-price segment, strategic product positioning and prudent price management can lead to notable achievements.

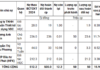

The latest financial report reveals that, as of July 2024, 91.5% of Vua Nem’s 130 stores achieved positive EBITDA, a significant improvement over the 71.4% recorded in the previous year. Notably, the percentage and number of stores with negative cumulative EBITDA have been steadily decreasing since the beginning of the year, and it is anticipated that by the end of 2024, 100% of the stores will attain positive EBITDA.

QUALITY BEYOND “LOW PRICES”: A KEY FACTOR IN INCREASING CUSTOMER BASE

Vua Nem asserts that its low-price strategy does not compromise quality. “Our approach is not to follow the market but to focus on developing products with superior materials, eliminating middlemen, and offering products directly from the factory to our stores at the most reasonable prices for consumers,” said a company representative.

As a result, a range of affordable yet high-quality products, catering to the diverse needs of consumers, have been introduced. Notable mentions include the Magic and Elite Original spring mattresses, the Osaka, Akita, and Hachi foam mattresses, and especially the Gummi Lite latex mattress line.

The Goodnight Hachi foam mattress, designed for couples, offers a mid-range price. With its sturdy 2-layer foam construction, multi-point massage surface, and antibacterial bamboo fiber cover, the product is built to last, catering to couples’ needs through various stages: newlywed, pregnancy, and parenting.

For those who prefer spring mattresses but are financially constrained, the Goodnight Magic is an excellent choice. Rated as one of the most accessible options in the spring mattress line, Goodnight Magic maintains quality with its independent spring bag system, reducing noise and motion transfer while providing superior spinal pressure relief.

In the past year, Vua Nem also focused on diversifying its sleep care product portfolio, introducing the Iyashi herbal compress belt and MI night light, among others, to attract younger customers aged 22 and above. “We want all our customers to find top-quality products at the best prices, whether they shop in our stores or through e-commerce platforms,” the company representative added.

This strategic approach has enabled Vua Nem to turn its finances around, increase sales, and attract a younger demographic, with a 30% increase in young customers compared to the previous year. With its current trajectory, Vua Nem is well on its way to shortening its growth timeline and achieving a positive profit margin this year.

The Turnaround: How Vua Nem Reversed its Fortunes and Rose from the Ashes

Quick reactions to market fluctuations, agile pricing strategies, and product diversification have been instrumental in Vua Nem’s remarkable turnaround. The company adeptly navigated through challenging times, avoiding potential losses and achieving positive growth.