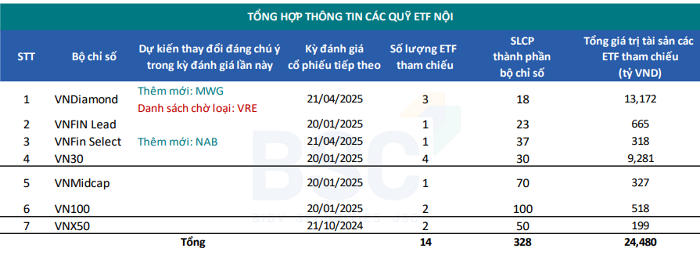

The Vietnamese stock market is gearing up for an important event on October 21. This is when the Ho Chi Minh City Stock Exchange (HOSE) will announce changes to the constituent stocks of significant indices, including the VNDiamond Index, VN-FinSelect Index, and VNX-50 Index.

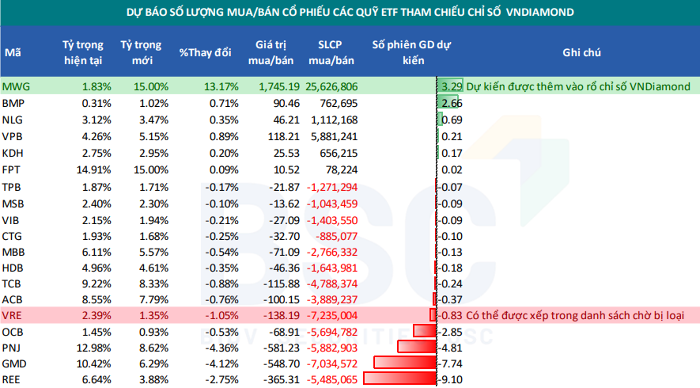

According to BSC Research’s predictions, based on data as of September 30, the VNDiamond Index is likely to welcome back a retail industry giant – MWG stock. Notably, MWG was removed from this index in April 2024 but now has the chance to return as it meets the criteria for sector diversity (the banking sector has reached its 40% weight limit) and has a high FOL ratio (foreign ownership limit ratio).

On the other hand, VRE, owned by Vincom Retail, faces the risk of exclusion from the VNDiamond Index due to not meeting the FOL ratio criterion. If this situation doesn’t improve, VRE could be officially removed in the April 2025 review period.

Currently, there are three ETFs in the Vietnamese market that reference the VN-Diamond Index: DCVFMVN Diamond ETF, MAFMVN Diamond ETF, and BVFVN Diamond ETF.

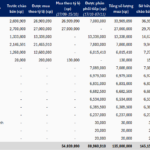

The analysis team also points out an anomaly with the DCVFMVN Diamond ETF. Despite MWG being removed in April 2024, this Dragon Capital-managed ETF still holds MWG stock. According to Bloomberg, the number of MWG shares in this ETF as of May 31, June 28, July 31, and August 30, 2024, were 8 million, 6.98 million, 3.94 million, and 3.4 million, respectively.

Source: BSC Research

|

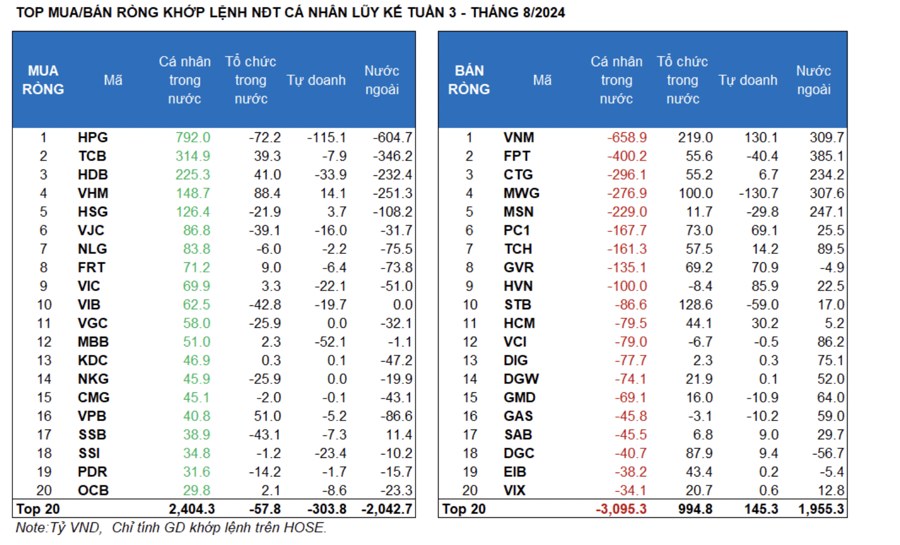

Given this information, BSC Research forecasts that ETFs tracking the VNDiamond Index may need to purchase approximately 26 million MWG shares. Conversely, some other stocks, such as VRE, OCB, PNJ, GMD, and REE, could face selling pressure, with expected volumes ranging from 5.5 to 7.3 million shares for each code.

Besides the VNDiamond Index, other indices also witnessed notable fluctuations. The VN-FinSelect Index is expected to add NAB stock, while the VN30 Index closely monitors the potential inclusion of ACV and BSR – two large enterprises in the process of transferring from UPCoM to HOSE.

BSC Research notes that BSR will require a minimum of six months of listing on HOSE to be considered for the VN30 Index. This means that the probability of entering the Top 20 stocks by market capitalization is not guaranteed as other stocks are also showing significant improvements in this criterion.

In the case of ACV, if its capitalization improves after the transfer to HOSE and it enters the top 5 market capitalization (currently outside the top 5), ACV will need a minimum of three months of listing to be approved for the VN30. If the capitalization is outside the top 5, ACV will require a minimum of six months of listing (similar to BSR) to have a chance to enter the VN30 Index.

Regarding the January 2025 review, if the Exchange does not change the index calculation rules, BSC Research, based on data as of September 30, assesses that LPB stock has met the conditions to enter the VN30 (entering the top 20 market capitalization). This implies that POW stock may be at risk of exclusion from the VN30.

Thiên Vân

The Young Chairman: Unveiling the Face Behind the Newly-Approved HoSE-Listed Securities Firm

As of now, the young chairman holds 73 million DSC shares (35.6% of the capital), with an estimated value of nearly VND 1,700 billion.