Governor of the State Bank of Vietnam, Nguyen Thi Hong – Photo: VGP/Doan Bac

At the regular monthly Government meeting for September 2024, held online with 63 localities on October 7, the Governor of the State Bank, Nguyen Thi Hong, said that recently, inflation worldwide has been decreasing towards target levels, and central banks have begun to loosen monetary policy, with the Fed reducing interest rates by 0.5% after many months of consideration and caution.

The US Dollar Index has increased since the beginning of the year, but the pressure has eased, allowing for a boost in export growth, an important driver for the economy, said the Governor.

Regarding the domestic economy, Ms. Hong said that the economic growth drivers from both the supply and demand sides have improved and recovered. However, consumer demand has not improved significantly, as reflected in the total retail sales excluding prices, which increased by only 5.3%, lower than the same period last year (8%).

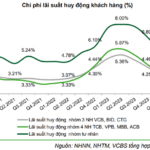

Inflation has been kept relatively stable, and it is possible to achieve the target for 2024. At the same time, the average lending interest rate continued to decrease by about 0.5%, and the Vietnamese dong depreciated by about 1.66% – a suitable level that also contributes to the stability of the monetary and foreign exchange market.

In the past time, the banking industry has also actively promoted credit growth. As of September 30, credit increased by 9% compared to the same period last year, a 16% increase. Usually, credit increases sharply in the last months of the year, so this year’s target of 15% is feasible.

The State Bank also continues to implement debt restructuring solutions, maintain debt groups, and increase the support package for seafood and wood processing from VND30,000 billion to VND60,000 billion. Credit institutions have registered new credit packages for new loans and reduced interest rates.

Currently, 30 out of 45 credit institutions have registered, with a total package value of VND405,000 billion, and interest rates will be reduced by 0.5-2%…

The banking industry also directs credit institutions to actively review their financial situation and prepare documents for the handover ceremony of the two zero-dong banks after a long period of difficulties. For the remaining two banks, the State Bank is also instructing units to complete the work soon and report to the Prime Minister.

According to Ms. Nguyen Thi Hong, as 98% of enterprises in Vietnam are small and medium-sized, it is necessary to enhance credit guarantees for small and medium-sized enterprises to facilitate credit capital flow.

“Huge Cash Injection by Banks: Over $8.6 Billion Pumped into the Economy in Mid-September, Says Governor; A 15% Credit Growth Target is Well Within Reach.”

As of the end of Q3, the banking sector has extended an additional VND 1.2 quadrillion in loans, achieving approximately 60% of its targeted credit growth. This leaves a remaining loanable fund of around VND 800 trillion for the final quarter.

The First 9 Months CPI Up 3.88%, Core Inflation Up 2.69%

The surge in food prices in provinces and cities directly impacted by storms and their aftermath, the implementation of increased tuition fees in some localities following Decree No. 97/2023/ND-CP, and rising rental costs were the primary drivers of the 0.29% month-over-month increase in the consumer price index (CPI) for September 2024. Compared to December 2023, September’s CPI rose 2.18%, and it increased 2.63% year-over-year.

“Proposed Higher Interest Rates for Second and Subsequent Home Buyers”

In an effort to tighten lending policies for real estate speculators, the Vietnam Real Estate Brokers Association has proposed higher interest rates for those purchasing a second or subsequent home.