Governor of the State Bank of Vietnam, Nguyen Thi Hong (Photo: VGP)

At the regular Government meeting for September 2024, Governor Nguyen Thi Hong stated that as of September 30, credit growth reached 9% year-to-date and 16% compared to the same period last year.

“Credit tends to increase significantly in the last few months of the year, so our target of 15% growth is definitely achievable,” emphasized Ms. Hong.

Previously, according to the SBV’s data, credit growth for the entire economy as of September 17, 2024, reached 7.38% compared to the end of 2023 and only 6.63% at the end of August.

Thus, in September, credit growth increased by nearly 2.4 percentage points, equivalent to a scale of about VND 300 trillion. In the second half of September alone, the credit injected into the economy by the banking system was nearly VND 220 trillion.

Since the beginning of 2024, the SBV has assigned credit growth targets to credit institutions corresponding to an average growth rate of about 15%. With total outstanding credit of nearly VND 13,569 million billion at the end of 2023, the banking system aims to lend an additional VND 2 million billion in 2024.

At the end of the third quarter, the banking industry had lent an additional VND 1.2 million billion, achieving about 60% of the set credit growth target, with a remaining quota of about VND 800 trillion for the fourth quarter.

Previously, many banks reported high credit growth rates in recent months and requested the SBV for additional room.

Sharing at the Conference of the Government Standing Committee with joint-stock commercial banks on September 21, Mr. Ho Nam Tien, CEO of LPBank, said that the bank’s credit growth had reached 15.97% (outstanding loans increased by nearly VND 44 trillion), the highest figure in the system so far.

Also, at the event, HDBank Chairman Kim Byoungho said that the bank’s credit growth had reached over 15% year-to-date, with outstanding loans exceeding VND 390 trillion. The non-performing loan ratio stood at 1.74%.

To promote credit growth, the representative of HDBank proposed that the State Bank of Vietnam consider assigning additional targets to credit institutions with good capital supply capacity based on balancing management objectives and continue to review the situation in the fourth quarter.

At Military Commercial Joint Stock Bank (MB), credit growth is also high compared to the industry. As of the end of August, outstanding credit reached about VND 685 trillion, up 11.14% compared to 2023, and 9.4% at the end of the second quarter.

Mr. Luu Trung Thai, Chairman of MB, said that most of the new outstanding balance (47%) or VND 32.7 trillion was allocated to the retail segment, with production and business loans growing by about 20% year-on-year.

As of the end of August, the leader of Nam A Bank revealed that the bank’s credit growth was at 14%, corresponding to 85% of the quota assigned by the SBV, and it is expected to be further relaxed.

On the other hand, some banks still recorded credit growth below expectations.

According to Ms. Nguyen Duc Thach Diem – CEO of Sacombank, although many solutions and mechanisms have been applied to promote credit growth, Sacombank’s credit growth, in particular, has not yet met expectations due to some difficulties and obstacles: Capital demand remains low as exports and domestic consumption have not recovered; Many enterprises downsized their production scale and were cautious about risks, so they did not actively use loans.

In addition, people’s incomes decreased, while the supply of real estate for living needs at reasonable prices was not met. Companies/real estate projects are still facing difficulties as the legal framework is not yet complete, and financial capacity has deteriorated severely.

Apart from the factor of people’s reduced income due to economic difficulties, the proliferation of lending applications with relaxed lending conditions and no collateral requirements has also taken a share of the consumer credit market, resulting in slower growth in consumer credit.

Regarding solutions, the CEO of Sacombank suggested that it is necessary to continue reducing capital costs and lowering lending interest rates to enhance capital accessibility. At the same time, she proposed that the Government continue to maintain an expansionary fiscal policy to stimulate aggregate demand, thereby promoting growth. Implementing tax and fee reduction solutions to directly support consumption demand, thereby increasing purchasing power;….

In the first half of the year, VIB’s credit growth was also lower than the average growth rate of the entire system.

Sharing at the Conference of the Government Standing Committee with joint-stock commercial banks, Mr. Dang Khac Vy, Chairman of VIB, said that as the banking industry is increasing the proportion of retail credit in its credit portfolio, with real estate and apartments accounting for a significant proportion of total collateral, the recovery of the real estate market will positively affect the economy and enable banks to increase lending and handle bad debts.

The Chairman of VIB hopes that the Government and ministries and branches will continue to implement synchronous solutions to promote the healthy and sustainable development of the real estate market, thereby helping banks to increase credit safely and strongly. At the same time, continue to implement the policy of not relaxing credit conditions to achieve credit growth at all costs to avoid subsequent adverse effects on the safe operation of banks and the stability of the system.

According to the survey results of credit trends of credit institutions (CIs) in the fourth quarter of 2024, credit institutions (CIs) expected credit growth in the fourth quarter to reach 4.8% and 13.2% for the whole of 2024. This result is 0.9 percentage points lower than the previous survey’s forecast of 14.1% credit growth for the whole year.

The Evolution of Vietnam’s Banking Sector: Unlocking the Secrets Behind its Success

The State Bank of Vietnam has just released figures pertaining to the latest customer deposit trends.

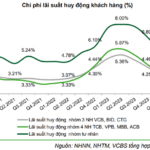

The Two Main Reasons Behind Rising Deposit Interest Rates

Deposit interest rates continue to rise at many banks in September. Speaking to *Kiem Toan* Newspaper, financial and banking expert, Dr. Nguyen Tri Hieu, attributed this trend to two main reasons.