Phenikaa Group JSC is offering 3,200tp at a face value of 100 million VND/tp under the lot code PKACH2431001. The bonds offer a fixed interest rate of 8.2%/year, maturing in 7 years on September 30, 2031.

The non-convertible, non-warrant-attached bonds are secured by 7.5 million shares of Vicostone (HNX: VCS), currently valued at approximately 465 billion VND (based on the closing price of 62,000 VND/share on October 4).

Early redemption of the bonds is not permitted, except in the event of a breach as per the provisions.

In December 2023, Phenikaa Group successfully raised 900 billion VND from two bond lots issued on the same date, with a 7-year maturity. The 600 billion VND lot offered a fixed interest rate of 6.2%/year, while the 300 billion VND lot had a floating rate of 5.87%/year. The company has paid a total of over 27 billion VND in interest for the first payment due on June 14, 2024.

Mr. Ho Xuan Nang – Chairman of Phenikaa Group’s Board of Directors

|

Phenikaa Group is a diversified conglomerate with over 30 member units operating in Vietnam, chaired by Ho Xuan Nang. Its core business is industrial manufacturing of surface materials, with quartz-based artificial stone as its flagship product. Sold domestically and internationally since 2004, this product is managed and operated by key subsidiaries including Vicostone, Style Stone, and Vietnam Stone Fabrication. The Group’s average revenue for the past five years has ranged between 4,000 and 5,000 billion VND per year.

For the first half of 2024, Phenikaa Group posted a post-tax profit of 514 billion VND, a 31% increase compared to the same period last year. As of Q2 2024, the company’s equity stood at over 9,000 billion VND, with total liabilities exceeding 6,300 billion VND, including 900 billion VND in bond debt. Consequently, the return on equity (ROE) improved to 5.78%, up from 4.54% previously. In 2022 and 2023, the Group’s post-tax profits were 1,000 billion VND and 611 billion VND, respectively.

Risk Mitigated by Strong Operating Cash Flow

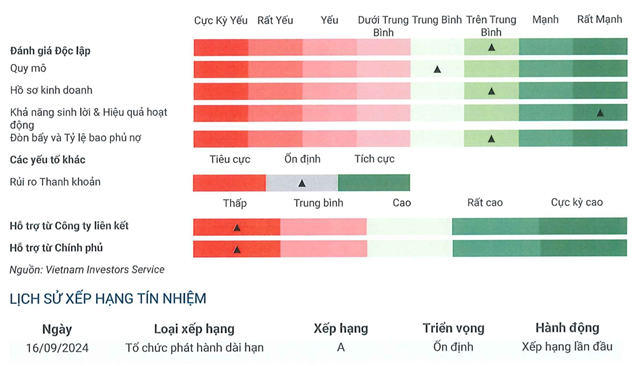

In September 2024, Phenikaa Group received a long-term issuer credit rating of A with a stable outlook from Vietnam Investment and Securities Company (VIS Rating). This was the first rating assigned to Phenikaa Group by VIS Rating.

The rating reflects the company’s “above-average” business risk profile and leverage, “very strong” profitability and operating efficiency, and “moderate” size based on its core operations in the construction materials industry. The outlook for the next 12-18 months is relatively positive, supported by the expected recovery in economic and construction activities.

VIS Rating’s assessment of Phenikaa Group’s creditworthiness. Source: VIS Rating

|

VIS Rating considers Phenikaa Group’s market position as “above-average” within the quartz-based artificial stone industry, as the Group is one of the largest exporters to the US market among Vietnamese manufacturers.

The Group’s key competitive advantages lie in its highly integrated vertical production process, commitment to product innovation, and well-established distribution network in the US market.

According to VIS Rating’s report, Phenikaa Group currently controls over 90% of the key raw materials required for the production of quartz-based artificial stone, including polyester resin and cristobalite. This enables the company to better manage its production costs compared to global competitors, especially those based in developed countries such as the US, Spain, and Israel.

However, the Group faces increasing competition from low-cost producers in China and India, as well as substitute materials such as ceramics, sintered stone, and natural stone.

Many of the company’s new business segments are still in the development phase or have recently commenced operations. The rating agency expects Phenikaa Group to benefit from this revenue diversification, given its recent significant investments in new technology and technical resources.

Phenikaa Group’s profitability and operating efficiency are assessed as “very strong,” with an EBITDA margin of 41-44%, one of the highest among Vietnamese enterprises. This is attributed to the company’s superior operational efficiency and ability to maintain high selling prices for its quartz-based artificial stone products in key markets. Moreover, the Group’s leverage is considered low compared to peers in the construction materials industry, with a debt-to-EBITDA ratio of around 2.7x over the past two years, significantly lower than the industry average of 8.4x.

“We believe that the strong profitability and operating efficiency have enabled the Group to invest in its core business as well as new ventures without relying heavily on debt,” VIS Rating stated in its report. The rating agency also expects the Group’s liquidity risk over the next 12-18 months to be manageable, given its strong operating cash flow and ample cash reserves.

Currently, Phenikaa Group’s short-term debt, primarily used to finance its working capital, is supported by credit lines from multiple banks. In a stress scenario, where access to new financing from banks is restricted, VIS Rating expects the Group to have sufficient operating cash flow to repay all maturing debt.

Phenikaa Group raises 900 billion VND through bond issuance

The Power of Persuasion: Crafting Compelling Copy for a Successful Business

“Ailing Power Company Raises $38 Million in ‘Triple No’ Bonds Despite $220 Million Losses”

Despite recording a post-tax loss of over VND 500 billion in the first half of this year, a power company has surprisingly raised nearly VND 900 billion in “three-no” bonds with a three-year maturity.

Optimizing the Securities Law: Further Tailoring the Corporate Bond Market?

The corporate bond market is undergoing a transformation to restore investor confidence after a series of setbacks. With impending revisions to the Securities Law, this market is expected to face further technical tightening measures.