Publicly listed interest rates for US dollar deposits at transaction locations

This Circular regulates the application of maximum interest rates for US dollar deposits of organizations (excluding credit institutions and foreign bank branches) and individuals at credit institutions and foreign bank branches.

Subjects of application: Commercial banks, cooperative banks, financial companies, specialized financial companies, foreign bank branches (credit institutions) operating in Vietnam according to the Law on Credit Institutions; organizations (excluding credit institutions) and individuals depositing money at credit institutions (customers).

Interest Rates

According to the provisions of this Circular, credit institutions shall apply interest rates for US dollar deposits not exceeding the maximum interest rate decided by the Governor of the State Bank of Vietnam for each period for:

a- Deposits of organizations

b- Deposits of individuals

The maximum interest rate for US dollar deposits specified in this Circular includes all forms of promotional expenses, applicable to the method of interest payment at the end of the term and other methods of interest payment converted according to the method of interest payment at the end of the term.

Credit institutions shall publicly list US dollar deposit interest rates at their legal transaction locations within the operating network of the credit institution and post them on their websites (if any). When accepting deposits, credit institutions shall not carry out promotions in any form (by cash, interest rates, or other forms) that are not in accordance with the provisions of law.

This Circular takes effect from November 20, 2024, and replaces Circular No. 06/2014/TT-NHNN dated March 17, 2014, of the Governor of the State Bank regulating the maximum interest rate for US dollar deposits of organizations and individuals at credit institutions.

For agreements on US dollar deposit interest rates before the effective date of this Circular, credit institutions and customers shall continue to implement them until the end of the term. In case the term has expired, the customer does not come to receive the deposit, the credit institution shall apply the deposit interest rate according to the provisions of this Circular.

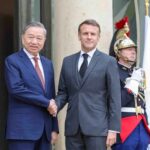

President Tô Lâm and French Counterpart Emmanuel Macron Hold Talks

“General Secretary and President To Lam and the French President agreed on significant directions and measures to enhance the Vietnam-France Comprehensive Strategic Partnership. Both leaders aim to deepen this strategic framework, ensuring practical and meaningful outcomes.”

The Future of International Trade: Reimagining Can Gio’s Potential as a Transport Hub in 2025

On October 2, 2024, Deputy Prime Minister Tran Hong Ha signed Document No. 746/TTg-CN on the project for the study on the construction of the Can Gio international transhipment port.