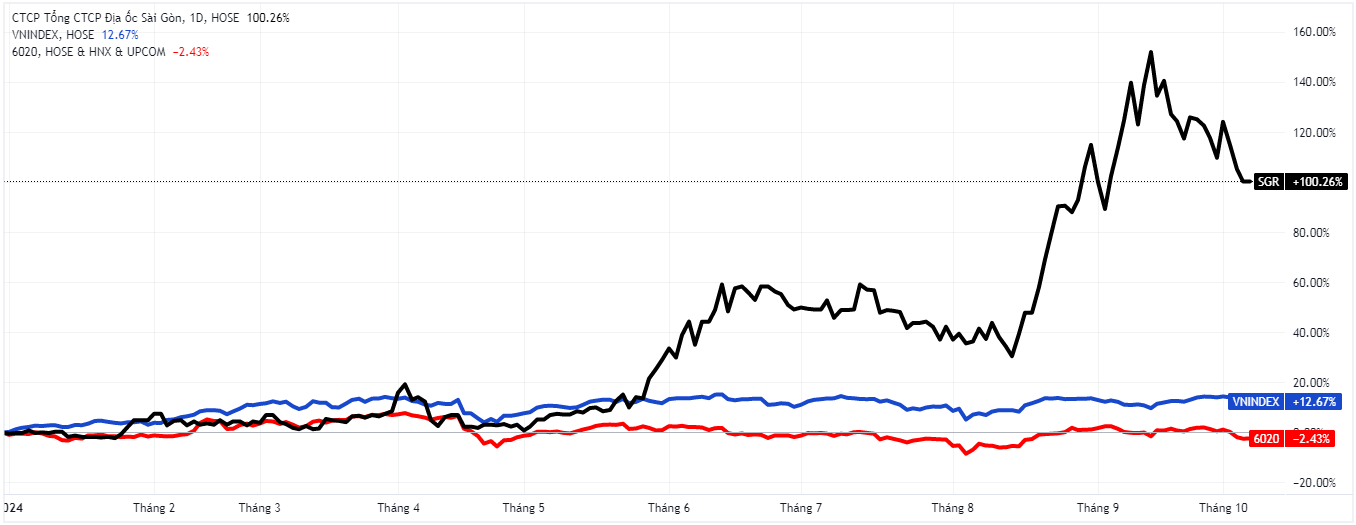

The surge in a mid-cap stock like SGR by over 100% is astonishing, especially when compared to the modest 12.7% rise in the VN-Index and the overall gloom in the real estate sector. This stellar performance, which occurred between May and September, is even more remarkable considering that SGR is currently banned from margin trading due to the company’s half-yearly loss.

|

Soaring Success

SGR: The Rising Star of the Real Estate Sector and the Market (*) Red line: Real estate stock index at the three exchanges HOSE, HNX, and UPCoM. Data as of 9:02 am, October 7, 2024. Source: VietstockFinance

|

While financial performance typically dictates market sentiment towards a stock, it is evident that a high-value capital-raising deal is driving the narrative for SGR. The stock’s upward trajectory began about a month after the 2024 Annual General Meeting (April 26), where Saigonres leaders announced a private capital-raising plan to address resource constraints.

The notable aspect of this fundraising round is the proposed share issuance price, which is 50% higher than the market price at that time, and the fact that there is only one buyer: the Chairman of Saigonres, Mr. Pham Thu.

According to the Chairman, this move will address Saigonres’ most significant challenge: meeting the required investment ratio to participate in projects.

Documents released in mid-September even set a higher issuance price for Mr. Thu than initially proposed at the annual general meeting. At VND 40,000 per share, he will contribute an additional VND 800 billion to the company (with owner’s equity of nearly VND 900 billion and charter capital of VND 600 billion) if he purchases the entire offered volume.

Chairman Pham Thu at the Saigonres Annual General Meeting, April 2024 – Photo: Saigonres

|

The market is familiar with Saigonres as a linked company, owned by Ms. Nguyen Thi Mai Thanh, who holds nearly 29% through HOSE-listed REE Corporation. However, the largest shareholder group in Saigonres remains the family of Mr. Pham Thu, with a total ownership of 42%.

Mr. Thu, born in 1949 in Bac Giang, is a rather low-key entrepreneur. Information about him is only briefly mentioned in Saigonres’ disclosures and on the company’s website.

At the 2020 Annual General Meeting of Saigonres, Ms. Mai Thanh stated that the majority of the company’s value – with total assets of VND 2,100 billion – lies in its land holdings and many unfinished compensation projects.

Owning assets and unlocking their value are two different matters. The illiquid nature of the real estate market over the past two years has further challenged Saigonres’ financial strategists in ensuring development capital and addressing compensation issues. “This is an extremely difficult problem,” said Chairman Pham Thu at the 2024 Annual General Meeting.

However, despite admitting that he had “many sleepless nights,” Mr. Thu affirmed his grand ambitions for Saigonres, as the company he leads now has a significant advantage over many peers grappling with legal and debt issues.

There are parties inviting Saigonres to participate in projects that Mr. Thu describes as “better than anything we currently have,” and the real estate market is showing signs of warming up.

Mr. Pham Thu pointed out that Saigonres’ most significant challenge is its low ability to meet the required investment ratio compared to the number of projects it wants to undertake. “We don’t meet the bidding requirements,” he said.

Current regulations stipulate that for each project, the owner’s equity must ensure a minimum of 20% of the total investment to be eligible for approval. Meanwhile, more than two-thirds of Saigonres’ charter capital has been contributed to member companies and joint ventures. This is the primary reason the company’s leaders decided to increase capital.

The veteran entrepreneur, with over 40 years of business experience, is gearing up for a significant battle. With a portfolio of 26 ongoing and prospective projects, Mr. Thu stated that Saigonres needs to increase its owner’s equity to VND 1,400-1,500 billion this year and VND 2,500 billion next year.

The company does not receive much support from banks, as they only lend when a project reaches the construction phase and do not provide capital for compensation or pre-investment activities. The majority of Saigonres’ projects have not yet reached the construction stage.

The most recently completed project – construction and sale to homebuyers – undertaken by Saigonres was back in 2018.

In recent years, their financial performance has mainly come from project sales, such as the transfer of Vung Tau Golden Complex (Phuoc Loc Company) in 2018, the transfer of Le Gia Plaza in Tan Uyen, Binh Duong to An Gia (HOSE: AGG) in 2019, or the recent sale of two apartment projects in Hiep Binh Chanh, Thu Duc City to Dat Xanh Corporation (HOSE: DXG).

Value and Waves

The leaders of Saigonres have diverse tastes in project selection. They are involved in developing an eco-urban area of nearly 50 hectares in Hoa Binh province – bordering Hanoi, low-rise projects in Binh Thuan province, and real estate in the tourist centers of Phu Quoc and Vung Tau.

In late 2023, Saigonres also successfully acquired a 7,700 sq. m plot on Le Sat Street, Tan Phu District, and won a land dispute over a prime location on Tran Nao Street, Thu Duc City, Ho Chi Minh City.

At the Annual General Meeting in April 2024, Saigonres leaders opined that the stock market had not accurately valued the company, partly due to a lack of information.

The actual value related to land holdings is often challenging to reflect in financial statements. Mr. Pham Thu recounted that the compensation price for their 15-hectare land in Dong Nai Province had increased from VND 500-700 thousand per square meter to a potential VND 3-4 million. “That’s for agricultural land. If we get it approved as a project, the value will double or triple,” he added.

However, in the current state of unfinished compensation, these real estate holdings cannot be accurately valued. “So, no matter how difficult the financial situation is, when many people advised me to sell, I still refused. Those assets will have value in the future,” he asserted.

The stock market is currently excited about SGR due to this stream of events. Still, investors who recall the stock’s historical performance may feel apprehensive.

In over nine years on the stock exchange, SGR has experienced four sharp surges followed by rapid declines. The frequency of these dramatic movements has increased since 2021.

With a low-liquidity stock like SGR, sudden enthusiasm can push prices to soar within a short period, and vice versa. Before this latest surge, SGR‘s daily trading value rarely exceeded the VND 1 billion threshold per session.

|

Boom and Bust

Since 2021, SGR has experienced a significant surge every year. Trading volume and stock prices have exploded and then contracted. Data as of 9:03 am, October 7, 2024. Source: VietstockFinance

|

The stock’s surge may have provided an opportunity for early investors to exit. In March 2021, Ms. Mai Thanh’s husband sold his entire stake in SGR in a matching transaction with an unknown buyer. In June 2024, Saigonres’ trade union also sold all its shares after the stock’s rapid rise.

However, Saigonres’ concentrated shareholder structure – with the Pham Thu family and REE Land holding nearly 71% – presents a barrier, making it challenging for insiders to buy the stock when prices are low.

“If it were for my personal benefit, I would have bought all these shares because I know their value,” said Mr. Thu, referring to the price of SGR hovering around VND 20,000 per share at the time of the Annual General Meeting this year.

“But if I bought, the market would freeze… because there would be nothing left to trade.”

Breakthrough Transactions: Travel Uninhibited with KIS Securities

In Q4 of 2024, KIS Vietnam Securities Joint Stock Company (KIS Securities) launched an exciting lucky draw promotion for its loyal “stock knights.” The total prize pool for this promotion amounted to an impressive 1.2 billion VND, featuring 25 Asian holiday packages, 6 sleek SamSung Zflip phones, and 9 state-of-the-art Fujifilm Instax cameras as rewards for the lucky winners.