KBSV Securities has recently provided an assessment of China’s outlook and its potential impact on Vietnam, highlighting the confirmed weakness of the Chinese economy with disappointing macroeconomic indicators.

CHINA’S GOVERNMENT STIMULUS PACKAGES ONLY HAVE SHORT-TERM PSYCHOLOGICAL EFFECTS

China has seen its economic growth forecasts lowered by major financial institutions, with a persistent downturn in the real estate market and deflationary risks becoming apparent. These three factors indicate a clear downward trend in China’s economic growth.

Specifically, financial organizations such as Bank of America, Citigroup, and Goldman Sachs have simultaneously lowered their GDP growth projections for the country in 2024 to as low as 4.7%, falling short of the government’s 5% target.

According to recently released August data, new and secondary real estate prices fell by 5.5% and 8.6% year-over-year, respectively, marking the sharpest decline since 2015. The downturn could be more severe as month-over-month (MoM) data also shows a steep decline. Although the Chinese government has introduced stimulus packages, including lowering policy rates and providing capital to cities to purchase unsold properties, the disbursement of funds and their impact have been slow.

There is a mismatch between excess supply and insufficient demand in tertiary markets, while primary markets face contrasting challenges, making it harder for local governments to intervene in the real estate market.

Deflationary pressures are building up. According to the NBS report, China’s CPI rose only 0.6% year-over-year in August, marking the third consecutive month of weaker-than-expected growth. Meanwhile, consumer prices remained almost flat across most commodity and service groups. The PPI has also been declining since the end of 2022, falling 1.8% in August, the sharpest drop in four months.

Fears of a deflationary spiral are well-founded as domestic consumers are increasingly limiting their spending on non-essential items. At the same time, falling real estate prices and overproduction in China are likely to put downward pressure on commodity prices and domestic consumption.

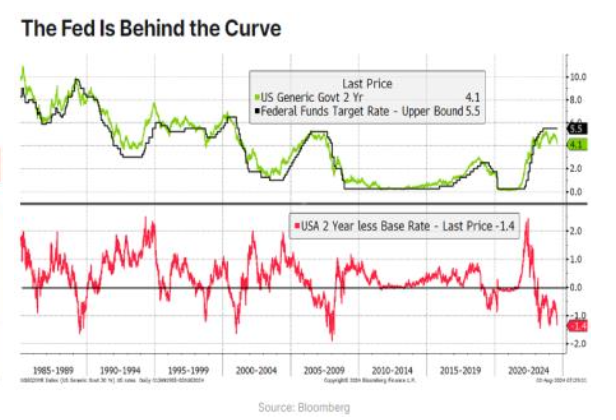

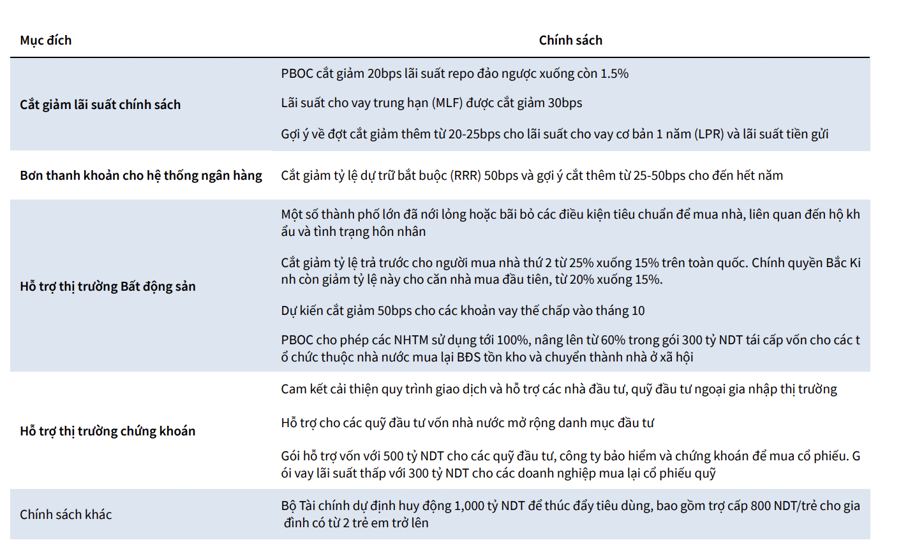

The Chinese government has swiftly introduced a series of stimulus policies, ranging from interest rate cuts to support for the capital, real estate, and stock markets, as macroeconomic data signals a downturn. Such sweeping changes by the government and the People’s Bank of China (PBOC) are unprecedented. Only on rare occasions in the past has the PBOC cut policy rates and the required reserve ratio (RRR) within the same month, with 2008 being an example.

This highlights the urgency in addressing deflationary risks and achieving the 5% growth target.

While the policies aim to ease pressure on various aspects of the economy, KBSV believes that the risks causing China’s current stagnation are more structural, and the government’s stimulus packages are only creating short-term positive psychological effects in the market.

Meanwhile, questions remain about the clear impact of these measures. The effectiveness of cutting policy rates is questionable. Reducing the current mortgage rate by 0.5 percentage points may help approximately 50 million households lower their annual interest payments by about 150 billion CNY, equivalent to increasing purchasing power by about 0.1% of GDP.

However, actual consumption and borrowing demand pose significant challenges to the policy’s success due to an aging population, rising unemployment rates in major cities, slowing wage growth, and a lackluster real estate market, all of which lead to restricted consumer spending.

Public spending is lagging behind the planned schedule. Contrary to the aggressive monetary policy, public investment is progressing slower than the budget plan, mainly due to implementation issues at the local government level. The packages providing capital to cities to purchase unsold properties for conversion into social housing are also facing disbursement problems.

KBSV attributes this to the imbalance between risk and yield after converting these assets, coupled with high local government debt, which delays the purchase of unsold properties, especially in tertiary markets.

SEVERAL VIETNAMESE INDUSTRIES ARE LIKELY TO BE AFFECTED

According to KBSV, the Chinese government’s economic stimulus packages will have positive short-term effects, partially improving consumer sentiment and supporting the real estate market. However, the medium-term decline in China’s economic growth is irreversible due to the structural issues faced by the world’s second-largest economy.

This remains a notable risk factor for the Vietnamese stock market due to the high level of interconnection between the two economies.

The sectors most vulnerable to these risks include aviation and services: Chinese tourists have consistently accounted for a large proportion of international visitors to Vietnam and are among the highest spenders. A downturn in China’s growth affects the income of its citizens, leading them to cut back on non-essential spending, which significantly impacts the number of tourists visiting Vietnam.

Export goods: As China is the second-largest consumer of Vietnamese goods globally (after the US), a weak Chinese economy will reduce demand for Vietnamese products such as agricultural produce, seafood, rubber, and wood.

Building materials: Excess capacity and high inventory levels due to a frozen real estate market will result in a flood of cheap Chinese building materials in the market. This, coupled with the tendency of major economies like the US and Europe to impose import taxes, creates intense competition for domestic building materials companies.