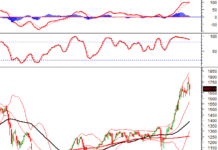

The enthusiastic upward momentum in the morning triggered short-term profit-taking trades in the afternoon, creating noticeable pressure. The VN Index once again climbed close to the 1300 mark, and a defensive stance has emerged.

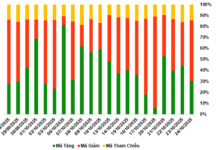

The volume of successfully bottom-fishing trades over the past few days, along with the volume of trapped trades in the 1300 range, has been released, putting pressure on most stocks, including the strongest ones. In such sessions, the range of price suppression, along with large or small volume, reflects the resistance.

Many stocks fell below the reference price by the afternoon; such stocks are weak, at least for this session. The rest needs to observe how much the green price range is suppressed and the ability to withstand buying pressure. With the “original 1300 point” statement, the 3-session bounce is still considered a “test” of the peak again, and it is unclear whether there will be a breakthrough. Therefore, short-term profit-taking or reducing inventory is normal.

Today’s focus is on the very focused cash flow and stocks with higher-than-average liquidity, along with a strong price increase range, and a slight price retreat from the peak are healthy stocks that can absorb short-term inventory well. Stocks are differentiating in strength as cash flow has not spread widely. The blue-chip group has better cash-attracting signals, more stable prices than mid-cap and penny stocks. This is also reasonable because large cash flows usually choose blue-chip stocks or sufficiently deep liquidity codes to operate.

The market is still in the testing phase of supply on the upside and within the old peak range. Note that the VN Index is not homogeneous with stocks, and the peak of the VN Index is not the peak of the stocks. Therefore, many codes that were sold off today are actually not peaks at all, but are psychologically influenced when the VN Index approaches the old peak. Therefore, transactions should observe the specific floor price of the stock.

Still holding the view that the market is positive, stocks that have risen rapidly in recent days may slow down a bit, and those that are still forming a base, the price bounces down due to general psychological pressure, can be bought more. In sessions like today, healthy stocks are exposed, and a good portfolio is unaffected.

Today’s derivatives market is difficult to make a profit, although VN30 rose quite strongly, but most of the increase was at the jump at the beginning of the session, while the intraday fluctuation during the session was very narrow, but the basis differed quite a bit. The points where VN30 exceeded 1367.xx were not effective for Long, and the break points of 1367.xx did not get the corresponding basis.

The profit-taking session this afternoon created different price effects; purely looking at the VN Index shows signs of weakness, but many stocks are still strong. Cash flow into blue-chips is good, and large-cap stocks are still supportive, with VN30 outperforming the VN Index. The strategy remains to buy stocks, Long/Short flexibly with derivatives.

VN30 closed today at 1360.58. The nearest resistance for tomorrow is 1368; 1376; 1380; 1388. Support is at 1357; 1348; 1341; 1333.

“Stock Blog” is personal and does not represent the opinion of VnEconomy. The views and evaluations are those of the individual investors, and VnEconomy respects the author’s point of view and writing style. VnEconomy and the author are not responsible for any issues related to the posted evaluations and investment views.