Today’s price action was interrupted by the patience of waiting liquidity, stifling any potential recovery. It was only when prices dipped lower that larger waiting orders emerged, revealing substantial buy-side interest. The low volume carried over from last weekend’s session, which could be seen as a positive sign as those who wanted to cut losses had already done so.

The unexpected macroeconomic data released over the weekend created some initial excitement, but the key factor was that the money flow disagreed with the bullish sentiment. The weak buying pressure quickly led to a deterioration of the upward momentum. The market is currently in the hands of sellers rather than buyers, and price negotiations will likely continue to create volatile sessions like today with low volume until those holding capital take a more assertive stance.

Looking at intraday fluctuations, the market is inducing a sense of disappointment as any upward movement is met with selling pressure. However, only those holding stocks are feeling discouraged; those holding cash are in a more comfortable position. The market is still in the ‘test margin’ phase and has yet to test investors’ psychology. It will transition to the bottom-forming phase when stockholders become indifferent to price movements.

Today’s session exhibited two positive aspects: First, the volume. In a downward trend, a slowdown in trading after high-volume distribution and sharp declines indicates either a reduction in selling pressure or a decrease in loose liquidity. The matched orders on the two exchanges today totaled 11.5 thousand billion, similar to mid-September sessions. Second, the presence of substantial buy orders at deep prices revealed towards the end of today’s session. Whenever prices dipped, trading activity intensified, and some stocks, particularly securities stocks, witnessed impressive reversals, suggesting a shift in the mindset of capital holders.

Market transactions always involve probing the intentions of each side, and volume, price range, and fluctuations are part of that outcome. While guesses can be right or wrong, the likelihood of accuracy increases when multiple signals align over several sessions. Therefore, the process of forming a market bottom or top often involves unsuccessful fluctuations and rarely concludes within 1-2 sessions.

Some stocks have corrected to attractive buying levels, but as the market remains unstable, a gradual buying strategy is advisable. Stockholders are at a relative disadvantage, so exercising patience can provide an edge. Buying on dips is relatively easy, and covering previously sold stocks means there’s enough for everyone without creating competition.

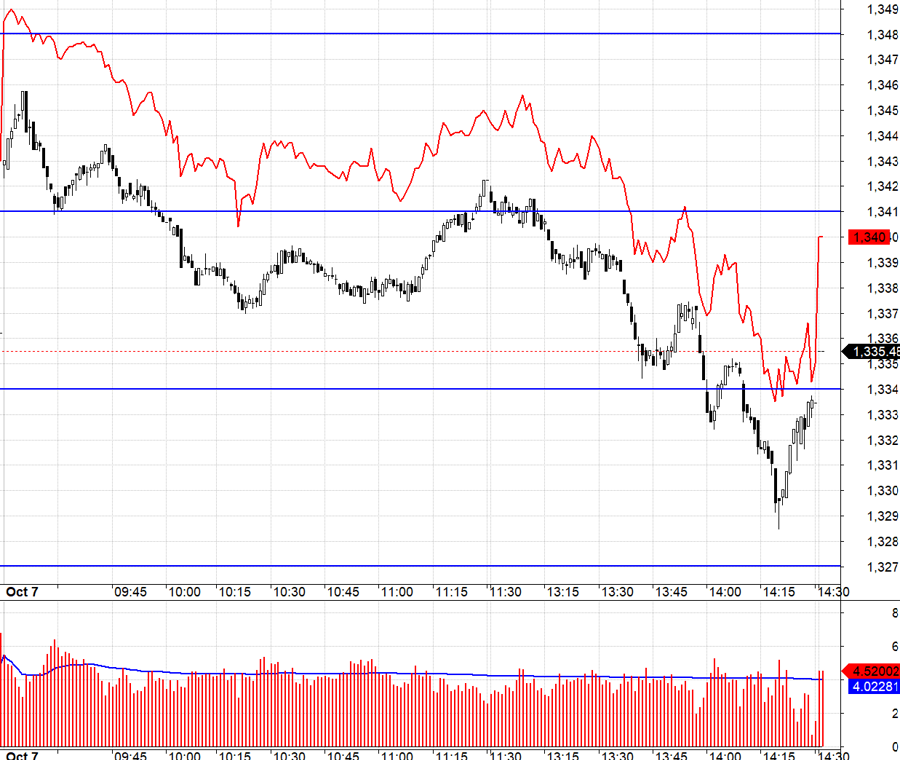

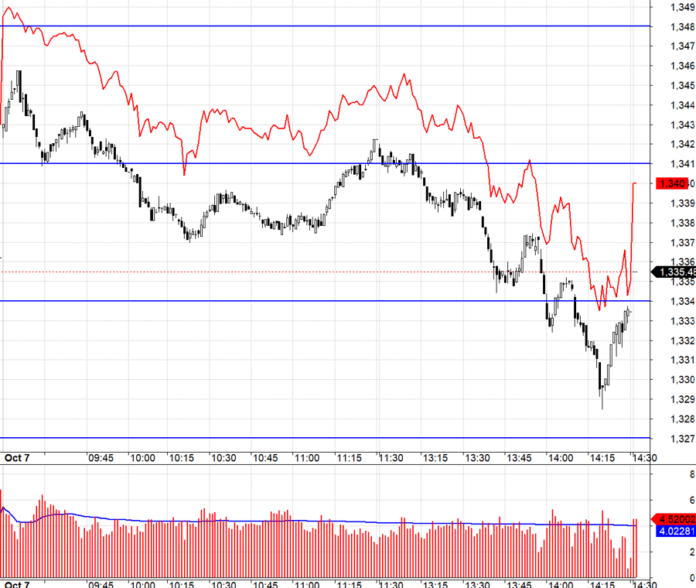

Today’s derivatives market continued to reflect expectations of the underlying market as the F1 basis remained positive throughout the day. However, this situation on low volume is easily exploitable by short sellers. Nevertheless, to increase volatility, they would need to push the underlying index. In the morning session, VN30 dipping below 1341.xx favored shorts, but it wasn’t very profitable as the underlying index remained range-bound, and not cutting losses quickly could even result in a loss. The afternoon session was more promising, with VN30 again falling below 1341.xx, this time with a more substantial impact on the underlying index, despite the unchanged basis limiting short-selling profits. VN30 exhibited two volatility expansion regions, from 1341.xx to 1334.xx and then to 1327.xx. However, it’s crucial to maintain discipline by closing half the position at the 1334.xx threshold to secure profits, and then aim for additional gains without incurring losses.

Today’s considerable reduction in volume indicates a decrease in loose liquidity. The market is likely to experience a few sessions of narrow price ranges with persistently low volume or sessions with forced volatility to test supply. The strategy remains to focus on stock-picking and employ a dynamic approach with derivatives.

VN30 closed today at 1335.48. Tomorrow’s resistances are 1341, 1348, 1356, and 1365, while supports are 1333, 1325, 1318, and 1308.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The assessments and investment perspectives are solely those of the individual investor, and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and investment perspectives.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)