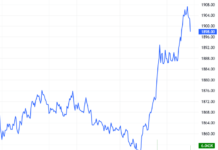

Gold prices declined for the sixth consecutive session on Wednesday (Oct 9) as the US dollar and Treasury bond yields continued to strengthen, with markets no longer betting on a significant rate cut in the November meeting of the Federal Reserve. A forecast suggested that gold prices could dip to the $2,500/oz range in the coming months but are expected to remain elevated through 2025.

At the close of trading in New York, spot gold fell by $13.5/oz compared to the previous session’s close, equivalent to a drop of over 0.5%, settling at $2,608.7/oz, as per data from Kitco.

As of 8 a.m. Vietnamese time on Thursday (Oct 10), spot gold prices in the Asian market had risen by $1.4/oz compared to the US close, equivalent to a 0.05% increase, trading at $2,610.1/oz. Converted at Vietcombank’s selling exchange rate, this price was equivalent to about VND 78.7 million/troy ounce, down VND 400,000/troy ounce from the previous day’s morning session.

Earlier in the day, Vietcombank quoted the dollar at VND 24,630 (buying) and VND 25,020 (selling), down VND 5 at both ends compared to the previous day.

Gold, an asset priced in US dollars and bearing no interest, came under pressure from the strengthening greenback and rising Treasury yields.

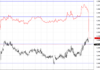

The Dollar Index, measuring the greenback’s strength against a basket of six major currencies, closed at 102.93, the highest in nearly two months. Over the past five sessions, the index has climbed by 0.84%, according to data from MarketWatch.

Yields on the 10-year US Treasury note continued their ascent after breaching the 4% level for the first time in two months earlier in the week. At the close, the yield on the 10-year note was up 3.8 basis points to 4.073%. The yield on the 2-year note increased by 4.3 basis points to 4.022%.

These moves came as markets this week stopped betting on a 50-basis point rate cut by the Fed in its November meeting.

Minutes from the Fed’s Sept. 18 meeting, released on Oct. 9, showed that “a substantial majority of participants” supported a 0.5 percentage point rate cut at that meeting. However, the minutes also indicated that the Fed did not have a preset plan for future rate cuts.

In the futures market, speculators are now wagering on an over 80% chance that the Fed will cut rates at its November meeting, with a reduction of 0.25 percentage points. The probability of the Fed keeping rates unchanged at this meeting stood at nearly 20%, up from 12.5% the previous day, according to data from the FedWatch Tool on the CME exchange.

“The dollar continued to strengthen, and economic data supported a 25-basis point rate cut more,” said Phillip Streible, chief market strategist at Blue Line Futures, in a Reuters interview.

However, according to Carlo Alberto De Casa, an analyst at Kinesis Money, the downward trend in interest rates and ongoing geopolitical tensions mean that gold prices will remain supported in the long run.

In a report, Oxford Economics economist Diego Cacciapuoti shared a similar view. He argued that gold’s upward momentum is weakening, but strong fundamentals will keep prices elevated through 2025 and beyond.

The report predicted that gold prices could be in for a short-term correction “because the recent rally has been supported by falling real yields… Since April – after real yields peaked – falling real yields have supported gold prices.” Recently, as real yields have turned higher again, coupled with central banks’ net gold purchases slowing down, gold has come under pressure.

Mr. Cacciapuoti forecasted that, in this context, many investors could sell gold to take profits. “Speculative positioning in gold is at its highest since the Covid-19 pandemic and has been rising very slowly lately. This suggests that speculators may be finding gold less attractive,” he wrote, adding that between now and January 2025, gold prices could dip and consolidate around $2,500/oz.

However, the expert also believes that gold prices will rebound and remain elevated in 2025 as the fundamental factors remain largely favorable for the precious metal.