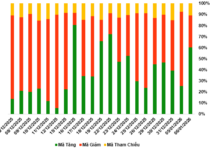

55 out of 61 equity funds outperformed the Vn-Index in September 2024, according to statistics from FiinTrade.

Among them, the SSIAM VNFIN LEAD ETF had the highest performance of 5.0%. Funds with performance above 4% included United Vietnam Opportunity Fund, TCFIN, and KIM GROWTH VNFINSELECT ETF. The remaining funds recorded growth rates of 2-3%, including PYN Elite, MB Capital Value Fund, Thiên Việt 5 Growth Fund, SSIAM VNX50 ETF, DCVFMVN30 ETF, KIM GROWTH VN30 ETF, MAFM VN30 ETF, SSIAM VN30 VEIL ETF, Bordier Growth Fund, FPT CAPITAL VNX50 ETF, Thiên Việt 4 Growth Fund, VINACAPITAL VN100 ETF, and IPAAM VN100 ETF.

Compared to August 2024, the performance in September was lower for most funds due to an unfavorable market context with liquidity decreasing for the third consecutive month to its lowest level in nearly a year, individuals aggressively selling off, and no leading sectors.

Since the beginning of 2024, 38 out of 61 equity funds, as per FiinTrade’s statistics, have recorded growth far exceeding the Vn-Index. Notably, the VinaCapital Modern Economy Stock Fund (+33.3%), DCVFMVN Diamond ETF (+30.5%), and Vietnam Long-Term Growth Fund (+28.6%) have stood out. A common thread among these three funds is their inclusion of FPT and ACB in their top holdings.

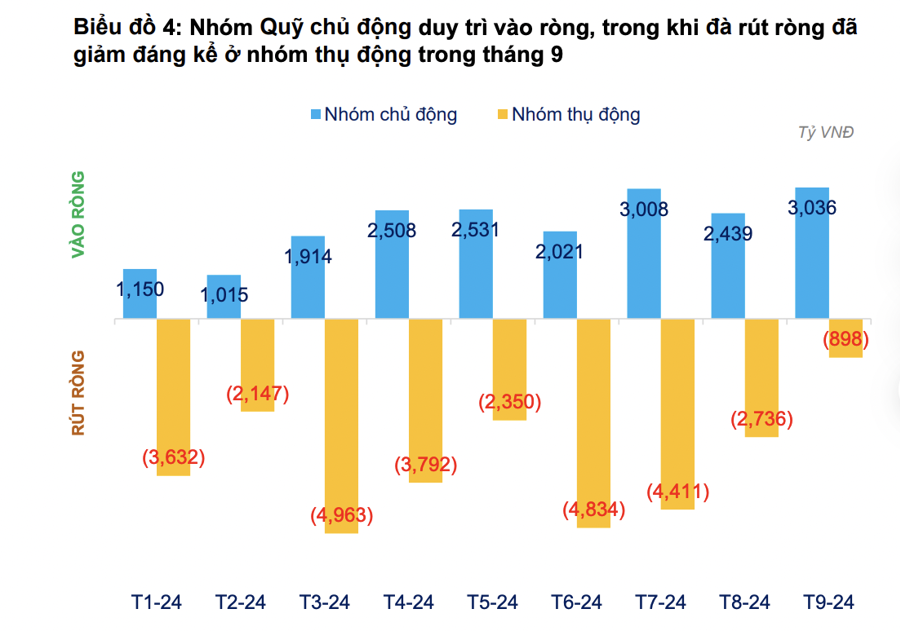

Capital inflows into the Vietnamese stock market through investment funds were positive in September 2024, with a net inflow of over 1,100 billion VND after nine consecutive months of outflows (totalling more than 18 trillion VND). Inflows continued into active funds, and passive funds saw reduced outflows.

This data is calculated from 100 investment funds with a total NAV of nearly 231,800 billion VND. In terms of investment strategy, there are 63 equity funds, 23 bond funds, and 14 balanced funds. By fund classification, there are 66 open-ended funds, 24 ETFs, 6 closed-ended funds, 3 retirement funds, and 1 real estate fund.

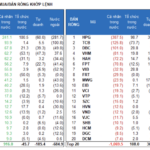

There was a differentiation in capital flows by fund type. In September, capital inflows continued into open-ended funds, reaching 655 billion VND, while outflows were seen in ETFs (-846 billion VND) and closed-ended funds (-839 billion VND). For open-ended funds, capital allocation was mainly into the Dynamic Securities Investment Fund (VFMVF1) with 239 billion VND, 5.62 times higher than the previous month. In contrast, outflows from ETFs mostly came from the Fubon FTSE Vietnam fund (672 billion VND), and outflows from closed-ended funds were led by the VEIL fund (511 billion VND).

On a 12-month cumulative basis, open-ended funds recorded net inflows of over 6,700 billion VND, while outflows were seen in closed-ended funds and ETFs, at 4,800 billion VND and 29,900 billion VND, respectively.

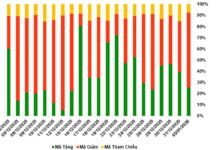

In terms of asset allocation, according to FiinTrade’s statistics, 10 out of 18 open-ended equity funds reduced their cash holdings in September 2024, mainly those with a scale of less than 1,000 billion VND. In contrast, larger-scale funds increased their cash positions.

Regarding the investment fund flows into the Vietnamese stock market, SSI Research noted that active funds continued to maintain a net selling position in September, albeit at a much slower pace compared to August. Notably, capital flows from active funds investing solely in Vietnam started to return in the last week of September, with a strong trend from Thai funds. Overall, these funds investing solely in Vietnam withdrew a net amount of approximately 320 billion VND in September (lower than the 600 billion VND in August).

There may be a time lag compared to other countries in the region, but with the positive inflow trend in Malaysia and Indonesia, SSI expects active funds to continue allocating weights to Vietnam in the future.

A highlight in September was the official issuance by the Ministry of Finance of a circular amending four circulars related to foreign institutional investors’ ability to buy stocks without requiring sufficient funds and the roadmap for English disclosure. This will form the basis for a positive assessment by FTSE Russell in early October. This development also enables foreign investment funds to proactively manage their cash flows, thereby improving trading liquidity.

The Savvy Investor’s Take: Unraveling the Intricacies of the HPG Sell-Off

Individual investors sold a net 71.3 billion VND, including 148.1 billion VND in matched orders. The top stocks sold were HPG, TCB, DBC, VHM, HAH, FPT, FRT, MWG, and EIB.

The Ever-Rising Bridge Tolls: A Costly Commute

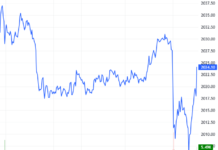

Although the VN-Index only slightly increased by 3.24 points (+0.25%) during the morning session, the index traded above the reference level for most of the time, with a positive market breadth. This is a result of buying power pushing the market to higher price levels. Blue-chips are leading the gains and dominating market liquidity, accounting for more than half of the total trading volume.

The Market Beat: Energy Stocks Fail to Prop Up the Index, VN-Index Still in the Red

The market closed with the VN-Index down 4.36 points (-0.34%) to 1,287.84, while the HNX-Index fell 1 point (-0.42%) to 235.05. Bears dominated today’s session, with 440 declining issues versus 248 advancing issues. The large-cap VN30-Index painted a mixed picture, as 19 stocks lost ground, 10 tickers climbed, and 1 stock stayed flat.